- Speculation rampant about the reasoning behind Trump’s timing

- Tariffs’ impact appears negative from historical standpoint

- Market focusing on fears of global trade war

- Potential trade war not the only ingredient to current uncertainty

US President Donald Trump's announcement of his intentions to implement tariffs of 25% on steel imports and 10% on aluminum—for which a decree is expected to be signed later today—added to recent equity volatility last week, but the move toward greater protectionism in US trade polices is not the only factor plaguing stocks as volatility returns to Wall Street in 2018

Why Did Trump Make The Decision Now?

Before looking at the potential impact from the policy move, analysts are widely focusing on the reason for the announcement itself. Overall, it should be remembered that Trump repeatedly made these types of promises throughout his presidential campaign, so the announcement itself should have come with little surprise, even despite objections by Trump’s own staff that are arguably one of the main reasons why his chief economic adviser Gary Cohn decided to resign.

“Our steel and aluminum industries (and many others) have been decimated by decades of unfair trade and bad policy with countries from around the world,” the President explained at the beginning of this month.

“We must not let our country, companies and workers be taken advantage of any longer,” he insisted.

Beyond the President’s own explanation, some observers suggested that upping the noise on tariffs at this time was a negotiating tactic as the US, Canada and Mexico were finishing up the seventh round of talks on the North American Free Trade Agreement (NAFTA).

More partisan calls accused the President of simply wishing to get political coverage ahead of key mid-term elections. In fact, US primaries kicked off in Texas on March 6 (after the announcement) with a reported surge in Democratic voter turnout while Pennsylvania, the steel state, is gearing up for special elections in its 18th District where Democrat Conor Lamb is facing off against Republican Rick Saccone in order to replace Republican Tim Murphy who resigned in October over a sex scandal.

Trump’s stance on tariffs would be expected to receive particularly widespread support from voters in battleground states across the industrial Midwest.

“Of course, if you go to Ohio or Pennsylvania, or you go to the heartland of American Main Street, there’s universal support,” the White House’s director of trade and industrial policy Peter Navarro recently proclaimed when defending Trump’s tariff announcement.

While the White House spokeswoman Sarah Sanders told reporters on Wednesday that Trump's announcement on steel and aluminum tariffs is on track to come by the end of this week, speculation was that it would happen on Saturday when the President holds a campaign-style rally in the Pennsylvanian district, though new reports say the White House could formalize measures as soon as today.

Economic Impact Of Tariffs Looks Negative

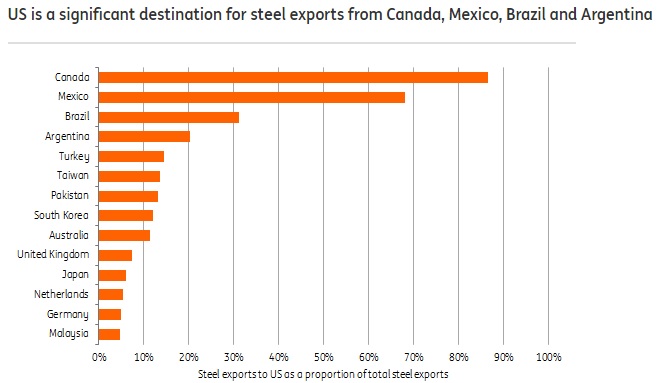

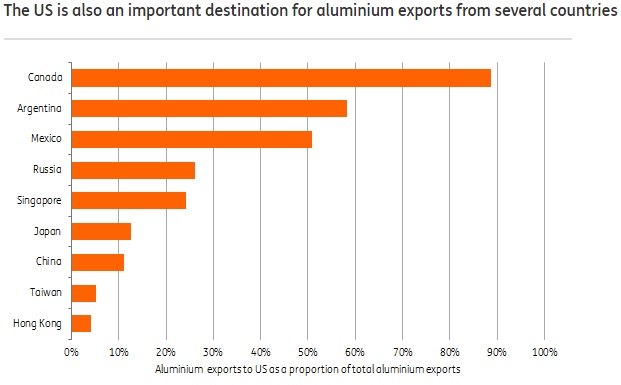

Sticking to the case at hand, ING recently produced two charts indicating where the direct impact from the planned tariffs would fall.

