Colgate-Palmolive (NYSE:CL) is an American multinational consumer staples company. The company specializes in the production, distribution and provision of household, health care, personal care and veterinary products. After lean years in terms of results and stock performance, Colgate- Palmolive has seen a resurgence over the last 18 months. A strong FY2023 led to a strong 6 months so far in 2024 as the company improved its finances across the board, increasing revenues and net profits, decreasing expenses, while also bringing in more cash. Colgate- Palmolive remains committed to rewarding their shareholders, increasing dividends for the 61st year in a row. Portfolio rebalancing towards defensives like consumer staples by investors amidst fears of a US recession coupled with the above-par results for the enterprise has resulted in the company outperforming the S&P 500 index over the last year after trailing the index for multiple years prior. For a long-term investor, the current price indicates an ideal selling opportunity to pocket some off the gains in a sector where high growth tends to occur infrequently and lasts only for a short period of time.

Financials and Operations AnalysisColgate-Palmolive's results have turned around after a lean FY-2022 across all fronts. Net Income grew by 29% for FY-2023 and exceeded its FY-2021 figure, and increased by 36% for the nine months of FY-24. The company increased its net cash by 43% in the 18 months since the end of FY-2022, while at the same time continue its policy of increasing its dividend, meaning that over the last year and a half, Colgate has been able to continue to generate cash despite consistent cash outflows.

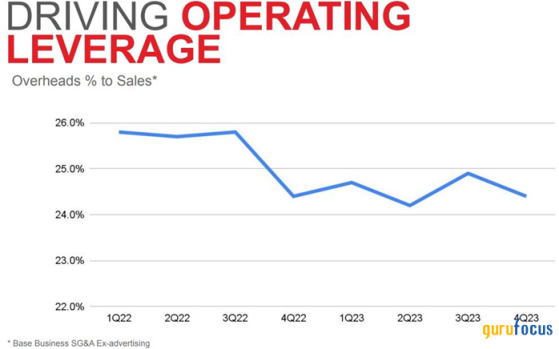

For a company as large and globally present as Colgate, accessing new markets to drive revenue growth and profitability may be difficult. Revenues grew by 8.2% in 2023, but growth has been stagnant across business segments and geographies. Hence, in such a situation, decreasing expenses can be the driver of profits. In FY2023, Colgate was able to bring down cost of sales as a percentage of net sales compared to FY2022. The company built on this is 2024; Q2 2024 cost of sales decreased compared to Q2 2023, despite revenue increasing over the same period, with this trend continuing in Q3 2024. The result is a 64% increase in Net Income and EPS for 6 months ending Q2 2024 as compared to Q2 2023. The graph below (source: Investor Presentation) illustrates the company's focus on reducing expenses.

From a financial management lens, Colgate-Palmolive is reasonably well-placed. The company has a liability to equity ratio lower than 1, and the majority of its long-term debt (over 52%) is due post 2028. Thus, over the short term, the company is not burdened by excessive debt obligations; this is a positive for an investor in the stock as lower debt obligations imply that the company is more well placed to return value back to shareholders in the form of dividends and repurchases due to the company will not be cash-strapped. Net cash from operations stood at $3.745 billion, 3x the amount of public debt (short and long-term) due in 2024 ($1.127 billion). Colgate-Palmolive has returned $28 billion in cash to shareholders in the last 10 years. For a company that struggles to find growth opportunities due to its sheer size and global presence, the commitment towards the long-term benefit of the shareholder over short-term projects is a sign of prudent use of funds by management.

Two concerns from Colgate-Palmolive's finances present us with an opportunity at understanding the company's upcoming vision. First, the current ratio is just above 1, driven by an increase in short-term borrowings of $337 million. The second is Goodwill, which is an intangible asset that reflects the premium paid over fair value for the acquisition of a company. Goodwill is around 21% of total assets, which is a sizable amount, that could materially affect the asset base if this value is written-down or if the subsidiaries fail. The increase in borrowings and the significant goodwill payment indicate that Colgate-Palmolive is willing to take risks in the near-term in order to solidify growth prospects; the company is ready to pay a healthy premium for acquisition's it believes will be part of Colgate-Palmolive's growth story continuing in to the future, while the increase in near- term borrowings indicate the company wants to take proactive steps to increase earnings in the near-term.

Share Price and Industry PerformanceAfter lagging the S&P500 Index for multiple years, Colgate-Palmolive has had its best year, up one-third, outperforming the index on both a price and total return basis considering a 1-year period (graph below).

Investors snapped up shares in consumer staples stocks like Colgate-Palmolive, Coca-Cola (NYSE:KO), etc. amid concerns over a potential slowdown in the US economy. Since then, as economic data continues to point to a strong US economy, consumer staples stocks have retreated to their February 2024 level this is particularly true for both Colgate-Palmolive and P&G, which are both hovering at the same level as a year ago. As we can see below, consumer staples generate large gains during times of investor concern, as evidenced by their performance in September of 2024, when the anticipation of rate cuts were high.

Viewing Colgate-Palmolive's competitors presents us with a clearer picture for the consumer staples industry. As seen earlier, Colgate-Palmolive's Net Income increased greatly in FY-24, on the back of improved operations. This was the case for competitors Clorox (NYSE:CLX) increasing Net Income by 3.5x for 3 months ending September 30th 2024, whilst P&G's profits grew by 7.5% for the 6 months ending 31st December 2024, while Unilever (LON:ULVR)'s profits decreased.

