Fixed income ETFs are making a comeback. After a challenging 2022, these funds are regaining popularity and attracting significant investor interest. While equities might still be the "cool kid on the block," fixed income ETFs are steadily growing, representing about 20% of total ETF assets.

In this newsletter, we highlight a few data points on this growing asset class in the ETF wrapper.

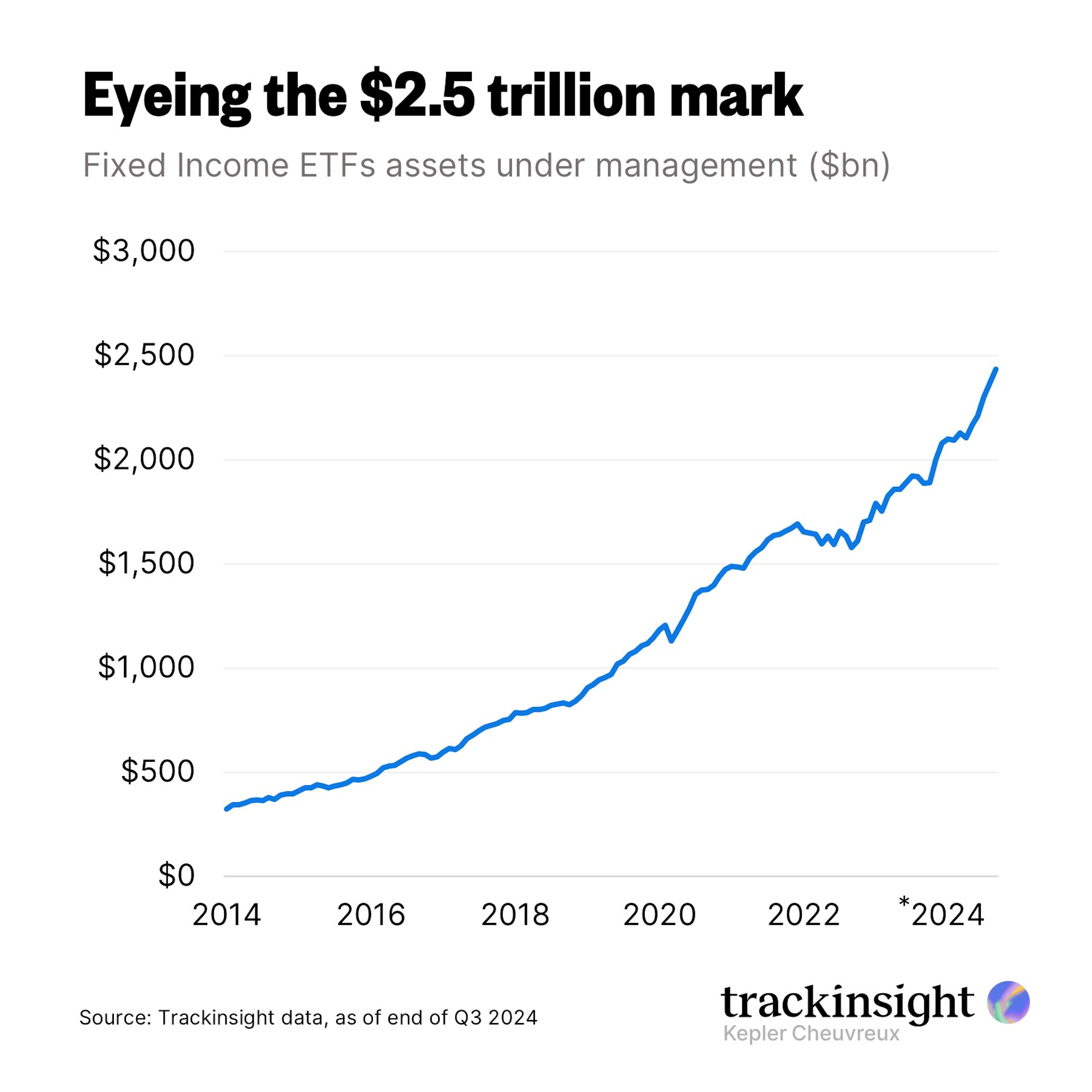

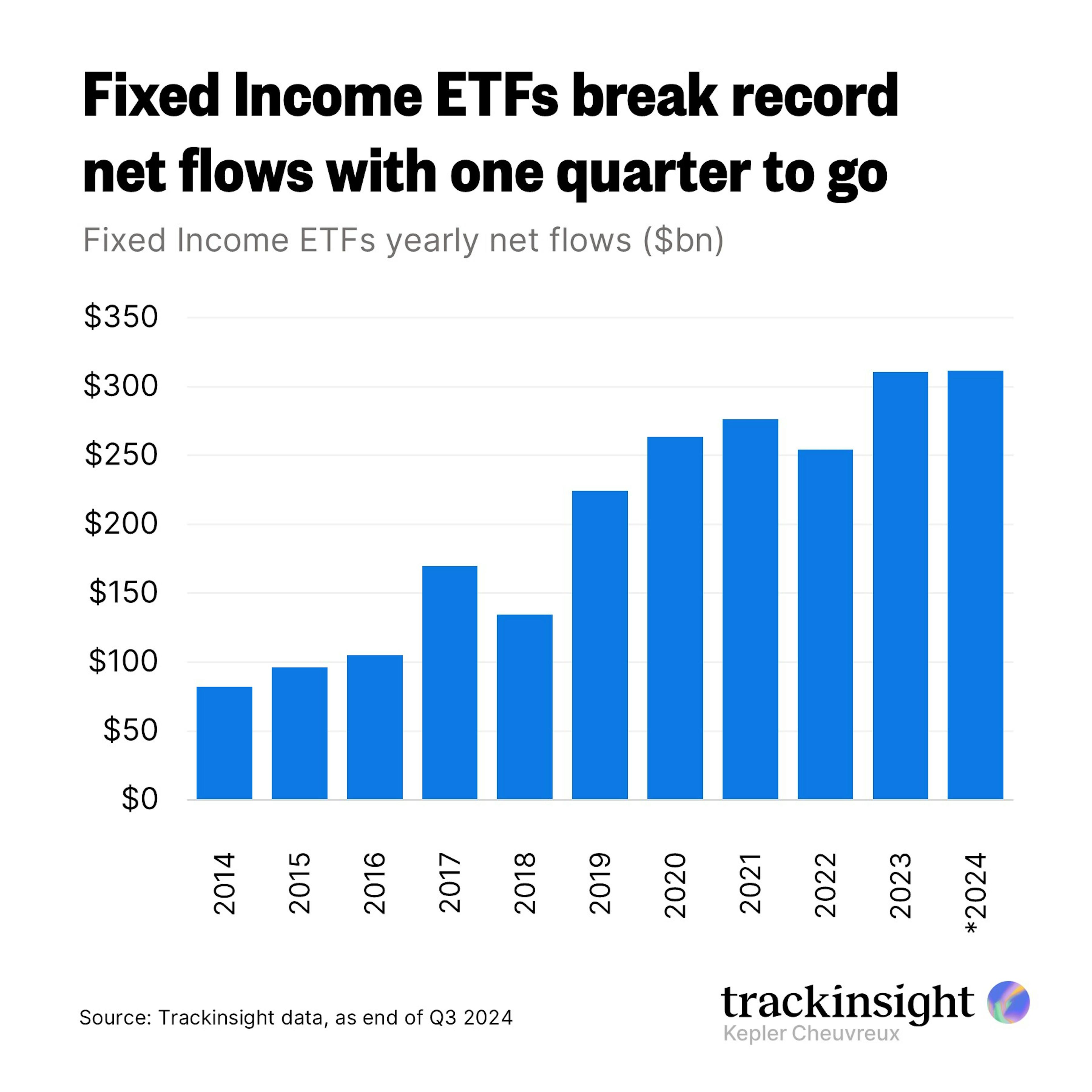

With global ETF assets nearing $2.5 trillion (as of end Q3 2024), the fixed income category has experienced stellar growth over the past two years. In fact, net flows for fixed income ETFs are breaking records and are on track to reach a staggering $400 billion globally this year.

