Markets were higher on Friday, easing some of the pain inflicted throughout the week, rising by around 1%, with the S&P 500 down 83 basis points for the week. This week, it will be all about the data, central bank decisions, and earnings, which likely means that the bond market and currency movements will be in focus.

Yield Curve to Break Out This Week?

The biggest driver of markets will continue to be the yield curve, largely determined by economic data and commentary from the Fed and BOJ meetings, as they will have the most significant impacts on the yield curve. The yield curve has been steepening, but it has not yet broken out of any ranges.

The big question is if the 10-2 curve can break out and head above -15 basis points. That has been the level where it has stopped twice before, since October 2023.

Granted, for different reasons: with the 10-year yield rising to meet the 2-year yield in the summer of 2023, and now the 2-year yield falling to meet the 10-year yield in the summer of 2024. Both carry very different messages—one of economic strength, while the latter suggests Fed rate cuts.

It is possible that if this summer’s breakout has legs, the advance ahead of us could be rather steep.

One factor that could influence rates, which is flying under the radar, is this week’s quarterly refunding announcement. The estimates are due today afternoon at 3 PM, with the actual breakdowns coming on Wednesday at 8:30 AM. The size of the issuances and the duration breakdowns will matter.

The Treasury has leaned on issuing more Treasury bills in recent months, which has helped drain the reverse repurchase facility at the Fed. A shift from bills to longer durations could slow that process. Additionally, with a presidential election cycle and a pending debt ceiling debate early next year, it will be interesting to see where the Treasury estimates the Treasury General Account (TGA) to be at year-end. A higher TGA and lower bill issuance likely mean that reserve balances at the Fed will decline further, while a lower TGA and greater bill issuance probably mean that reserves will climb.

Moreover, with the prospects of rate cuts coming in 2025, we could see a shift from risk assets into Treasuries later this year, as interest rates will diminish since the peak in the hiking cycle and economic cycle has likely passed.

I would imagine that a steeper yield curve led by a falling 2-year rate means that the USD/JPY continues to decline. If and when we see the US10Y-US02Y break the -15 basis points barrier, we will see the USD/JPY break the 152 level of support.

Yen May Signal Market Direction

I would also imagine that where the yen goes will determine where the equity market goes because, since March 2023, the QQQ to IWM ratio has traded almost perfectly in line with the USD/JPY. The trade since the SVB collapse may have simply been short yen, short small caps, and long mega-cap tech. This is why a steeper yield curve and a lower USD/JPY may continue to inflict pain on the market-cap-weighted indexes that have outperformed.

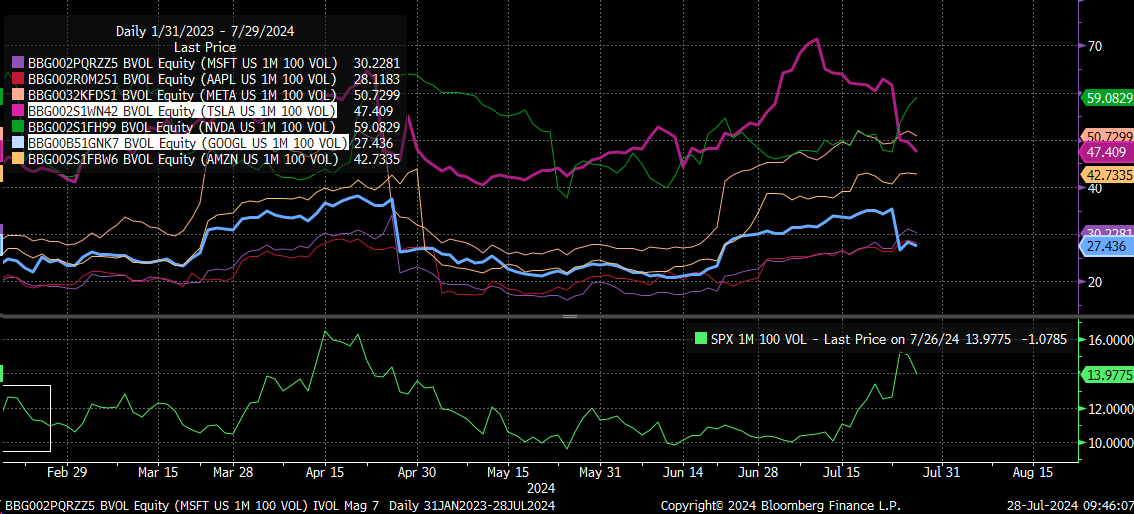

Of course, the low volatility nature of the trade may have driven the short volatility trade to extremes as well, such as when the one-month implied correlation index closed below 3 on July 12. However, implied volatility is expected to be seasonal.

It should mostly end this week after we get results from Apple (NASDAQ:AAPL), Meta (NASDAQ:META), Amazon (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT). The implied volatility levels for Alphabet (NASDAQ:GOOGL) and Tesla (NASDAQ:TSLA) plunged following their results, as expected, and the same will likely happen to the other four.

This means the volatility dispersion trade, which pushed these four stocks, is due to unwind this week.

USD/CAD: Resistance Breakout to Indicate S&P500's Next Move

On top of that, the USD/CAD is knocking on the door of the 1.385 level again, and this will now be the fifth time. The last four times it was unable to push through, it marked a bottom in the S&P 500. The question is, what will happen on the fifth attempt?

Unfortunately, I do not have all the answers, and I am waiting to find out, like everyone else. While I think about what may happen, I prefer to wait and see. But there is no doubt that this is an important week.

I think the trade mentioned above is nearing its expiration date; the Fed will cut rates at some point, and the BOJ will raise rates at some point. The yield curve has already been inverted for a very long time, and it is in the Fed’s best interest to get the yield to steepen.

It’s just a matter of when the tectonic plates shift, and when they do, it will be felt by all. Whether it comes this week or next quarter, I do not know, but everything is in place for it to happen, and it could happen this week if conditions align.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.