Colgate-Palmolive has a lower P/E of 24.91 than both Clorox at 55.54 and P&G at 26.45, whilst having a marginally higher P/E than Unilever at 21.12, who had considerably worse results. We can infer then that the underlying earnings haven't been the primary driver in the stock price for these companies and that the prevailing macroeconomic sentiment is the primary factor in determining the stock price trajectory of companies in the consumer staples industry. With reasonable P/E and much better financials, Colgate-Palmolive is the best placed company while compared with its peers.

The PEG ratio, i.e., the Price-Earnings-to-Growth ratio for Colgate-Palmolive is 3.77. This means that the P/E is nearly 4x the growth rate of earnings. Earnings are going to grow slowly for a company as big and in a low-growth sector like Colgate-Palmolive. As a general rule, PEG ratios above 1 are considered unfavorable as the price has accounted for a rise in earnings. Thus, looking at the high value of the PEG ratio for Colgate-Palmolive, we can infer that the price may have topped out and that it is a good time for an exit.

Zooming out, and comparing Colgate-Palmolive to the S&P 500 index over a longer time-frame we can see that it has consistently lagged the index on a total return basis (attached below). This is common across Colgate-Palmolive's competitors. P&G returned 50.71% and Clorox returned 16.42%. This mismatch in stock performance compared to financial results underscores the point made above that defensive companies like Colgate-Palmolive outperform the market in spurts and then tend to lag the market for years at a time.

Colgate-Palmolive saw a large run-up in its price last year reaching a high of $109.3. Since then, as growth stocks outperformed in Q4 2024, Colgate-Palmolive's stock price has retreated to its February 2024 level, hovering between the $84-86 range. The P/E ratio of 24.91 is slightly lower than that of the S&P 500 Index of 28.77, which although paints a picture of undervaluation is actually a warning sign. This is concerning as the S&P 500 Index is a composite index that is comprised of many stocks that can be categorized in the growth category (ex: Technology stocks like Nvidia (NASDAQ:NVDA)).

A company like Colgate-Palmolive having the nearly the same P/E as the representative index suggests that Colgate-Palmolive is slightly overvalued at its current price. From a fundamental perspective, a company that has sales growth of 6-8% a year, and is not in a disruptive industry like Technology; having close to the same P/E as the National Index is concerning. Investors like to invest in companies like Colgate-Palmolive because of their low P/E or P/S ratios. The major point of attraction to include a consumer staples company in one's portfolio is the assumption that such stocks are cheap relative to the index; as they represent a defensive hedge against recessionary circumstances. When the defensive company itself has a P/E similar to the index, it suggests that the gains have crystallized and that it would be a good time to sell. That analysis is supported by recent market sentiment surrounding Colgate-Palmolive, as the stock has dropped massively in Q4 2024, and its still elevated P/E levels may imply that a further drop in price may be on the cards in the near future.

From a long-term lens, Colgate-Palmolive would be a conservative investors pick. The company has paid uninterrupted dividends since 1895 (129 years) and has increased its dividends for the last 61 years. Although the yield on these dividends may be lower as compared to other industries like technology or energy, the fact that the company has not only sustained but increased its commitment to rewarding its shareholders four times a year is a testament of the company's ability to weather various economic crises and setbacks.

Thus, for a long-term investor unconcerned with the short-to-medium term effects of business cycles and economic tariffs, Colgate-Palmolive is a safe bet, with modest capital appreciation and the assurance of regular payment of a dividend.

Future OutlookColgate-Palmolive managed to turnaround after a poor 2022 with strong performances across revenue and profitability over the last 21 months. The company has managed its finances well, focusing on cutting costs as a measure to increase profits and that tactic has worked, especially for a company of Colgate-Palmolive's size that may find it difficult to organically increase volumes to drive revenue growth. Despite small concerns over short-term liquidity, the company has managed to steadily build up its cash balances and does not have large amount of debt due before the close of the decade. At the same time, the company has remained committed to rewarding shareholders through continuous dividend payments.

We can see that although the company has been doing all the right things to ensure financial success, its growth in the stock market was largely due to investor concerns over an economic slowdown back in Q3 2024. Since then, the stock has retreated back to its February 2024 levels, indicating that investors still consider the stock to be valuable despite sluggish growth numbers. Despite its impressive performance over the last 18 months, Colgate-Palmolive has seen gains similar to its competitors.

For the investor with a long-term horizon, it may be beneficial to book some profits as such levels of capital appreciation for a low-growth stock like Colgate-Palmolive doesn't happen often. At the same time, the long-term investor would do well to not sell off their entire position in order to draw on dividend payments as well as benefit further from capital appreciation if recession fears turn out to be true.

For the investor with a short-to-medium-term outlook, considering the fact that Colgate- Palmolive's P/E ratio has reached the same level of the S&P 500 Index, it may be a good time to sell. If tariffs from the Trump administration deter the prospects of many growth companies, it may be a good time to buy again and ride the defensive wave as investors look for safe investments. For now, as markets await the fate of international tariffs and tensions over an economic contraction decrease, it may be a good time to move out of consumer staples and a company like Colgate-Palmolive and look for investments in a more promising growth field.

This content was originally published on Gurufocus.com