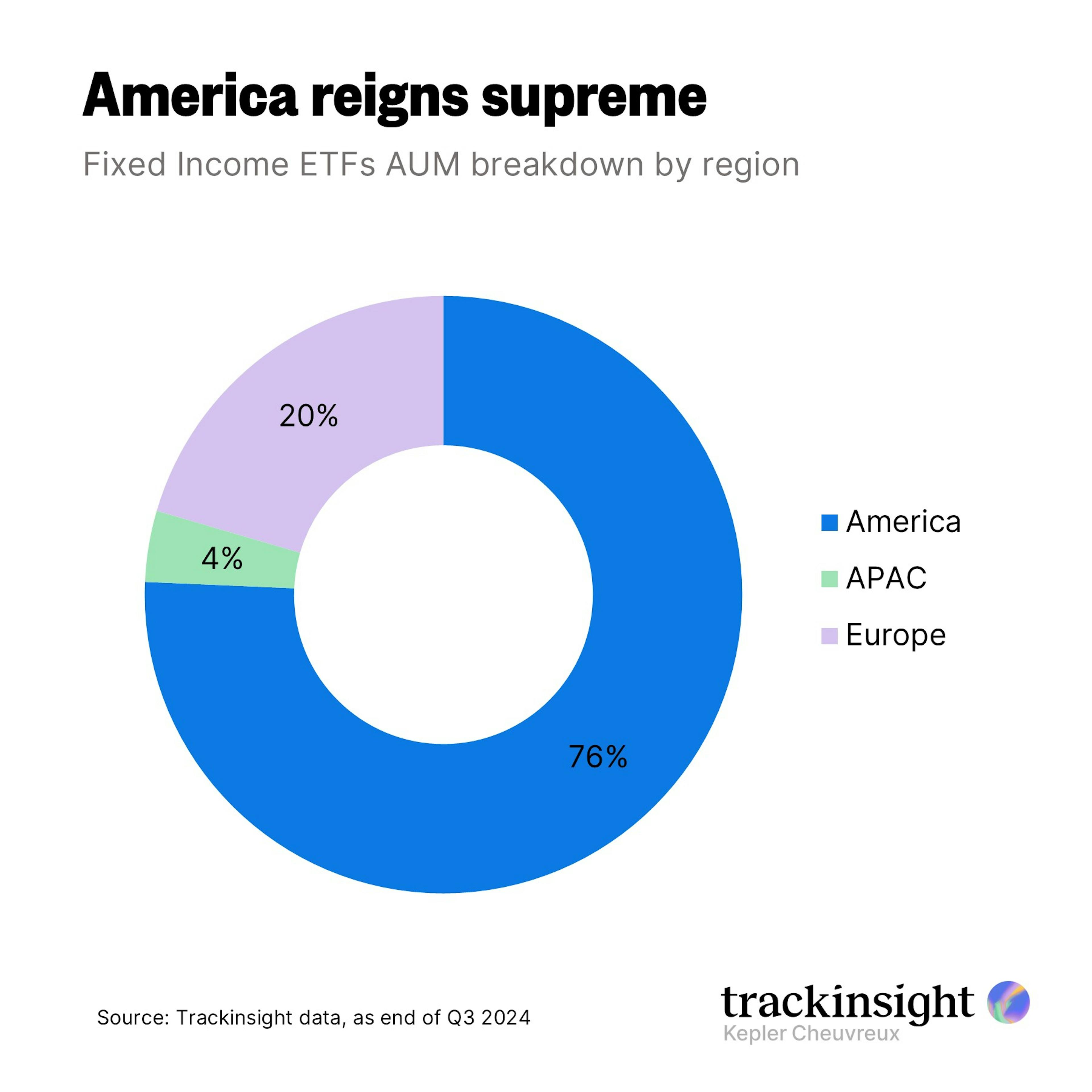

America (U.S. dominates the global fixed income ETF landscape, accounting for over three-quarters of all assets in this category.

