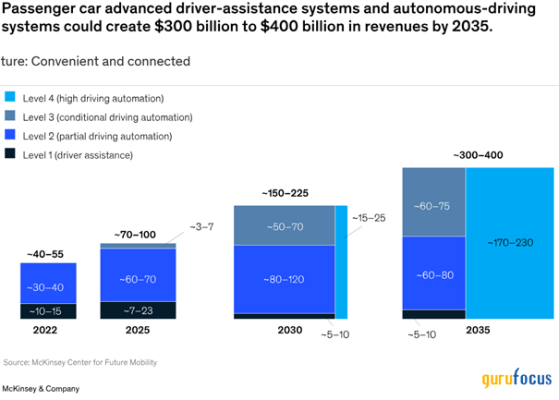

Tesla’s( NASDAQ: NASDAQ:TSLA) Recent HighlightsTesla’s FY 2024 performance had been bleak with reporting only 1% gain in revenue in 2024. Furthermore, EBITDA was down 4% in 2024 which primarily stemmed from price cuts revitalizing demand in the fiercely competitive EV market. For the first time in history Tesla saw a decline in the number of units delivered for which the [url="]ailing EU BEV[/url] market and BYD to blame. However, for long-term growth investors, the opportunity in Tesla lies in the autonomous vehicle market where it faces stiff competition from its local rival Waymo. The AV industry is expected to push Tesla to the next levels as the TAM in the western part of the world presents an incredible opportunity for Tesla as McKinsey projects the AV market to be worth $400 billion in the next ten years. Interestingly, Tesla has taken a technologically different approach than its rival to engineer the its robotaxi, Cybercab which is expected to be launched in 2026. And the technological difference backed by sound reasoning should eventually give the Austin-based carmaker’s shareprice a meteoric rise in the long term.Positive Catalysts- The race to full autonomyWhen it comes to core technological philosophies, it seems Waymo and Tesla have very contrasting views on the autonomy of vehicles. On one hand Tesla prioritizes mass deployment in quick succession whereas Waymo focuses on precision and deployment in a narrower spectrum. Sensor Technology: Mr. Iulian Dnistran explains and contrasts the sensor technology of the two Avs in a remarkable manner. Waymo’s fifth-generation sensor suite, which is currently deployed on its fleet of Jaguar I-Pace EVs, has no fewer than 13 sensors, including a 360-degree lidar, three perimeter lidars, three radars and a bunch of video cameras. All these gizmos create a 360-degree view of the area surrounding the vehicle and make it so that the car can drive even when it’s foggy, sunny or pouring rain outside. The cameras are also automatically cleaned if they get dirty. The lidar suite creates a high-resolution, 360-degree field of view with a range of approximately 1,000 feet. Meanwhile, the long-range cameras can see stop signs as far as 1,600 feet. The radars complement the lidars and cameras with their ability to detect objects and their speed irrespective of weather conditions. The lidar sensor comprises a laser source acting as a transmitter, a photodetector acting as a receiver, and an assembly of lenses or optics to steer and collect the laser pulses. Lidar’s use of pulsed lasers allows Avs to map the 3D model of an environment quickly and more accurately than radar or sonar. Tesla on the other hand, prudently eliminates LIDAR technology and rather depends on cameras as its main sensors. The idea is neural networks would help to decipher visual data and mimic human vision. This strategy comes under the notion of keeping hardware costs down.Autonomy Level: Back in October last year, when Musk had unveiled the Cybercab, it was there where he said Tesla aims to hit the Level 5 autonomy level with Cybercab. Level 5 essentially means zero human intervention. The Cybercap is expected to be launched in 2026 with no steering wheel. And scalability seems to be the driving force behind Cybercab’s growth as Tesla intends to use the available real-time data from its fleet of existing models to adjust to any environment via the help of extensively trained large language models (LLMs). Furthermore, the Cybercabs are expected to cost under $30,000 when it goes in production in 2026. On the other hand, Waymo currently operates at Level 4 autonomy within specified areas that demand pre-mapped environments to run with any human intervention. Due to the need of regularly updating the sophisticated 3D maps on a frequent basis, Waymo faces scalability issues.Model QFrom the above charts we can deduce that Model 3 and Y, the two cheapest models Tesla has to offer, contributed 95% of the total vehicle sold globally in FY24. Considering the fierce competition in China, what Tesla needs now is caffeine shot in revenues in the form of cheaper models. And Model Q couldn’t come at any better time specifically when the trillion-dollar automaker saw only [url="]1% growth[/url] in revenue in FY24. Model Q is reported to be launched in the first half of this year with a starting price of [url="]$40000[/url], which is line with Model 3 ($44000) and Model Y($46000). It is reasonable to expect that it would cause a spike in the Tesla’s revenue in Q3 and Q4 of 2025. And this present an incredible momentum opportunity for investors as the rise in sale would well and truly be reflected in the share price.Negative Catalysts-Uber & Waymo’s partnership In late 2023 Uber (NYSE:UBER) and Waymo had entered into partnerships where that would deploy Waymo’s autonomous vehicles in Ubers’s ride-haling services, starting in Phoenix. And in September of last year, the partnership expanded into cities like Austin and Atlanta where services would be available in early 2025.Under the most recent agreement in these cities, Uber will manage and dispatch a fleet of Waymo’s fully autonomous, all-electric Jaguar I-PACE vehicles, which will grow to hundreds of vehicles over time. Through this expanded partnership, Uber will provide fleet management services including vehicle cleaning, repair, and other general depot operations. Waymo will continue to be responsible for the testing and operation of the Waymo Driver, including roadside assistance and certain rider support functions. The expansion into cities like Austin and Atlanta is indicative of the mutual success of the partnership and helps to address Waymo’s scalability issues due to Uber’s extensive customer base. Furthermore, Tesla may find it difficult to fully established its ambitious robotaxi services under Tesla network as Uber and Waymo already have lead in the market.

