- Tesla investors are closely watching for insights on Cybercab production and autonomous driving advancements.

- Analysts expect the Q3 earnings report to reveal how Tesla is managing key regulatory and market challenges.

- With Tesla stock at critical support levels, the earnings results could significantly influence the next price move.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Tesla (NASDAQ:TSLA) is gearing up to release its Q3 earnings report after the U.S. markets close today.

Investors are eager to see how the company is managing its ambitious goals, particularly the highly anticipated rollout of the Cybercab and ongoing regulatory challenges.

Tesla’s stock has been stagnant following the recent unveiling of the autonomous Cybercab, with many analysts and investors hoping for more detailed guidance on production timelines, an update on autonomous driving (FSD) and regulatory approvals.

Despite this, analysts expect Q3 earnings per share to hit 60 cents, with revenue forecasts standing at $25.4 billion.

Investor Focus: Affordable EV and Robotaxi

Tesla's strategy to launch a cheaper electric vehicle (EV) is considered an important move to increase the company's future sales.

In the second quarter results, Elon Musk stated that they planned to start production of new vehicles in the first half of 2024.

However, details about this vehicle, called Model 2 and planned to be sold at a price below $ 30,000, have not yet been shared. This raises another question mark among investors.

"We, Robot" event The lack of timelines and development details of new products such as Cybercab and Robovan, which were introduced, raised concerns that Tesla could fall behind its rivals Waymo and Cruise in terms of legislation and technical aspects.

However, Tesla may allay concerns by providing more details on these vehicles in its third-quarter earnings report.

Tesla's Financial Performance

Although fully autonomous driving and robotics developments at Tesla are extremely important for the future of the company, we can see that deliveries will be considered an important factor that will affect the share price in the short term.

Tesla's third-quarter vehicle deliveries exceeded the previous year's figures but were slightly below market expectations.

The company increased its vehicle deliveries in the first quarter of the year, delivering 462,890 vehicles. However, this figure was slightly below the 463,897 units expected by analysts.

In the financial results to be announced today, a perspective on the company's financial situation will be formed, as well as clues to plans and strategies will be sought.

In this context, statements on low-priced vehicles and fully autonomous driving technology will be closely monitored.

Looking at the expectations for the company's third-quarter financial results; It is seen that analysts at InvestingPro have a revenue expectation of $25.67 billion for the last quarter.

While it is seen that the consensus expectation for Q3 fell by 15%, this figure can be seen to be in line with the $25.5 billion revenue in the previous quarter. Still, the expectation is higher than $23.35 billion in the same period last year.

Source: InvestingPro

Earnings per share (EPS) expectation for Tesla is estimated at $0.6 before the earnings report, down 45%. While the EPS expectation is higher than the previous quarter, it is estimated to remain below the same period last year.

Source: InvestingPro

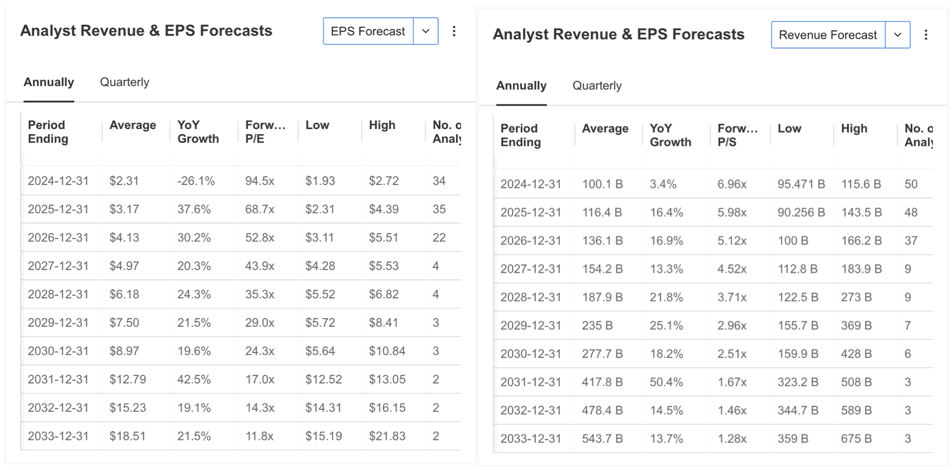

In the expectations for the coming periods, analysts expect EPS to be $2.31 at the end of this year, down 26%, while longer-term forecasts predict that the EPS increase may increase by an average of 30% on an annual basis.