Source: ING

Source: ING

Although the charts above show the US as an important destination for steel and aluminum exports from a variety of countries, they are actually only a small fraction of world trade.

Steel and aluminum exports to the US accounted for less than 1% of world exports of all products by value in 2016 (they were 3% of Canada's total exports and less than 1% of China's), according to data compiled by ING.

But even with that in mind, a similar situation allows us to extrapolate the economic impact. Former President George W. Bush pushed through a steel tariff of a higher 30% rate in March 2002, which was initially supposed to last for three years. However, a challenge from the World Trade Organization (WTO) impelled Bush to withdraw the tariffs in December 2003.

A study by Trade Partnership Worldwide examined the economic impact and found that while 187,500 jobs were gained by the steel industry in response to the tariffs, around 200,000 Americans actually lost their jobs by December 2002 due to higher steel prices.

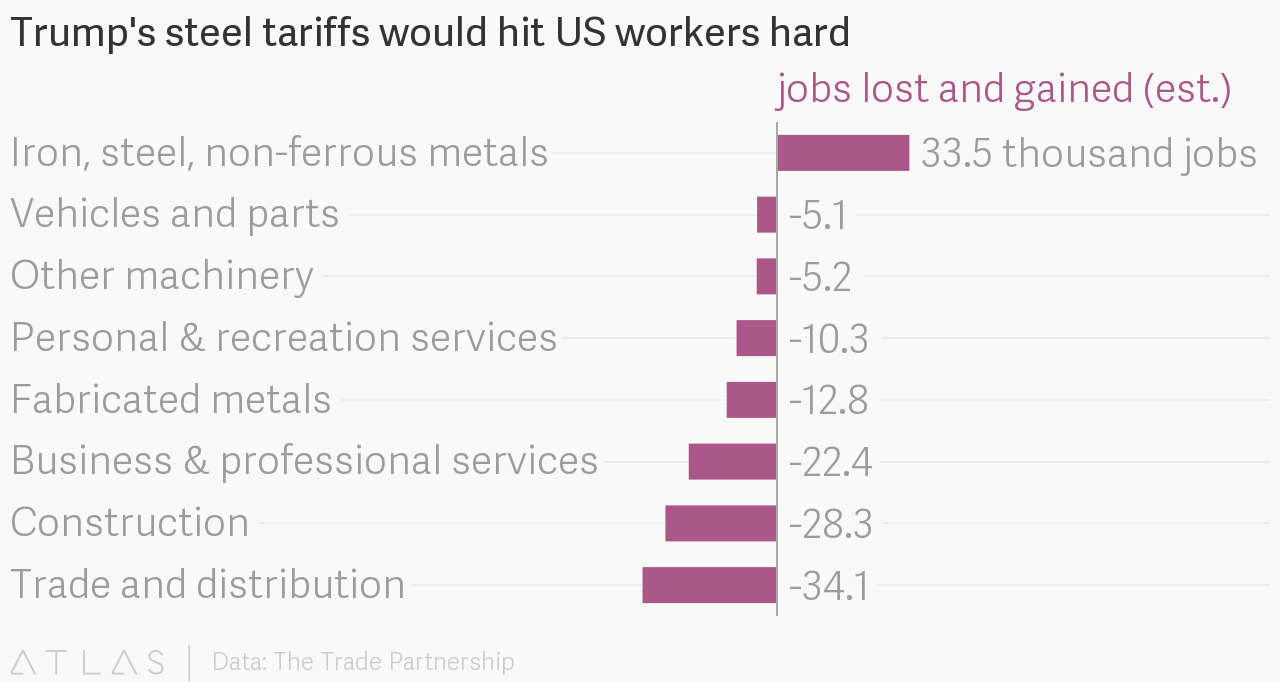

That compares to a study released on Monday by the same two experts at The Trade Partnership that determined that five jobs would be lost for every one created by Trump’s steel tariffs.