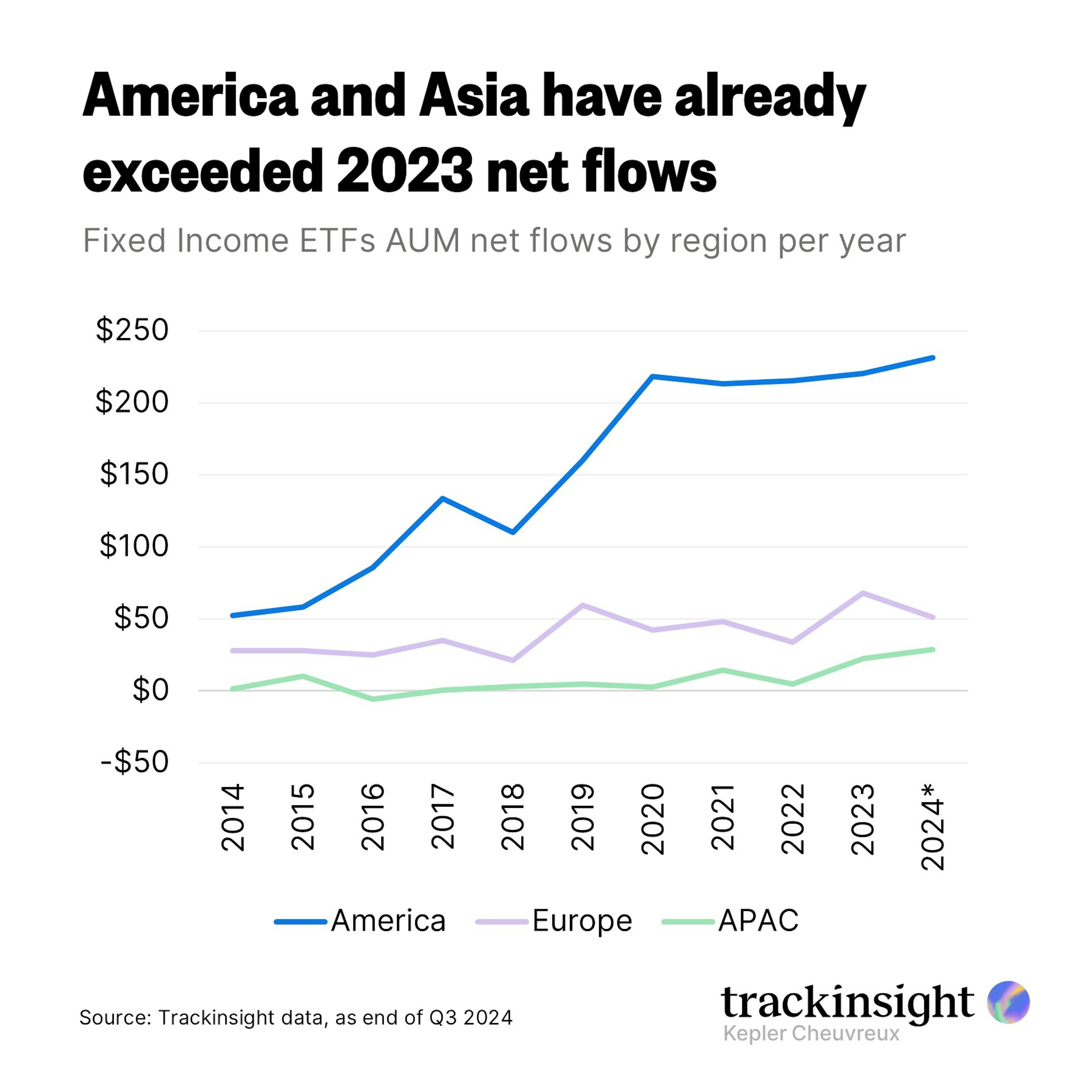

Both America and Asia experienced stronger net inflows in the first nine months of 2024 compared to the entirety of 2023. Europe, meanwhile, has some ground to make up.

