The GuruFocus Triple Buy Web Screener is for investors interested in companies that gurus, insiders, and companies representing the stock perceive to be undervalued and are buying. This screener can be accessed by GuruFocus premium subscribers from the Insiders tab at the top of the GuruFocus home page. Criteria for this page are stocks in which at least one insider and one guru have purchased at least 1,000 shares in the last 3 months, and that the company has also been buying back shares as evidenced by a share buyback ratio greater than 0. This combination of criteria is used to create a list of potentially substantial investments, as significant buying activity from these groups can indicate confidence in the stock’s prospects. Currently, the page includes a list of 106 companies. To narrow the list further, I applied filters for stocks with at least $1B market capitalizations within 20% of 52-week lows, yielding a list of 47 stocks. After adding this list to a portfolio and opening it in GuruFocuss All-in-One screener, I applied additional metrics, identifying modestly and significantly undervalued stocks with ROIC percentages above 10, predictability rank of at least 1 star, EV-to EBITDA between 1 and 10, a TTM PE ratio between 1 and 15, and ensuring that each stock’s ROIC was greater than its WACC, indicating that each stock was creating value for its investors.

With these stringent criteria, this list of companies is relatively dynamic. I started writing this article in January 2025, and the list has had several changes since then. One company that has consistently remained on the list throughout late January to early March is Terex Corporation (NYSE:TEX), a global industrial equipment manufacturer specializing in materials processing machinery, waste and recycling solutions, mobile elevating work platforms (MEWPs), and equipment for the electric utility industry. Terex designs, builds and supports products used in maintenance, manufacturing, energy, minerals and materials management, construction, waste and recycling, and the entertainment industry.

Terex has three main segments:

1. Materials Processing comprising roughly 37% of company sales, designs, manufactures, services, and markets materials processing and specialty equipment, including crushers, washing systems, screens, trommels, apron feeders, material handlers, pick-and-carry cranes, rough terrain cranes, tower cranes, wood processing, biomass, and recycling equipment, and their related components and replacement parts.

2. Aerial Work Platforms comprise roughly 58% of company sales. The company designs, manufactures, services, and markets aerial work platform equipment, utility equipment, telehandlers, and related components and replacement parts.

3. Environmental Solutions Group, now comprising 4.4% of the company, was introduced to the Terex lineup after it was acquired from competitor Dover Corporation (NYSE:DOV) in September 2024. This segment focuses on waste management and recycling solutions and includes refuse collection vehicles, waste compaction equipment, and associated parts and digital solutions.

Over the years, Terex has focused on its core segments following numerous acquisitions and the divestiture of underperforming businesses. The company’s products are in high demand for nonresidential construction, maintenance, manufacturing, energy, and materials management applications.

Terex’s global sales distribution spans the US (60.5%) other North American countries (5.2%), Europe (27%), Asia Pacific (10.8%), and other parts of the world (6.8%).

Terex employs approximately 10,200 people. Its most prominent institutional owner is BlackRock (NYSE:BLK), Inc., which holds approximately 14.2% of company shares. Insiders own 1.9%

GURU TradesRegarding trading activity in the last two quarters, the overall sentiment among gurus and institutional investors has been positive, with buyers increasing their holdings by an average of 69.16% and sellers reducing their holdings by an average of 41.16%.

Buyers include Ken Fisher (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Renaissance Technologies (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), the Jefferies Group (Trades, Portfolio), and Steven Cohen (Trades, Portfolio). Ray Dalio (Trades, Portfolio) increased his holdings by over 176% in Q3; Ken Fisher (Trades, Portfolio) increased his holdings incrementally from Q2 through Q4 2024. Jeremy Grantham (Trades, Portfolio), Renaissance Technologies (Trades, Portfolio), the Jefferies Group (Trades, Portfolio), and Steven Cohen (Trades, Portfolio) became new shareholders during the same period.

Sellers include Chuck Royce (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Joel Greenblatt (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Ray Dalio (Trades, Portfolio), and the Jefferies Group (Trades, Portfolio), with the Jefferies Group (Trades, Portfolio) selling out entirely in the second quarter.

Chuck Royce (Trades, Portfolio) increased his position by over 109% in the second quarter and reduced it by approximately 52.5% during the third and fourth quarters. Mario Gabelli (Trades, Portfolio) reduced his position by 3.47% in the second quarter and increased it by 2.05% in the third quarter. Ray Dalio (Trades, Portfolio) reduced his position by 77.29% in quarter 2 and increased it by 176.06% in quarter 3.

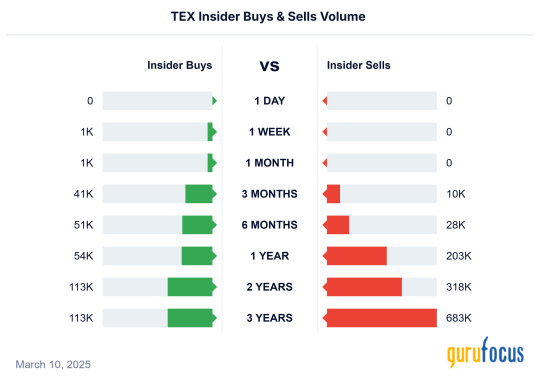

Insider TradesSince May 2024, Terex has had nearly a 2-to-3 ratio of buy-to-sell transactions and a 1-to-3 ratio of shares bought to shares sold transactions. The buying activity consists of 4 transactions, including one by Director Andra Rush in August for 2,205 shares valued at $119,864 and 3 by Director David A. Sachs since November valued at $2,579,400.00.

