Investing ledged Warren Buffett (Trades, Portfolio) has said, It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

The Hershey Co. (NYSE:HSY) is a wonderful company that I believe is trading at a fair price. While Buffett is not a shareholder, Berkshire Hathaway (NYSE:BRKa) (NYSE:BRK.A)(NYSE:BRK.B) controls See's Candies, which is engaged in a similar business. Berkshire has previously been rumored to be interested in acquiring Hershey, but such a transaction has not materialized. Buffett also previously helped another confectioner, Mars, finance its acquisition of Wrigley.

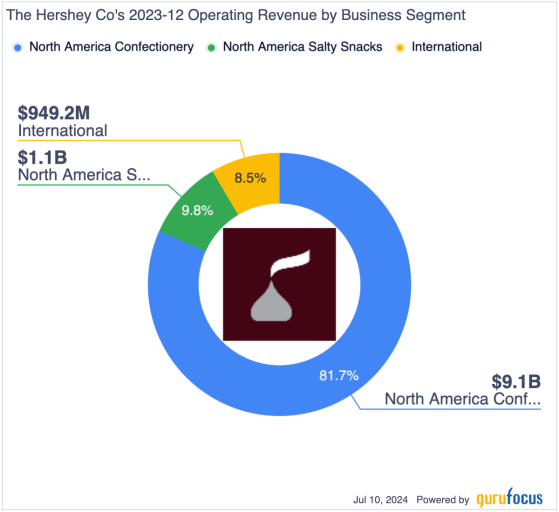

The leading U.S. confectionerHershey is the leading U.S. confectionary with an estimated 45% market share. In addition to being a leader in the chocolate division, the company also has a significant salty snacks business which accounts for roughly 10% of total revenue.

Some of the company's key brands include Reese's, Hershey's, KitKat (in the U.S. only), Twizzlers, SkinnyPop and many others. While most of Hershey's sales come from North America, it also has an international business that accounts for roughly 8.50% of total sales. Key competitors include Mars, Nestle (XSWX:NESN), Mondelez (NASDAQ:MDLZ) and others.

The company is relatively unusual in that a trust, The Hershey Trust Co., has control over it with roughly 79% voting power.

Strong brands create wide moatTracing its roots all the way back to 1894, Hershey has clearly stood the test of time. In 1900, the company began selling Hershey's Milk Chocolate bars. Today, the flagship brand accounts for roughly $2.40 billion in annual sales.

Another one of the company's first products to take hold was the Hershey Kiss, which began selling in 1907 and today represents a business with $580 million in annual revenue.

In 1963, Hershey acquired H.B. Reese Candy Company. Today, Reese's is its largest single brand with annual sales of just over $3 billion.

The point is the key brands owned by Hershey have clearly been longtime favorites. These brands have been able to thrive despite vast changes in the food retail business, including intense competition, the consolidation of wholesale distributors and evolving consumer preferences.

As shown by the chart below, despite operating in a highly competitive business, Hershey has been able to deliver very strong returns on invested capital and maintained healthy profit margins.

Moreover, the company's large scale gives it an advantage over smaller players in terms of negotiating with distribution companies and sharing marketing, research and development costs across a larger revenue base. Consumers also have a strong preference for brands they know, favoring incumbent brands with large market share.

Former Hershey executive Phil Stanley has previously discussed this phenomenon of strong persistent performance of key brands:

"What the team found through in-depth analysis is that our top velocity performers for nearly all pack-types and in all classes of trade are our core items. Items that have been around for 20 years or more. Shoppers have been voting for these products with their wallets for years, and we've gone back to the basics to put together a compelling argument for why consistently choosing core items with incredible equities is the clear path to happy shoppers and profitable sales for retailers.Recent challenges The confectioner has faced a number of challenges recently. Perhaps the most significant long-term challenge is a potential decline in consumption of its key products due to increased adoption of GLP-1 drugs. While the company does not believe that the adoption of GLP-1 drugs is having a material impact on its business, it has said there remain a lot of unknowns regarding the long-term impact related to these drugs.While innovation undoubtedly helps bring excitement, consumers find the most comfort and indulgence in the items they've known and loved for years. Hershey's iconic brands have exceptionally high consumer loyalty that, importantly, is incremental to the category. Consumers will leave the category if these items are not available on shelf. It has become clear to us that ensuring these powerfully loyal brands, forms, and package types are available is much more incremental to the category than SKU proliferation that damages item productivity and jeopardizes on-shelf availability for core items."

