- BYD saw a Q1 slowdown, missing analyst expectations and posting its lowest annual growth in 4 years.

- Meanwhile, Tesla retook the lead as BYD's sales slumped.

- As BYD stumbles, the stage is set for Elon Musk's company to pounce.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

Chinese EV giant BYD (SZ:002594) (HK:1211) experienced a slowdown in the first quarter of 2024, raising concerns despite a net income increase of 10.6% year-on-year to 4.57 billion yuan ($632 million).

While revenue reached 124.94 billion yuan ($17.3 billion), representing a 4% increase year-on-year, it fell short of analyst expectations by roughly $1 billion and marked the lowest annual growth rate in the past four years.

BYD's struggles extend to sales, with only 300,000 battery-powered cars sold in Q1, significantly lower than the record 526,000 in Q4 2023. This decline resulted in Tesla reclaiming the global electric car sales crown after BYD's brief leadership.

Meanwhile, Tesla (NASDAQ:TSLA) started 2024 with job cuts and disappointing results. However, recent announcements like the earlier-than-expected arrival of a new low-cost model and a partnership with Beijing for autonomous driving technology in China have boosted investor sentiment, pushing the stock price up over 8% in the past month.

Both companies now face a fierce battle for market share, which will likely impact their stock performance.

BYD's Outlook: Analysts Remain Bullish

Despite the recent stumbles, analysts remain largely optimistic about BYD's future.

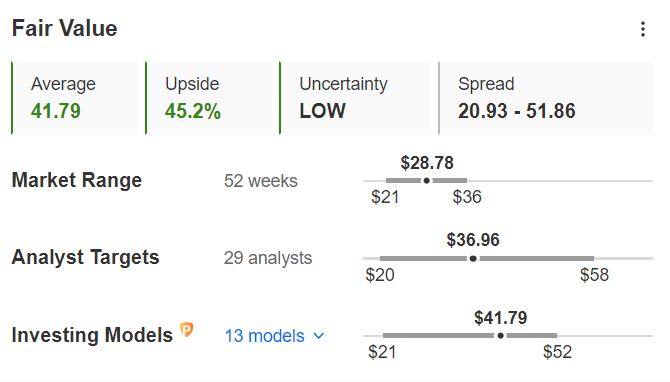

Source: InvestingPro

While the stock's fair value is estimated at $41.79 per share, representing a 45.2% increase from its current price, the average target price among analysts is set at $36.96 per share, suggesting strong potential for growth.

Tesla's Stock: Neutral Sentiment with Some Upside Potential

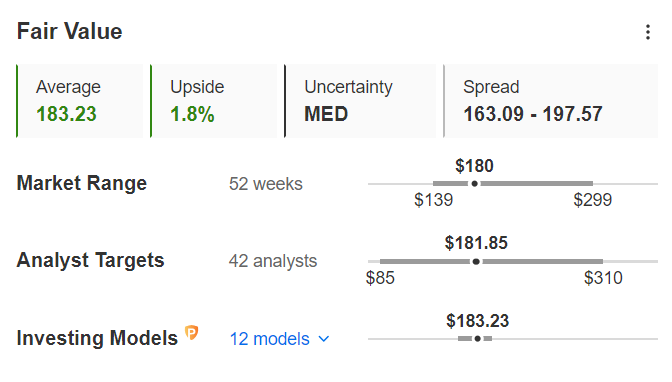

Tesla's stock currently faces a more neutral sentiment, with a fair value of $183.23 per share and an average target price of $181.85.

Source: InvestingPro

However, some analysts predict a significant rise, with Cantor Fitzgerald initiating coverage with an "overweight" rating and a $230 target price.

Conclusion

While Tesla has regained the electric car sales lead, BYD's strong analyst support and potential for future growth make it a compelling investment option. Both companies offer exciting opportunities, but investors should carefully consider their individual risk tolerance and investment goals before making a decision.

***

DISCOUNT CODE.

Start the month by making the right investments. By clicking on one of the links shown within the article, for a limited time only, you can take advantage of a special discount to subscribe to InvestingPro+ and thus take advantage of all our tools to optimize your investment strategy. (The link directly calculates and applies the additional discount. In case the page does not load, you enter the code proit2024 to activate the offer.)

You will get a number of exclusive tools that will enable you to better cope with the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

Take advantage HERE AND NOW of the opportunity to get the annual Investing Pro+ plan at a special discount. Use code proit2024 and get over 40% off your 1-year subscription.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.