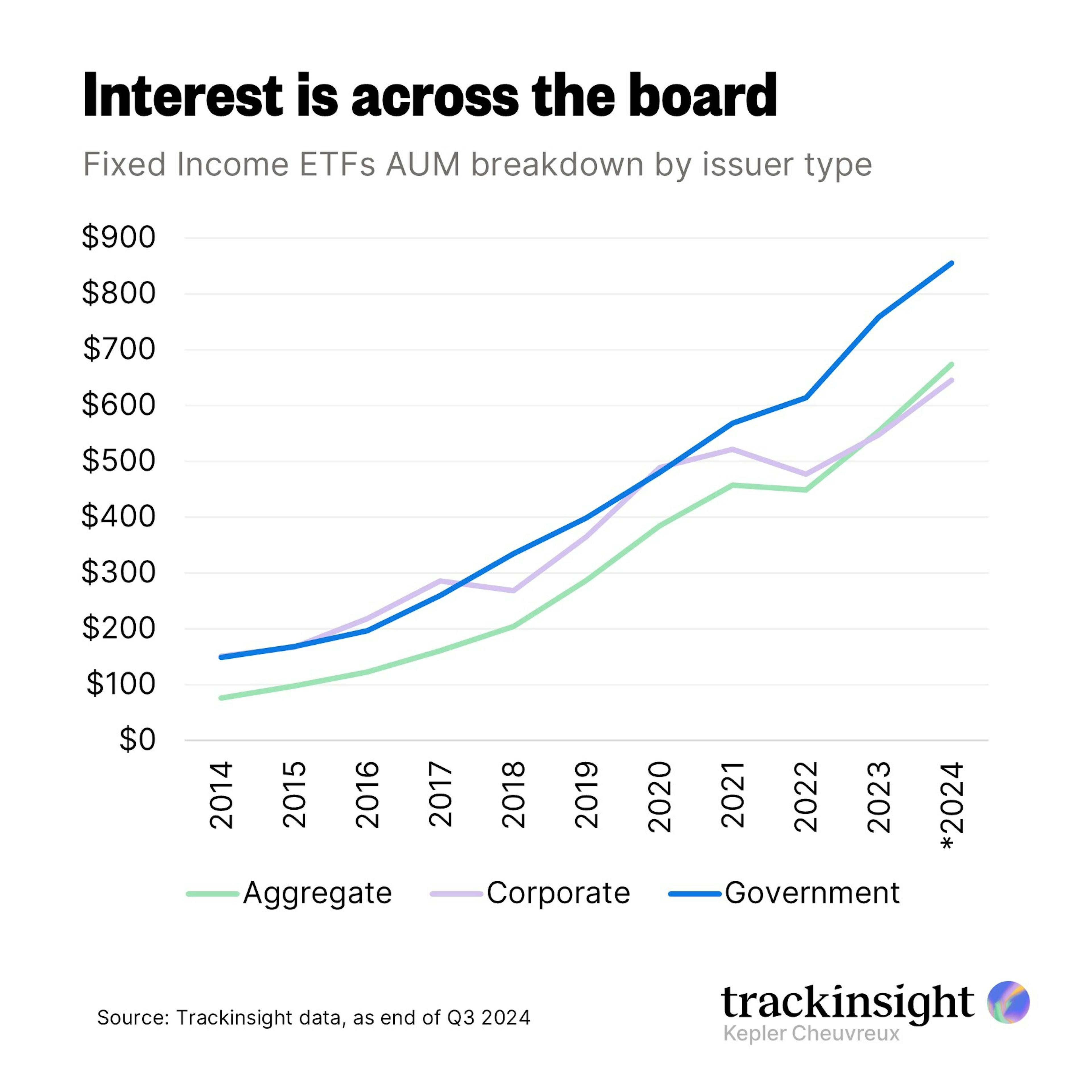

Government, corporate, and aggregate fixed income ETFs have experienced significant asset growth, with Government bond ETFs surpassing $800 billion and the other two nearing the $700 billion mark.

Aggregate bond ETFs have attracted the highest inflows in the first three quarters of the year, drawing over $100 billion compared to $85 billion for Government and $82 billion for Corporate bond ETFs.

Discover insights into active versus passive strategies, credit ratings, maturity profiles, and more. Uncover top ETF issuers, index providers, and the best and worst-performing fixed income funds. Additionally, see which funds are gaining popularity and which are falling out of favor.