Source: The Trade Partnership

In 2005, Lancaster University Economics professor Robert Read analyzed empirical studies to determine the impact of Bush’s steel tariffs (dubbed “Safeguard Measures” in the study) for their impact on the US economy. “All of these studies find that the costs of the Safeguard Measures outweighed their benefits in terms of aggregate GDP and employment as well as having an important redistributive impact,” Read wrote.

Tariff Fallout Raises Trade War Worries

A perusal of analyst notes on the recent noise quickly makes clear that markets are not so much concerned over the steel and aluminum tariffs themselves, but rather the threat that those countries affected will retaliate, sparking the start of an all-out global trade war in response to Trump’s “America First” program.

Trump himself may well have left an out for the US’ neighbors as he suggested that Canada and Mexico can avoid the tariffs “if a new and fair NAFTA agreement is signed.”

Underlying fundamentals stateside remain strong while the Federal Reserve appears to be committed to its “gradual” removal of extremely-loose accommodative monetary policy. Yet Trump’s insistence to move forward and Cohn’s recent departure leaves markets with a feeling of uncertainty over to just what lengths the White House may now go in its protectionist approach.

While steel and aluminum producers stateside are expected to benefit, perhaps being offset by those firms that use the materials, Europe has already upped the ante, threatening to retaliate with tariffs on American goods such as bourbon, motorcycles, orange juice, peanut butter or even Levis.

Investors are left to wonder just how far the flames will spread as they attempt to analyze the impact on long-term growth, prices and, of course, corporate profits.

Don’t Blame Just The Tariffs For Market Jitters

Although reading financial headlines in the last week would lead one to believe that stocks have become jittery ever since Trump announced his intention to implement the tariffs, placing all the blame for recent volatility on the possibility of a future trade war is an over-simplification.

As the chart from the VIX, the market’s fear gauge, below shows, there has been a major shift higher in volatility this year from 2017.

In fact, the S&P 500 only underwent a daily move of 1% in either direction during all of 2017, on just eight occasions. So far in 2018 and starting on January 26, the global benchmark has already surpassed that percent change on 16 separate occasions.

William Delwiche, investment strategist at Baird Market and Investment Strategy had already pointed out at the end of last week that the number of 1% moves in the S&P was slightly above the 20-year median pace, “but 2018 is hardly an outlier.”

Even more interesting from Delwiche’s chart above is how 2017 stands out as the least volatile year out of the last 20.

