Good afternoon! This is Market Pulse, the newsletter that tells you what you need to know about Canadian Real Estate in 2-3 minutes.

Interest Rates & Household Debt

The Bank of Canada has been holding rates steady at 4.5% with a prime rate at 6.7% but that might change in the coming months. The CPI increased by 0.1% to 4.4% in April vs 4.3% in March which is not much but, if we get another few months of up ticks, that might trigger the BoC to increase rates once again. The faster inflation comes back down to 2%, the sooner rates can be cut. A prolonged fight against inflation with high rates will mean economic fallout for other parts of the Canadian economy.

The biggest concern is Canadian household debt, as more home owners will be renewing their mortgages in the coming years at higher rates. 1/3 already have and many more will be coming up for renewal. On top of that, existing debts such as lines of credit which typically have higher fluctuating rates are becoming more expensive to service along with car loans and other common debt obligations. Even as banks are handing out higher amortization periods for borrowers who can’t absorb the increased rates, BoC mentioned these people are susceptible to future economic shocks, such as another rate hike and/or higher unemployment rates. Currently, more than 30% of the big 5 bank mortgage portfolios contain amortizations higher than 30 years.

The next few months will be important to watch as our central bankers figure out which road to take in the fight against inflation. The unemployment rate and CPI will be important indicators to keep an eye on in the coming months. So far, unemployment has remained stable around 5% but we have to remember that unemployment is a lagging indicator. As consumer spending decreases due to

unemployment is a lagging indicator. As consumer spending decreases due to tight budgets resulting in business growth declines, we will likely start seeing the unemployment rates rise.

The Government Wants To Finance Mortgages

In the face of a potential liquidity crisis, the Canadian government has been devising a plan to rolling Canada Mortgage Bonds (CMBs) into the general debt program. Let’s take a look at what that means.

What is a Canada Mortgage Bond? The Canada Mortgage Bond (CMB) is a financial instrument used in Canada's housing finance system. It is a type of bond issued by the Canada Mortgage and Housing Corporation (CMHC), which is a government-owned corporation. The purpose of CMBs is to provide funding for private mortgage lenders.

Here's how it works: Private lenders provide mortgages to homebuyers, and these mortgages are often insured by CMHC or other private insurers. To fund these mortgages, lenders package them together and create mortgage backed securities (MBS). These MBS are then sold to investors.

To make these MBS more attractive to investors, CMHC created the Canada Mortgage Bond program. The program operates through the Canada Housing Trust, which acts as a middleman. The trust buys the mortgage-backed securities from lenders and finances the purchases by selling CMBs to investors.

The Canadian government is considering cutting out the investors to capture profit from the spread between the CMBs and Canadian government bonds for themselves. (CMBs generally pay higher interest rates than government bonds)

The problem with this? Well, if the government needs to sell more government bonds to finance the CMB purchases, it could elevate the yields the government

bonds to finance the CMB purchases, it could elevate the yields the government needs to pay on their bonds. This situation would evaporate the gains made from the strategy as the spread between the two shrinks. Not only that, it could potentially increase borrowing costs for the rest of the economy since higher bond yields means more expensive financing for consumers, businesses and the government itself. Ironically, this could do the very thing the government would be trying to prevent.

Hopefully, a better way can be found that won’t wreak havoc on the sensitive economic times we’re living through right now.

Purpose Built Rentals Are Trying To Make A Comeback

The number of purpose-built rental apartments being constructed in the Toronto area during the first quarter of 2023 (20,270) is nearly equal to the total number of apartments completed in the region between 1980 and 1999 (20,514) according to Urbanation. For the last few decades, we’ve been getting nothing but Condos. Companies like Rhapsody have been trying to change that in Canada since 2014. After venturing into the Canadian market in 2014, Rhapsody, a property management company based in the U.S., currently oversees a portfolio of 20 rental complexes comprising approximately 7,000 apartments.

Rob Martin, the SVP of the organization mentioned it’s been a process to help condo developers re-learn how to build purpose built rentals. One of the interesting things he tells them is about dens: “just remove them all.” In a condo, turning some unused nook or cranny in a corner into a “den” is desired by condo investors because it helps them justify higher values for a property. For renters, Martin mentions, the desires are different. They don’t want to pay extra for a tiny space that cannot be used as a bedroom or office space. But they will take wine fridges, larger hallways, social/wellness programs and customer service to the point where they will help you hang things on the wall.

These types of purpose built rentals are offering better experiences than condos but are also priced at a premium. A 479 square foot studio goes for $2,400 in

one of Rhapsody’s buildings called The Well. A larger unit with a separate unit goes for $2,600 for 517 square feet all the way up to $7,800 for 1,200+ square foot apartments.

With the rise in interest rates starting in spring 2022, the number of new purpose-built rental starts significantly decreased. The quarterly starts dropped by half, declining from approximately 7,800 to less than 3,000 in the last two quarters. Although there are still approximately 115,000 planned units in the purpose-built pipeline, it remains uncertain when or if they will be completed.

A history of purpose built rentals

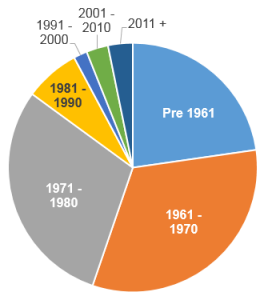

This chart shows the proportion of purpose-built rental units in Ontario, grouped by year of construction.

Pre-1961: 23%; 1961-1970: 33%; 1971-1980: 30%; 1981-1990: 7%; 1991-2000: 2%; 2001- 2010: 3%; 2011+: 3%.

Chart Source: @RE_marketwatch

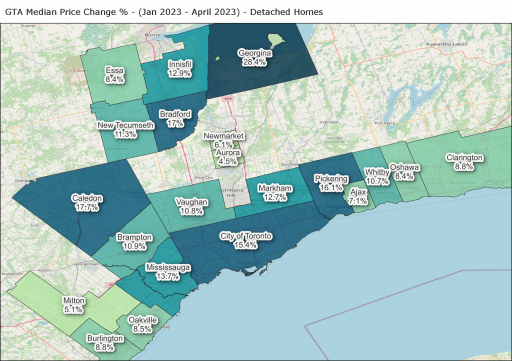

Housing Prices Update

This time we look at detached home prices in the GTA since the beginning of the year (Jan 2023). Of the areas analyzed, Georgina saw a whopping 28.4% jump in median prices since the start of the year. Following behind is Caledon and Pickering. Just about every region is seeing a comeback in prices due to low inventories.

This content was originally published by the Market Pulse Newsletter.