Four selling transactions occurred in May, including one by President of Materials Processing Kieran Hegarty for 17,190 shares valued at $1,001,490, 1 by Senior Vice President of Human Resources Amy George for 12,000 shares valued at $756,480, 1 by Vice President Chief Administrative Officer and Controller Stephen Johnston for 3,239 shares valued at $200,818, and 1 by Senior Vice President and Gen Counsel Secretary Scott Posner for 12,500 shares valued at $756,000,

Kieran Hegarty sold an additional 182,493 shares valued at $1,051,740 in November, and President and Chief Executive Officer Simon Meester sold 9,877 valued at $505,110 in December.

Share BuybacksTerex Corp returned $92 million to shareholders through share repurchases and dividends in 2024, more than offsetting equity compensation dilution. The company has $86 million remaining under itsshare repurchase authorization and plans to continue buying back shares.

Terexs buyback yield has been trending upward at 33.7% per year for the last five years. The companys buyback ratio has fluctuated between -1.15 to 3.47% in the last five years and is 1.8% as of March 10, 2025.

Why are Shares Undervalued?Guru Focus has reported several warning signs that may cause investors to proceed cautiously when snapping up Terex shares.

First, the companys asset accumulation exceeds its revenue accumulation. Terex experienced a significant uptick in asset levels between the 3rd and 4th quarters of 2024, mainly attributed to the increase in intangible assets, which had year-over-year (YOY) and quarter-over-quarter (QOQ) increases of approximately 600%. This is likely due to the acquisition of Environmental Solutions Group (ESG), which was completed on October 8th, 2024. CEO Simon Meester contended that the acquired company has been financially accretive, citing the second highest adjusted earnings per share ($6.11) in the companys history as an indicative of the strength of its current portfolio. In contrast, however, revenues had YOY and QOQ increases of only 1.47% and 2.39% during the same period, shedding some skepticism of Mr. Meesters enthusiasm. The company anticipates a slower start to 2025, with only about 10% of full-year earnings per share expected in the first quarter.

Secondly, Terex Corporation’s earnings are of poor quality, as evidenced by a Sloan ratio of 37.28% and an inconsistent balance between accruals and cash flow. Terexs operating cash flow and free cash flow have fluctuated over the years declining sharply in the first quarter of 2024, although recently, they have been in an upswing. Key profitability ratios such as operating margin, net margin, and return on capital have shown variability over the years, with notable declines in 2024 compared to 2023.

TEX Data by GuruFocus

Terex has also significantly taken on more debt since the ESG acquisition. Acquisition-related financing increased interest and other expenses by $24 million year-over-year. The companys long-term debt and capital lease obligations are currently the highest since the end of 2001; it has a debt-to-equity ratio of over one, and its working average cost of capital of 12.41% exceeds those of competitors. However, the company does have healthy liquidity ratios, which mitigate the risk of taking on the additional debt burden.

Furthermore, the heavy truck and equipment makers industry has been experiencing some softening. Elevated inflation and interest rates have concerned the heavy equipment industry due to its customers’ reliance on financing large capital purchases. Recent trends suggest that interest rates may soon drop, offering relief to the industry. Lower borrowing costs could stimulate demand for equipment financing.

Due to industry-wide channel adjustments, Terexs legacy segment sales were down 17% in the fourth quarter. The weak European market remains a factor impacting the company’s performance in the Materials Processing segment. However, on a more optimistic note, the global heavy trucks market is expected to grow substantially by 2032, driven by infrastructure development, global trade expansion, and the integration of new technologies. Terex’s innovation and product expansion could drive long-term growth.

The company also has had a history of fluctuating shareholder yields, which are currently negative. This may dissuade conservative investors who are more likely to select stocks with consistent shareholder yields.

Clearly, the ESG purchase has disrupted the stocks fundamentals, but in the long run, the accretive value of this purchase is likely to be recognized.

Next StepsTerex’s future presents a mix of opportunities and challenges. Although the company faces considerable headwinds in the near term, its strategic moves and the potential for market recovery position it well for future growth.

Moreover, its 12-month average price target of $51.80 has a potential upside of over 27%, making it an excellent investment for bargain hunters willing to endure near-term volatility. The company currently has price-to-book, price-to-book, and price-to-sales ratios that are ranked higher than other industry players and near 10-year lows.

As the ESG acquisition trajectory is still in its infancy, further examination and duration are needed to determine the actual accretive value of this transaction. Terex expects the merged companys operational run rates will deliver at least $25 million by 2026. The ESG segment is anticipated to generate mid-single-digit sales growth in 2025. The acquisition is also expected to reduce cyclicality and expand Terex’s addressable markets, particularly in the waste and recycling industry, which is characterized by low cyclicality and steady growth.

As always, note that I am not a financial advisor, so prospective investors should conduct their own evaluations. This article is intended only for informative purposes and should not be construed as investment advice.

Become a better investor and get access to insights offered by GuruFocus

This content was originally published on Gurufocus.com