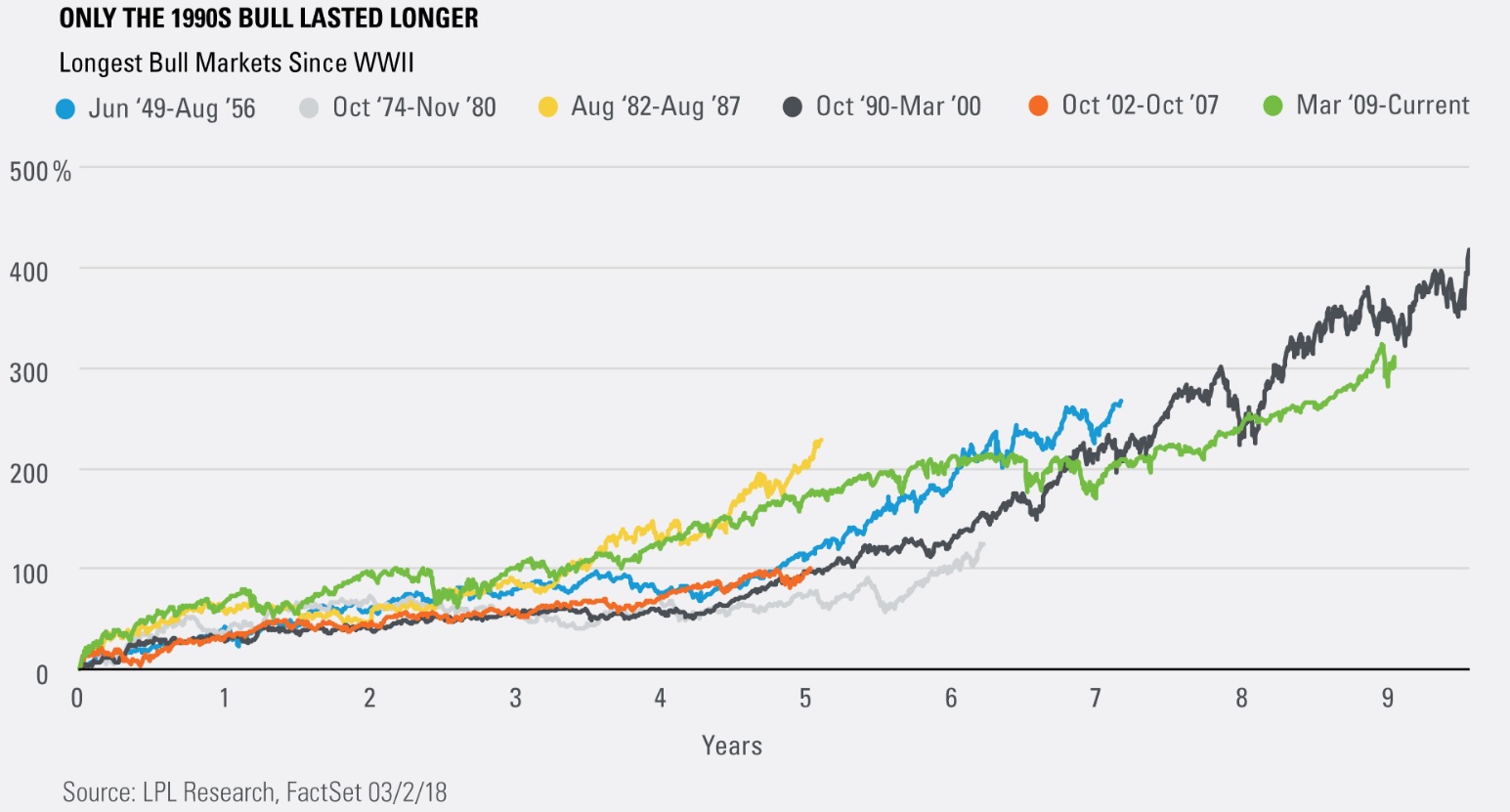

With American equities on track for the current bull market run to celebrate its nine-year anniversary on March 9, equities may be running out of steam after quite an impressive climb.

“This is now the second largest (nearly quadrupled on a total return basis) and second longest (nine years) bull market since World War II, with only the 1990s bull market standing in its way,” LPL Research recently reminded investors in a note.

With Trump’s fiscal stimulus packages likely a thing of the past, stock investors may well be hard pressed to find further reasons to not just break, but simply hold near, all-time highs without taking a breather or even undergoing a correction before attempting to take another shot at continuing the upward climb.

Still, it’s worthwhile remembering that the President’s comments on trade came charging in on the coattails of no-less-significant worries sparked by remarks from Federal Reserve Chairman Jerome Powell that recent economic strength could result in a slightly more aggressive removal of accommodative policy, putting the market nerves on edge. In that light, Trump’s declarations did little more than pick up the “volatility baton” from Powell who implied in congressional testimony to the House last week that four rate hikes this year (instead of the expected three that currently priced in at around 70%, according to Investing.com’s Fed Rate Monitor Tool) could be in the cards given his positive take on how the economy had strengthened since December.

Adding to the uncertainty of where the White House is headed with trade policies and what the global reaction will be, tariffs are widely expected to push up costs for American consumers as well. Price increases on products from abroad or those domestic items that use higher priced materials could well be the push to subdued inflation levels that has been missing in the Fed’s puzzle for a more aggressive policy tightening.

Don’t get us wrong; the threat of global trade wars shouldn't be taken lightly, but the fallout from new tariffs is but another piece of that market nemesis, uncertainty, that is keeping investors on edge, during a year with several factors signaling risks ahead. And as we’ve already seen, 2018 is already a far cry from its calmer predecessor.