Super Micro Computer Inc. (NASDAQ:SMCI) is one of the most integral companies in artificial intelligence infrastructure at the moment. It is known primarily for its liquid-cooling technology, and its valuation multiples have expanded significantly on growth from this and other services for AI development. Management has built up significant inventory in anticipation of future demand, but there are risks related to fluctuations in this as well as growing competition in the market.

Despite the risks, I believe Super Micro has a reasonable valuation, and it could generate substantial alpha over the medium term if bought at this time.

Super Micro Computer is foundational to AI proliferationThe company is an integral supplier of infrastructure for AI data centers, providing high-performance, energy-efficient solutions that meet the increasingly high demands of AI workloads. For example, its rack-scale solutions are crucial for data centers, making Super Micro Computer foundational in the AI ecosystem. One of the company's core innovations is its liquid cooling technology. This addresses the high energy consumption and heat generation of AI models. It reduces power consumption and enhances performance in data centers by allowing chips to operate at higher capacities while minimizing hot spots.

Management has formed strong collaborations with Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), leveraging their advanced GPUs in its server solutions. These partnerships allow Super Micro to remain competitive in facilitating high-performance AI applications by integrating cutting-edge AI chips into its products. Along with Dell Technologies (NYSE:DELL), the company is also supplying server racks for Elon Musk's AI startup, xAI. The partnership is in an effort for xAI to build a supercomputer capable of training advanced AI models.

Super Micro is adding three new manufacturing facilities, with a focus on Silicon Valley and global locations, to support the growth of AI and enterprise rack-scale liquid-cooled solutions. This should more than double the production capacity of liquid-cooled AI SuperClusters. Currently, the company ships around 1,000 units per month. This manufacturing facility expansion is strategically timed as the demand for AI infrastructure continues. Liquid-cooled data centers are expected to grow from less than 1% to 30% of all data center installations in the next two years, according to a Super Micro investor relations press release.

Despite the company's unique position in the AI infrastructure market, it also competes with Vertiv (NYSE:VRT), Green Revolution Cooling and Schneider Electric (EPA:SCHN) SE (XPAR:SU) in liquid cooling. Of these, Vertiv and Schneider are arguably the most threatening competitors to Super Micro due to their expensive product offerings and global reach. Green Revolution Cooling is not publicly traded, but it is still relevant and offers competition for market share.

Financial and valuation analysisOne of the most notable downsides of Super Micro's manufacturing model, including its current capacity expansion, is that it has negative free cash flow as a norm. This is a result of its high capital expenditures, which have to be kept in mind when analyzing the company as it is notably less agile than other tech companies that outsource production and focus on design. Super Micro reported negative cash flow from operations of $635 million in the fourth quarter of 2024 and capital expenditures of $27 million. The low operating cash flow was due to high levels of inventory, which ballooned to $4.40 billion by the end of the quarter, a result of stockpiling components and raw materials to meet the growing demand for its AI and cloud infrastructure products. This is a short-term concern, but given current trends in AI infrastructure expansion, the company is likely to sell this inventory, so it is important for it to be able to meet the current demand during the current supply chain challenges.

Super Micro Computer is a growth stock; for the fiscal period ending June 2025, Wall Street estimates on consensus that it will achieve year-over-year normalized earnings per share growth of 55%. For the fiscal period ending June 2026, the consensus is 30% normalized earnings growth. Despite such high growth rates, the company's valuation is lower than I would expect right now. This includes a forward price-earnings ratio of nearly 18, a PEG ratio of 0.43 and a price-sales ratio of 2.50.

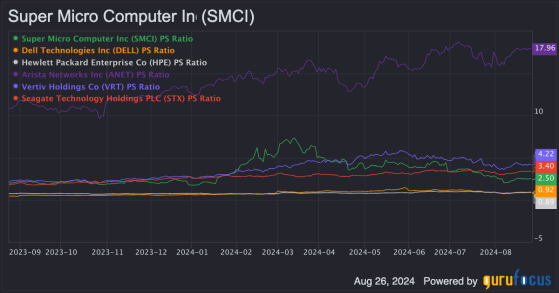

Comparing Super Micro to Dell, Hewlett Packard (NYSE:HPE), Arista Networks (NYSE:ANET), Vertiv Holdings and Seagate Technology Holdings (NASDAQ:STX) provides a useful peer analysis. Given how quickly the company has been growing its revenue, it seems undervalued as it is reasonably valued relative to its peers in my price-sales ratio analysis. This is a reason to be bullish on Super Micro stock right now, in my opinion.

However, Super Micro is still valued highly compared to its history. Its price-earnings ratio of 29 is significantly higher than its 10-year median of 17.65. Further, its price-sales ratio of 2.36 is much higher than its 10-year median of 0.56.

The company has been involved in providing high-performance, high-efficiency server, storage and networking solutions for many years, but the reason the valuation multiples have expanded so significantly now is due to the massive proliferation of AI, which has contributed to unusually high growth rates. I believe it is fair to say that Super Micro Computer is now being valued as an AI infrastructure company rather than a server and data center company, which has drastically increased investor sentiment. However, moving forward, I believe this does open the stock up to volatility risk, especially if AI infrastructure spending slows down over the next few years as expected by Wall Street analysts.

Margin and inventory risk analysisSuper Micro's gross margin for the fiscal year ending June was 14.13%, which is significantly lower than its peak of 18% over the past 13 years and lower than its 10-year median of 14.94%. In the fourth quarter, its gross margin fell to 11.23%, down from 15.50% in the previous quarter and 17% a year ago. Management has attributed this to factors such as its product mix, competitive pricing to secure new designs and increased costs associated with ramping up new technologies like its direct liquid-cooled rack-scale AI GPU clusters. The industry is now growing more competitive, which is putting pressure on margins, affecting its profitability despite its revenue growth. To combat these pressures, Super Micro is focusing on improving its product and customer mix, enhancing manufacturing efficiencies and scaling up production in cost-effective locations like Malaysia and Taiwan.

Further, I mentioned the cash flow impact of high levels of inventory at the moment. I believe Super Micro's inventory levels are critical to assessing its near-term results and financials. As of June, day's inventory stood at 82.62, which is higher than the previous year, indicating an increase in the time it takes to sell its inventory. The inventory turnover ratio for the same period was 1.10, indicating inventory is being sold and replaced at a relatively slow pace. It also had an inventory-to-revenue ratio of 0.80 for the three months ending in June, meaning it is holding a significant amount of inventory compared to its sales. While this is a strategic medium-term move from management to be able to meet demand and mitigate the risk of supply chain constraints, it also opens up the possibility for changes in demand to significantly negatively impact Super Micro.

ConclusionSuper Micro Computer was definitely overvalued recently, but it is currently down nearly 50% from its all-time high. As a result of its more favorable valuation, I believe the stock is a good opportunity currently, though there are significant risks in the form of the company's inventory management, pricing pressures and broader competition.

Despite the potential drawbacks, Super Micro Computer is currently integral to AI infrastructure, which is a demand that is set to continue substantially, even if it does begin to slow down in the coming years. The company has been valued in the market differently as a result of this AI demand, and I think this higher sentiment is set to be maintained moderately moving forward, opening up medium-term alpha potential.

This content was originally published on Gurufocus.com