As society accelerates its decarbonization journey, the resource inputs necessary for this energy transition are appreciating in value. This article will spotlight the pivotal role of copper in this transition and the ETF solutions that enable investors to tap into this burgeoning market.

The Importance of Copper

Copper’s exceptional electrical conductivity and contribution to energy efficiency make it a critical element in energy transmission. It possesses the necessary physical properties to transform and transmit energy derived from sustainable sources—electromagnetic (solar), kinetic (wind), and geothermal—to their useful final state, such as moving a vehicle or heating a home. Furthermore, its broad market demand and versatility in use across many industries have historically positioned its price as a gauge of the global economy. As the global economy moves towards decarbonization and electrification, emerging clean-energy technologies require significantly more copper than traditional systems.

The Current Market for Copper

Copper is a predominantly long-cycle commodity – it takes 2-3 years to extend an existing mine and approximately 8 years to establish a new greenfield project. This long lead time for the majority of copper supply, combined with the mining sector’s resistance towards new project capital expenditures, leaves the copper market in a precarious position regarding securing the necessary supply to meet future expectant demand. Given this context, copper prices must rise now to incentivize enough supply to solve potential deficits. Recently, copper prices passed the US$10,000 per ton mark, propelled by projections of tightening global supplies and heightened demand from the electric vehicle and power sectors, which offset weakening demand from China.

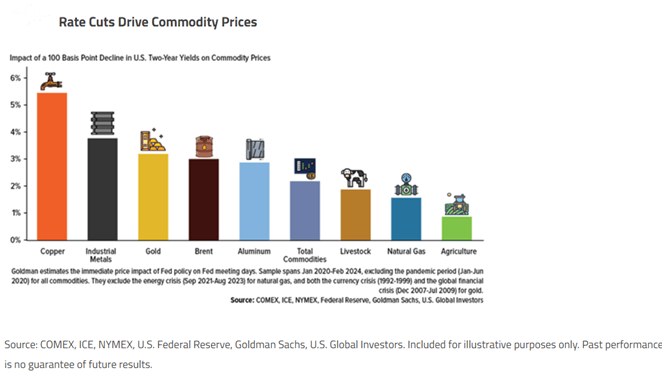

Copper’s role as an economic bellwether is well-established, with its price historically rising as business conditions improve. Though the current interest rate environment is expected to remain ‘higher for longer,’ past trends suggest that rate reductions in a non-recessionary environment often led to higher commodity prices, with copper being the commodity that has benefited the most in such scenarios, making it a compelling investment opportunity.

The Future of Copper

As reported in October 2023 by BloombergNEF, a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy, copper prices may jump 20% by 2027 as supply deficits rise. Given the price appreciation that has already occurred, the copper market is entering a period of escalating deficits as constrained supply meets rising demand from increased electricity usage among developing countries and the growing electricity needs of developed countries for various technologies, such as data centers, artificial intelligence, and battery storage. Against this backdrop, copper and copper miners are poised to benefit from these changes.

Gaining Exposure to Copper through an ETF

For investors who desire to gain exposure to copper, there are ETFs that direct or tangential exposure to the copper producers.

Global X Copper Producers Index ETF (Ticker: COPP) provides exposure to the performance of companies active in copper ore mining that are listed on select North American stock exchanges. Currently, COPP seeks to replicate the performance of the Solactive North American Listed Copper Producers Index, net of expenses. COPP seeks to hedge any U.S. dollar portfolio exposure back to the Canadian dollar at all times.

BMO (TSX:BMO) Equal Weight Global Base Metals Index ETF (Ticker: ZMT) provides convenient and efficient equal-weight exposure to global base metals equities, benefitting from the increasing demand for base metals such as Copper, Lead, Nickel, and Zinc, used in various industrial and construction industries. The ETF is designed to replicate, to the extent possible, the performance of the Solactive Equal Weight Global Base Metals Index Canadian Dollar Hedged, net of expenses.

The Solactive Equal Weight Global Base Metals Index Canadian Dollar Hedged includes global securities in the base metals industry.

iShares S&P/TSX Global Base Metals Index ETF (Ticker: XBM) provides targeted exposure to global securities of issuers involved in the production or extraction of base metals by replicating the performance of the S&P/TSX Global Base Metals Index, net of expenses.

This content was originally published by our partners at the Canadian ETF Marketplace.