Many countries are experiencing a worker shortage. In the US, half of all Baby Boomers are now 65 or older and are moving into retirement.

This trend is not limited to the US. Between 2015 and 2030, the number of people aged 60 or more is expected to grow by 56% globally. The younger generations, in most cases, simply won’t be big enough to fill the jobs left vacant.

Some call this demographic decline. It is especially pronounced in countries like China, Germany, and Japan.

Economists Charles Goodhart and Manoj Pradham describe the problem in their book The Great Demographic Reversal. They explain that “there will be an absolute decline in the labor force in several countries.” Adding to this problem is the fact that “improvements in morbidity and mortality rates, will lead to a rapid increase in the number of retirees over 65.” The large population of elderly people will still need goods or services but meeting those needs will be difficult because the working age population will be smaller.

As the trend intensifies the world will need new ways to drive more productivity out of a smaller workforce. In many industries, the answer will be automation and robotics.

Here we look at

1. Why older people will outnumber younger people globally

2. How robotics and automation can help

3. Where individuals may want to invest

Why Are Global Populations Getting Old?

People age. That’s natural. What is happening today, however, is more than just aging. Consider that the median age globally was just over 20 in 1970. Today it’s just over 30. As the older demographic continues their march into their 60s and 70s the younger demographic behind them is fewer in numbers. Why?

Fewer children are being born. In the past, more people lived in rural settings than they do now. Children were needed to tend to the land. As economies grew, more people moved to cities to take manufacturing jobs and they had fewer children. This trend has been continuing for 70 years. As a result, we have more old people today than young people. This global imbalance intensified due to China’s one-child policy running from 1980 to 2015.

The problem is that most economic activity comes from people aged 18 to 45. They are working and producing output while also buying homes and spending to raise their families. What lies ahead is a world where the economic power of those 18 to 45 is overshadowed by the consumption, but not contribution, coming from those 65 and older.

As researchers at Our World in Data explain, “We are on the way to a new balance. The big global demographic transition that the world entered more than two centuries ago is then coming to an end.”

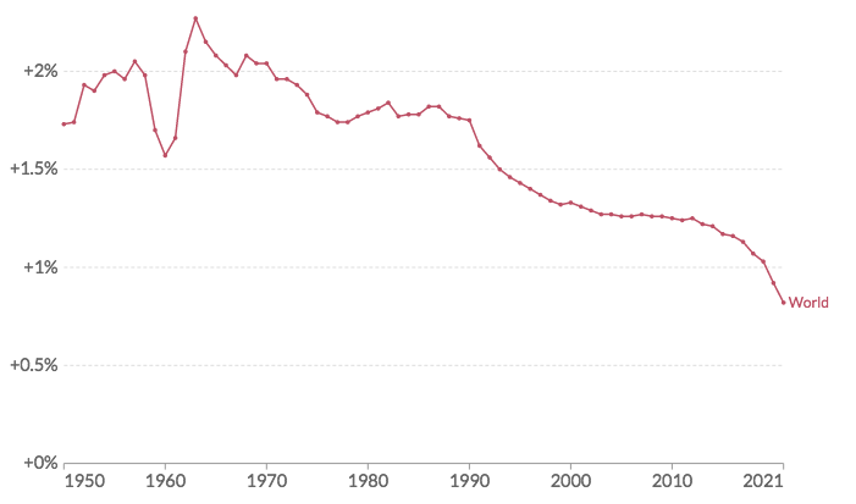

Population growth rate, 1950 to 2021

Can Robotics and Automation Help the $10.9 Trillion Problem?

The productivity problem is already enormous. The cumulative loss in output due to falling productivity is now over $10.9 trillion based on data from the US Bureau of Labor Statistics. This is a loss of $95,000 in output per worker.

Those who are still in their working years will need to be more productive in order to support the much larger older generations that are not in the workforce. Workers will also need to be more productive for longer because people are living longer. The average global life expectancy since 1900 has more than doubled and is now over 70 years.

Some are beginning to turn to robotics and automation to help augment the output of the working population. Estimates from McKinsey suggest that “automation could raise productivity growth on a global basis by as much as 0.8 to 1.4 percent annually.” Over just a few years this could add up to considerable gains.

One specific example of this phenomenon can be seen in BMW’s Spartanburg factory. Originally, workers were responsible for fitting doors with sound and moisture insulation. This part of the production was particularly strenuous and difficult. When the plant turned to robotics to assist they saw a 50% increase in productivity without job losses.

Robotic and automation technology adoption rates will vary across industries. Some, like auto manufacturers, are suited to immediately take advantage of advancements in robotics and automation. Other industries will need to be more creative to fold these solutions into their business model.

The bottom line is that eventually all industries will need these technologies because without them they will not be able to reach the productivity needed to survive.

How Can Investors Position Themselves for This Change

Investors have several ways to invest in technologies that will power the global economies of the next several decades.

L&G Global Robotics and Automation UCITS ETF (ROBO)

The L&G Global Robotics and Automation ETF spans sectors including information technology, industrials, and health care. Some of the top holdings offer exposure to companies that make machines and semiconductors that increase the productivity and efficiency of manufacturing operations. Some of the companies relying on these solutions include IBM (NYSE:IBM), Samsung (KS:005930), and Texas Instruments (NASDAQ:TXN).

Global X Robotics & Artificial Intelligence ETF (BOTZ)

The Global X Robotics & Artificial Intelligence ETF is most heavily weighted to the information technology sector (45.4%) followed by industrials (39.5%). The majority of companies in the ETF are located in the US, Japan, and Switzerland.

iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

The iShares Robotics and Artificial Intelligence ETF offers exposure to a global equal-weighted index composed of companies in sectors like information technology, communication, and industrials.