For years, the investment community has debated the merits of active versus passive investment strategies. A recurrent critique of actively managed ETFs is their historical struggle to outpace their index-tracking counterparts, especially when accounting for fees.

After all, while the magic of compounding can work wonders for returns, it can have a detrimental effect when applied to fees. But let's entertain a thought: What if actively managed ETFs came with a much lower price tag? Would that pique your interest?

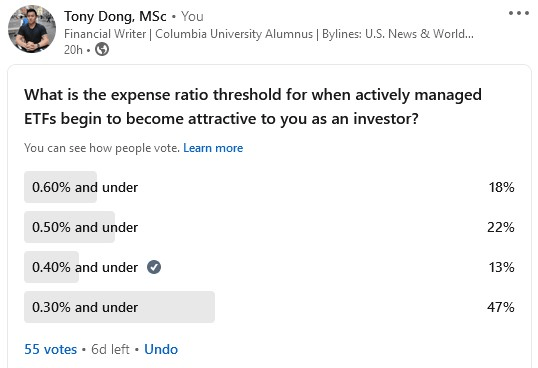

I recently posed a related question to my LinkedIn network, inquiring about the expense ratios at which actively managed ETFs start looking more attractive. Of the 55 professionals who responded, a significant 47% pinpointed a threshold of 0.30% and below.

While this informal poll provides an interesting snapshot, those craving a comprehensive deep dive might want to peruse the Trackinsight 2023 ETF survey.

For an even broader overview, I'd recommend the ETF Central screener, a handy tool for investors looking to identify optimal investment opportunities.

But for those eager to delve into specifics right now, let's turn our focus to the NYSE. Here, you'll find some of the most competitively priced actively managed equity and fixed income ETFs currently on offer.

Cheapest NYSE Listed Actively Managed Fixed Income ETFs

Fixed income stands out as a distinctive segment within the investment landscape where the case for active management grows even more compelling.

Following the turbulence of the bond bear markets in 2022 and, to some extent, 2023, many investors have come to appreciate the nuances and complexities inherent to this asset class.

The fixed income market, with its opaque nature and occasional liquidity constraints, lends itself well to active oversight.

From a risk-reduction perspective, active management can help navigate the drawdowns that might otherwise trip up passive strategies during a rising rate environment.

Moreover, in terms of alpha generation – the pursuit of returns above a benchmark – active managers in the bond space have a richer toolkit at their disposal.

Unlike their equity counterparts, bond funds have a plethora of levers they can adjust to respond to market conditions and seize opportunities.

These include, but aren't limited to, adjusting portfolio duration, fine-tuning credit quality, diversifying across geographies, and even optimizing factors like yield curve positioning and sector allocations.

Each of these elements, when managed effectively, can significantly enhance returns and provide a degree of protection, offering value in ways that mere bond indices cannot match.

Here are three of the cheapest NYSE-listed actively managed fixed-income ETFs right now:

- T. Rowe Price QM U.S. Bond ETF (TAGG): 0.08% expense ratio.

- Franklin U.S. Treasury Bond ETF (FLGV): 0.09% expense ratio.

- Dimensional Inflation Protected Securities ETF (DFIP): 0.11% expense ratio.

Cheapest NYSE Listed Actively Managed Equity ETFs

When the conversation turns to actively managed equity, the immediate association many have is with alpha generation – the art and science of selecting stocks either through a proprietary strategy or a rules-based factor approach, all with the aim of outperforming a benchmark.

However, beyond just stock selection for outperformance, many ETFs under the active management umbrella have distinct goals that cater to specific investor needs.

Some seek to deliver above-average monthly income, a valuable proposition for those focused on cash flow or in retirement planning stages. Others prioritize limiting downside risk, an endeavor often realized through sophisticated derivative strategies.

One of the most popular NYSE-listed ETFs that embodies both of these strategies via active stock selection and a covered call overlay is the JPMorgan (NYSE:JPM) Equity Premium Income ETF (JEPI), which charges just 0.35% and has attracted some $29 billion in AUM since inception.

Here are three of the cheapest NYSE-listed actively managed fixed-income ETFs right now:

- Dimensional US Equity ETF (DFUS): 0.11% expense ratio.

- WisdomTree U.S. Value Fund (WTV): 0.12% expense ratio.

- Dimensional US Core Equity Market ETF (DFAU): 0.12% expense ratio.

This content was originally published by our partners at ETF Central.