Tesla's year-end revenue guidance is estimated at $100.1 billion, up a fractional 3%, while revenue is projected to grow by just over 15% over the next two years.

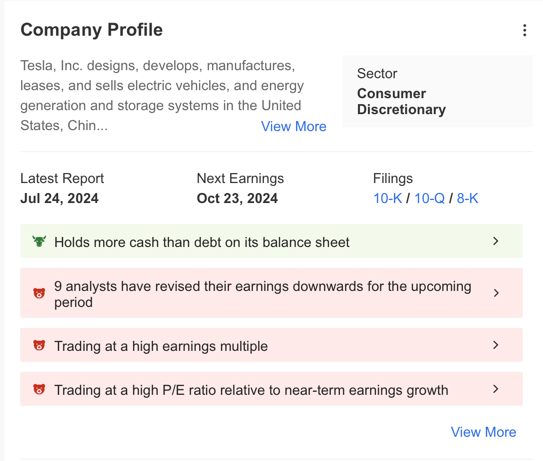

InvestingPro also has positive financial notes for Tesla as follows:

- The amount of cash on its balance sheet is above debt

- Cash flow to be sufficient to cover interest expenses

- High returns in the short and long term

Source: InvestingPro

Tesla's failure to pay dividends can be considered a negative situation for shareholders, and the expectation that the company's net profit will decrease this year, weak profit margins, EBITDA valuations, and high FD ratio are listed as other negative factors.

In addition, the high volatility of TSLA shares and its weak performance in the last month are also among the factors to be considered.

|

|

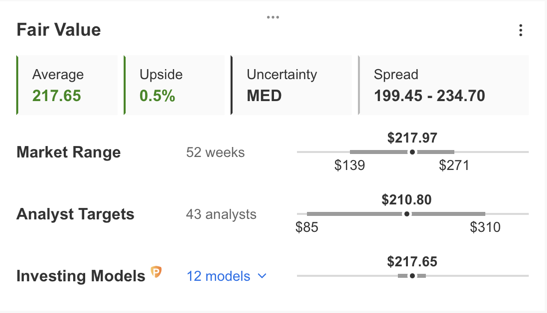

In light of this information, InvestingPro's Fair Value Tool has calculated a fair value price of $217.65 for TSLA based on 12 financial models.

This predicts that the stock is currently moving at fair value. In addition, the consensus view of 43 analysts on the platform shows the short-term price forecast for TSLA at $210.

Technical Outlook of TSLA

While it started a trend reversal in the second quarter of the year, it had quite volatile price movements in this process.

|

|

The stock, which rose rapidly between April and July, rose to $265 (Fib 0.786), the resistance level it failed to pass in the last quarter of last year. However, after being rejected once again from this level, it realized a deep correction towards $ 182.

While the stock failed to exceed the Fib 0.786 value according to the latest downward momentum, we saw that the correction ended in the middle band of the falling channel. In the current situation, the last 3-month recovery process was once again met with sales at the $ 265 limit. Then the failure of this month's event caused TSLA to retreat to $ 219 support.

The recent decline has also been a negative, causing the stock to break its short-term uptrend on volume. TSLA investors are now waiting for the Q3 earnings report at a critical support level. If investors do not get what they want in the report and the questions remain unanswered once again, we can see that the downward trend in the stock may continue. In the event of such negativity, the next support is seen as $ 200, while a slide to below $ 175 can be seen at a lower level.

On the other hand, if the earnings report meets expectations, this time we can see that TSLA's purchases above the $ 219 level may increase. In this case, the first target will be followed as the $ 240 band, and depending on the stock catching the uptrend again, we can see that the main resistance point can test $ 265 for the 6th time.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.