Toward the end of 2022 and throughout 2023, Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) was trading at exceptionally attractive valuations. However, now the GF Value chart is showing the stock to be significantly overvalued.

During my time writing and utilizing GuruFocus' proprietary tools, I have come to trust the GF Value chart immensely. From my further research and analysis on Taiwan Semiconductor, there are significant drivers of sales and profitability expansion to come, and mitigation from geopolitical risks through global diversification of manufacturing. However, I believe the company's valuation multiples compared to history show reason to be cautious, especially when observing the potential overvaluation in other artificial intelligence-related companies like Nvidia (NASDAQ:NVDA) at this time.

Operational developmentsThe company is actively expanding its operations outside of Taiwan by building three fabrication facilities in Arizona over the next five years. Management said it is also building two plants in Japan over the next three years and has announced plans to jointly invest in European Semiconductor Manufacturing Company in Germany, with production targeted to begin by the end of 2027.

Taiwan Semiconductor continues to lead in advanced chip manufacturing and is developing a new chip-manufacturing technology called A16, which is expected to enter production in the second half of 2026. Management has also announced it is going to charge customers extra for manufacturing outside of Taiwan, as there are increased costs associated with new manufacturing sites like Arizona.

Starting this year, the company increased prices for its advanced process manufacturing by 3% to 6%. Major clients like Nvidia, Apple (NASDAQ:AAPL) and Qualcomm (NASDAQ:QCOM) have shown a willingness to accept the price increases. This has led to many analysts raising price targets for the stock, with the company's long-term growth prospects being reinforced by the fact its higher pricing is likely to allow it to further develop its research and development and strengthen its moat.

In my opinion, these developments certainly add to the security of investing in Taiwan Semiconductor. However, one has to remember that the company's target market is already mature. Therefore, while AI markets are developing and HPC chips are likely to become more in demand as digitalization scales globally, Taiwan Semiconductor is unable to deliver the high growth that is more likely to occur in newer AI and semiconductor intellectual property companies. In addition, regulatory inhibitions surrounding AI and automation could inhibit growth in these sectors, which are predicted to be highly accretive to the company. That being said, Taiwan Semiconductor expects its AI-related revenue to double in 2024 and grow at a 50% compound annual rate over the next five years. It also expects AI-related revenue to potentially reach over 20% of its total revenue by 2028.

As CEO C.C. Wei said, "Almost all the AI innovators are collaborating with TSMC to address the insatiable demand for energy-efficient computing power."

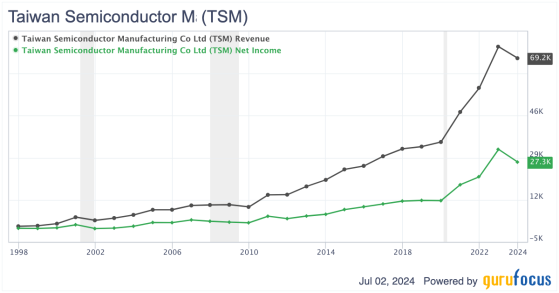

Financial and valuation analysisInvestors are anticipating future results with the current stock price growth the market has delivered, as the last year has actually seen both a revenue and net income contraction for Taiwan Semiconductor. In the first quarter, the company's revenue grew 16.50% year over year and its net income grew 8.90%.

Notably, Taiwan Semiconductor holds over 60% of the global semiconductor foundry market, which is significantly ahead of its closest competitor, Samsung (KS:005930) (SSNGY), which holds around 14%. Therefore, competition is much less of a problem than for most major tech businesses as the company's moat in manufacturing advanced semiconductors is unmatched anywhere in the world. In my opinion, this is likely to allow the company to continue to scale its profitability margins over the long term. These are already incredibly high, with a net margin of 38.75% at the time of writing compared to 7.37% for Samsung, but notably lower than Nvidia's net margin of 53.40%, which has recently overtaken Taiwan Semiconductor on the metric.

Given its exceptional moat, a reasonable revenue CAGR for Taiwan Semiconductor is forecasted by leading analysts to be around 16% for the next five years. The earnings per share CAGR by analysts is expected to be around 24% over the next five years, which is indicative of the margin expansion opportunity I have outlined above. However, over the past five years, revenue has only grown at a CAGR of around 19% and earnings without non-recurring items at around 24% per annum. Therefore, a significant expansion in valuation multiples is unwarranted, in my opinion. Arguably, a slight expansion would be fair due to the potential for future exponential fundamental growth as a result of the company's continued support for AI systems, but this year, its valuation multiples have risen disproportionately to these near- and medium-term expected gains.

The chart above illustrates the concern I have that is preventing me from investing in the company at this time. It is further supported when we view the multiple expansion in tandem with future estimates, as depicted in the GF Value chart:

In my opinion, despite the strengths that management has been able to deliver in driving revenue growth and profitability margin increases recently, as well as future strategy positives such as a direction toward AI, the stock is still too richly priced at present levels. In my opinion, investors would be wise to avoid allocating capital until the valuation has become more reasonable.

A price-sales ratio of around 7 would be more reasonable at this time, which would allow some expansion against the 10-year median of 6 but not inflated to levels that have obviously become unrealistic. The current price-sales ratio is around 11. Based on this analysis, I think it is highly likely the stock will experience short-term to medium-term volatility, especially as 2026 nears, which is when analysts are expecting the company's fundamental growth to ease somewhat following the current high-growth period of the cycle.

Risk analysisI have noticed in my previous research on Taiwan Semiconductor that geopolitical tensions surrounding Taiwan are a significant threat. However, this is being eased by management's focus on international fabrication facilities. In addition, I believe it is quite likely that Donald Trump will be elected in November to the White House, and I have a favorable opinion that he will be diplomatic and appeasing to Chinese interests. However, if Biden is elected, there is likely to be growing tension in international relations, in my opinion, as a result of the Democratic Party supporting NATO expansion, which is causing tension with Russia, China and Iran. The international expansion strategy by Taiwan Semiconductor to mitigate the geopolitical risk is shrewd, but it will be difficult for the company to replicate the Taiwan-based model in other markets, including due to cultural differences and increased production costs.

TSMC is also facing weakness in traditional markets like smartphones and PCs, although its AI-related demand is growing rapidly. This further reinforces my previous point that many of TSMC's core markets are already saturated, and its heavy reliance on AI markets moving forward opens up risks with regulatory inhibitions. In addition to these growth concerns, the company operates in a highly cyclical industry that is dependent on the demands of various technology companies. This ecosystem is largely prone to recessionary pressures as many of the advanced technologies are seen as luxuries rather than necessities. Furthermore, high capital intensity should be understood to also influence cyclicality for TSMC, with periods of large build-outs and development reducing margins temporarily and periods of production that are highly margin expansive due to the moats it develops in manufacturing capability.

ConclusionIn my opinion, Taiwan Semiconductor is positioning itself operationally to be one of the most enduring and powerful companies in the world over the next few decades. In the meantime, however, I believe it is incredibly important that investors take note of the valuation. Because the market understands the long-term value here, there are likely to be periods of irrational exuberance fueled by trends and heightened anticipation around sector growth in AI, robotics and automation. In my opinion, Taiwan Semiconductor's stock is overvalued right now and investors who allocated years ago or during 2022-23 would be wise to hold, but buying at the present valuation multiples seems likely to bring short-term to medium-term downside.

This content was originally published on Gurufocus.com