Geopolitical factorsPlummeting sales in Europe have cast doubts over its future in the transatlantic markets. EU had imposed a tariff of 7.8% on the Chinese made EV sold by Tesla. This coupled with Mr Musk’s proactive political engagement may have contributed to the decline of sales in the old continent according experts. Additionally the termination of the EV subsidies directed towards the general public by the German government in December 2023 may also have contributed to this as the German BEV market shrank by 27.4% in 2024. Unlike the performance in Europe, Tesla had a blistering year in China with revenue growing by 8.8% in the Chinese market. Furthermore, Tesla had delivered 657,000 units in China, presenting 36.7% of the global deliveries it made in FY24 and this makes China Tesla’s second biggest market. The concern on Tesla’s performance in China lies on the geopolitical relationship between China and the US. Just a few weeks back Cina had imposed a tariff of 10% on electric trucks imported from the United States, impacting Cybertruck’s growth in the Chinese market. Even though, Cybertruck accounts for a small share of Tesla’s revenue in China as depicted by the chart above, political strategists would agree that US-China relation currently stands on a very thin ice especially after the recent tariffs imposed the leaders of these two nations on each other lately.ConclusionDespite with a forward PEG ratio of 5.01, Tesla represents

opportunity to both momentum and growth investors. Momentum investors can reap

the harvest of stock gains in the later half of this year when Model Q is

expected to be rolled out. And this is because cheap models have always been

the holy grail of models of Tesla globally and as shown above models worth

$40000 to mid-$40,000 have accounted for 95% of the vehicles sold last year.

Growth investors can solace in the fact that Tesla is aiming for a mass

deployment by late 2026 or early 2027 albeit

in a gradual phases but elimination of LIDAR technology would help the AV

businesses to be profitable and the huge existing fleeting of Tesla vehicles

would ensure its Full-Self Driving (FSD) technology get enough data to train

its LLM and get enhance by that time. However, Tesla needs to be meticulous

with the safety and regulatory requirements as Waymo faced quite a bit of these

hurdles which hindered the pace of their scaling up. Admittedly, Tesla is not

an opportunity for conventional deep value investors as the 5.01 PEG ratio

would put them off.

This content was originally published on Gurufocus.com