A key near-term challenge has been rising cocoa prices. Prior to this year, cocoa prices had hovered mostly around $2,500 per metric ton, but rallied sharply to hit an all-time high of roughly $11,000 per metric ton in April. The move has been driven by supply-related concerns in the Ivory Coast and Ghana due to crop disease issues. The impact is significant as these two countries are estimated to produce two-thirds of global cocoa supply. While cocoa prices have pulled back somewhat over the past couple months to under $8,000 per metric ton, they remain well above historical norms. Hershey, like many of its peers, is managing commodity price risk through a hedging program as discussed in its most recent 10-Q:

Our costs for cocoa products will not necessarily reflect market price fluctuations because of our forward purchasing and hedging practices (including amount and duration thereof), premiums and discounts reflective of varying delivery times, and supply and demand for our specific varieties and grades of cocoa liquor, cocoa butter and cocoa powder. We generally hedge commodity price risks for 3- to 24-month periods. As a result, the average market prices are not necessarily indicative of our average costs.While the company appears to have hedged much of its cocoa exposure for 2024 and some for 2025, eventually it is likely to feel the impact of higher prices if they remain elevated. That said, I am optimistic the company will be able to pass on any increases in costs to consumers over time. The reason for this is that rising costs will be a challenge for all confectioners and I believe Hershey's strong brands give it pricing power. Moreover, the company also noted in on its first-quarter earnings call that it has not seen a change in price elasticity and thus expects to be able to put through price increases if necessary.

Despite recent headwinds, the company expects to report 2024 sales growth of 2% to 3% and earnings per share are projected to remain in line with full-year 2023 levels.

Valuation is reasonableCurrently, Hershey is trading at roughly 19 times consensus 2024 earnings per share, 18.80 times consensus full-year 2025 earnings per share and 17.40 times consensus 2026 earnings per share. Comparably, the S&P 500 currently trades at roughly 22.50 tunes consensus 2024 earnings.

While consensus estimates call for Hershey to report little to no earnings growth for 2024 and 2025, the company is expected to return to mid-single-digit earnings growth in 2026. Historically, over the past decade, the company has grown adjusted earnings per share at a compounded annual rate of roughly 10%. My view is the company should be able to deliver solid mid-single-digit earnings growth over the long term as the business has significant growth opportunities internationally and in terms of product expansion in North America. While Hershey is likely to experience somewhat lower earnings growth compared to the broader market, its earnings are less cyclical.

Over the past 10 years, Hershey has traded at an average trailing price-earnings ratio of 27.80, while the S&P 500 has traded at an average trailing price-earnings ratio of roughly 24 over that same period. Currently, the stock trades at a trailing price-earnings ratio of roughly 18. Thus, its valuation relative to the broader market and its own historical norms is fairly attractive.

Peer valuations suggest Hershey is reasonably valued at current levels. The consumer staples sector, which can be proxied using the SPDR Consumer Staples Select Sector ETF (XLP), trades at roughly 20.60 times forward earnings. Constituents of the exchange-traded fund are expected to grow annual earnings by nearly 8% over the next three to five years, which is roughly in line with Hershey's long-term earnings per share growth estimate of 6% to 8%.

ConclusionHershey is a wonderful company with a long history of delivering solid results. The company's competitive advantage is driven by its strong portfolio of brands, many of which have been around for decades.

The company has faced a number of challenges recently, including a spike in cocoa prices and increased adoption of GLP-1 drugs. However, I believe it will ultimately be able to manage these near-term challenges and deliver steady long-term earnings growth going forward.

Shares currently trade at a modest valuation discount to the broader market while they have historically traded at a moderate premium. Thus, investors currently have an opportunity to invest in a wonderful company at a fair price.

This content was originally published on Gurufocus.com