2023 was a remarkable year for Duolingo Inc. (NASDAQ:DUOL). Consumers loved the app, driving its shares up by 213%. This year, however, tells a different story. The stock is trading 22% lower in 2024, which I see as a buying opportunity.

There is a lot to like about the company. However, the higher-for-longer interest rate narrative has put pressure on the sector, while consumer purchasing power been squeezed. Despite these challenges, the factors that could lead to the stock price soaring again are quite compelling.

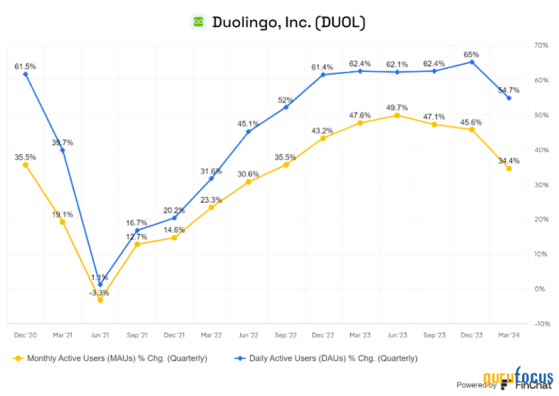

Duolingo cannot grow fast foreverThe company has faced pressure on two fronts. First, artificial intelligence tools like ChatGPT could make Duolingo obsolete. Second, the decline in monthly active users and daily active users in the last quarter. The stock dropped 18% in a single day following the release of its first-quarter earnings on May 8. However, I believe the results were not as bad as they seemed.

Revenue rose a better-than-expected 45% to $168 million. The 47% increase in bookings and a doubling of the operating margin also surpassed guidance. What scared Wall Street was the slowdown in MAU and DAU growth after five quarters of DAU growth above 60%.

Source: FinChat

To put some numbers in context, there are 97.6 million MAUs in the app and nearly a third of them, 31.40 million, use the app daily. Management has said the DAU growth should return to near 60% next quarter.

However, Duolingo is reaching a scale where maintaining over 60% DAU growth indefinitely is unrealistic. As such, it is natural for growth to slow down. Despite this, management is confident in returning to near 60% DAU growth. If they achieve that, it indicates the thesis is still alive and Wall Street has overreacted, though the company still needs to deliver on this promise.

Duolingo remains very attractive, having raised its outlook for the year, reflecting a "beat and raise" performance.

Optimized for growthSince its initial public offering on July 27, 2021, Duolingo's earnings per share have grown from a loss of $1.24 to an estimated 97 cents. Duolingo's freemium model, which offers ads or an ad-free premium tier, is working and user engagement is on the rise. Users are not only learning, but playing and interacting more.

There are concerns that ChatGPT and other AI programs will make Duolingo obsolete, based on the idea that people could use it to translate conversations in foreign countries, eliminating the need to learn languages. I disagree. People want to learn new languages for the connection and interaction with others. For example, another education stock, Chegg (NYSE:CHGG), has plummeted more than 60% since it announced AI was impacting new user growth. Chegg has now reported eight consecutive quarters of year-over-year revenue declines. That is not happening with Duolingo.

Generative AI will help Duolingo in the long term rather than work against it. The company used to generate content using large language models, which could take months. With AI, the company can generate new content more quickly and cost-effectively, enabling a more aggressive approach.

Another competitor is Udemy (NASDAQ:UDMY), which operates an online learning and teaching marketplace, offering a wide range of courses. Revenue is generated through course fees, with a share going to course creators. However, Udemy is more of a marketplace for content creators, while Duolingo creates its own courses through a large language model and now AI, creating a competitive advantage.

Other private competitors like Rosetta Stone, Babbel and other premium educators may follow Duolingo into ad-supported programs.

Another risk to consider is the regulatory risks related to educational standards.

Subscription strategy and new cohortsAs part of its strategy, Duolingo has been optimizing its subscription tiers, including the family plan and Duolingo Max tier. There are growth opportunities in expanding its English learning offerings, which currently represent less than half of its DAU. These new tiers will bring more engagement to the app. Users will be able to compete with friends, family and on a leaderboard of strangers as part of the gamification model, further enhancing user retention and satisfaction.

Duolingo is also expanding its offerings beyond language learning. The company launched new cohorts in music and math, which are currently in development and available only on iOS, with plans for Android later this year. There are also plans for instrument integration and licensed music. These new cohorts represent significant growth opportunities, in my opinion. The music cohort will eventually integrate instruments and licensed music, while the math cohort aims to make learning mathematics more engaging and interactive. These expansions into new subjects not only diversify Duolingo's offerings, but also attract a broader user base.

ValuationFrom a reverse discounted cash flow perspective, Duolingo's free cash flow needs to rise 23% and decrease at a linear rate to 15% in year 10 to justify the current price.

Source: Author

Analysts expect the company to grow its revenue by 36% per year over the next five years. FCF has been growing faster than revenue as the company optimizes its FCF margin. Using these assumptions and deducting 3% to account for dilution, the price target for Duolingo is around $257. It implies a potential growth rate of 48% from the current share price of $175.24.

ConclusionDuolingo has gained momentum since the Covid-19 pandemic and was one of the few that was able to maintain its momentum afterward. The company is doing well and just turned net income profitable on a GAAP basis four quarters ago. Its balance sheet is in excellent shape with $830 million in cash and only $54 million in debt.

I see significant operating leverage and efficiencies to be gained. AI will help the company reduce costs and create new courses more quickly and affordably rather than work as Duolingo's enemy. While I understand the risk of AI translation becoming more advanced and potentially reducing the demand for language learning apps, I believe people want to learn new languages to create connections. The new cohorts the company is creating, such as the Family Plan and Duolingo Max, along with diversification into music and math and potentially other subjects, will boost revenue once optimized. As a long-term investor, I see the stock as a buying opportunity.

This content was originally published on Gurufocus.com