When metals are discussed within the context of investing, the natural tendency is to think of precious metals, such as gold, silver, or platinum due to their economic value as a hedge against inflation and a store of value. But those are not the only metals of consequence, as base metals, such as nickel, copper, aluminum, and zinc are pivotal components in commercial and industrial development, such as construction and manufacturing.

Recently, Teucrium launched the Teucrium AiLA Long-Short Base Metals Strategy ETF (Ticker: OAIB), a quantitative-focused strategy that has the potential to achieve positive returns regardless of market direction. In this article we will examine the growing importance of base metals within the global economy, the factors driving their prices, the value proposition of the fund and why it could be a consideration for interested investors.

Increasing demand for base metals

Base metals, specifically copper, zinc, nickel, lead, and aluminum, are essential to our modern economy as they support sustained economic growth. While the use cases for these materials are numerous due to their versatility, two key trends within our modern economy have increased demand for base metals in recent years and will continue to do so in the years to come: Clean Energy and Electrification.

As illustrated in the following visualization provided by Visual Capitalist the demand for base metals is expected to grow exponentially within the current decade due to the mass adoption of electric vehicles and the proliferation of clean technologies; both of which utilize a variety of base metals and alloys.

As society moves towards carbon neutrality, the demand for base metals will continue to grow over time. This expected growth, in conjunction with the traditional/pre-existing use cases for these metals, will ultimately result in elevated pricing for these commodities.

Rising prices of base metals

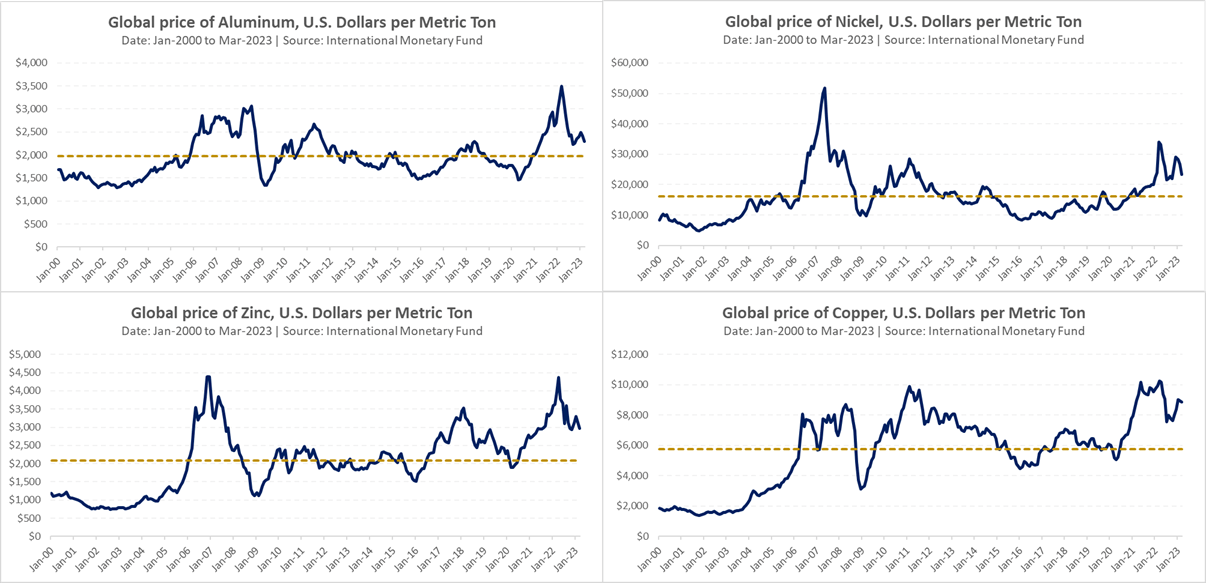

The price for base metals, like all commodities, is determined by market dynamics. In looking at the historical pricing of zinc, aluminum, nickel, and copper over the past two decades years, there have been sizable swings in price over time. However, post-2020 there is a clear upward trend among the base metals, as prices have remained elevated above their historical average – even against the backdrop of seismic market events such as the Russia-Ukraine war and weakening global demand in manufacturing.

As outlined in the World Bank’s April 2023 Commodity Markets, weaker than expected oil supply may be an impetus for further energy transition actions, further discouraging fossil fuel production - while also increasing demand for metals, particularly copper, nickel, and lithium– fundamental metals needed for electrification.

The reopening of the Chinese economy has also been identified as a source of demand generation for base metals, as the recovery is tilted towards commodity-intensive sectors, and not serviced-focused ones as previously thought. As stated in the report, The real estate sector in China may begin to strengthen sooner than assumed, raising import demand and prices for base metals. This could result in upward pressure on prices of aluminum, copper, lithium, and nickel, which are anticipated to experience a surge in global demand over the medium term because of their usage in the manufacturing of electric vehicle batteries.

Investing in base metals

Teucrium AiLA Long-Short Base Metals Strategy ETF provides investors with access to base metals exposure within their portfolio, through a liquid, low-cost solution. The ETF employs a replication strategy, mirroring the AiLA-S022 Market Neutral Absolute Return Index, which has exposure to six base metal commodities, namely, aluminum, copper, lead, zinc, nickel and tin. The fund’s long-short strategy highlights its opportunistic and dynamic nature, as the manager seeks to profit from both increasing and decreasing prices in one or more base metal markets.

For individuals interested in investing in the commodities space, particularly in the materials considered instrumental to ongoing economic development and energy innovation, the Teucrium AiLA Long-Short Base Metals Strategy ETF offers a simple and convenient way to gain economic exposure to the base metals utilized in much of the industrial and commercial development occurring across the globe.

This content was originally published by our partners at ETF Central.