U.S. banks have been struggling since regulators shut down and sold Silicon Valley Bank, Signature Bank and First Republic. However, the sector may have bottomed out as it bounced back last week, driving ETFs in the Financials sector up 1.32%.

In a notable demonstration of confidence, executives at U.S. banks have displayed an aggressive stance by significantly increasing their holdings of company shares according to VerityData. This surge in insider buying, reaching its highest level since the onset of the pandemic in 2020, serves as a compelling indication that the industry may be entering a pivotal turning point. In total, 778 executives of 244 different banks experienced insider share buying during the second quarter of this year, compared with 524 buyers in Q1 2023.

Investors often look at insider trading to get more information about a company’s outlook. The executives’ move sends a clear signal that the outlook for regional banks is more positive.

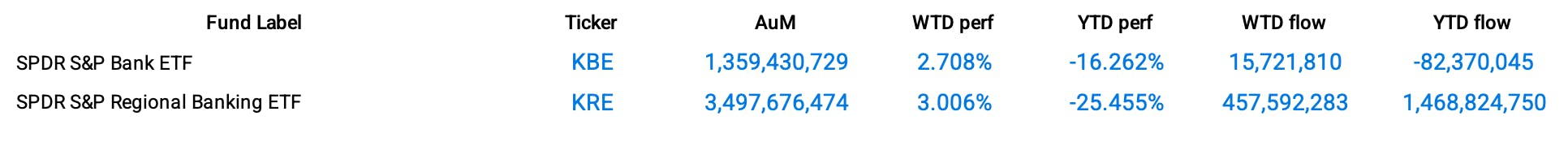

This surge of confidence certainly had an impact on bank-focused ETFs. As an illustration, the SPDR S&P Regional Banking ETF gained 3.01% for the week with inflows of $457.6 million. The SPDR S&P Bank ETF also recorded a significant performance of 2.71%.

Group Data

Funds Specific Data

This content was originally published by our partners at ETF Central.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.