The long-awaited Tuttle Capital Management Inverse Cramer Tracker ETF (SJIM) was released to much fanfare on March 1st, 2023, and investor sentiment is split. Some laud it as a highly innovative idea, while others are deriding it as a meme gimmick. Either way, it's certainly controversial.

Here's my angle – I think SJIM is great for the ETF industry. While it may not be as sensible of a long-term hold as say, the Vanguard S&P 500 ETF (VOO) is, it nonetheless plays an important role today: it's a magnet for Gen Z investors looking for a meme-worthy idea that resonates with them.

That's right – the same irreverent bunch of r/wallstreetbets-browsing, Robinhood-using Zoomers are now graduating to ETFs after years of YOLO'ing weekly out-of-the-money Tesla (NASDAQ:TSLA) call options. Funny thematic ETFs like SJIM are exactly the gateway drug they're looking for.

Gen Z invests in notables

I think the defining ETF trend of post 2020 is the explosion in thematic ETFs tracking notable persons. While thematic mega-trends like disruption, genomics, and robotics caught wind during 2020 as a result of Cathie Wood's ARK Invest ETFs, there wasn't a way to really bet against a person.

This changed in November 2021 when the AXS Short Innovation Daily ETF (SARK) launched. This ETF bet against Wood's flagship ARK Innovation ETF (ARKK). Because the ETF was actively managed with Wood making stock picks at the helm, investors who bought SARK were by extension, betting against her.

The next ETF that capitalized on this trend was the MeetKevin Pricing Power ETF (PP), based on the stock picks of a famous financial YouTuber, MeetKevin. Long story short, this actively managed ETF invests in U.S. listed companies that in MeetKevin's view qualify as an "innovative company" with "pricing power".

However, none of these ETFs were as notable or clamored about as SJIM due to one simple factor: a relative lack of "meme-worthiness".

Why meme potential is so powerful

Jim Cramer is one of the most famous personalities in investing, especially among younger generations. Sure, we can talk about actual powerful investors like Kenneth Griffin, Carl Icahn, Warren Buffett, but none of them resonate with the Gen Z crowd. (Asides from Ryan Cohen, who has seemingly attracted a cult of meme-stock apes that interpret every one of his tweets for hidden messages).

Jim Cramer stands out. As the host of Mad Money and an active figure on financial Twitter, Cramer is constantly in the headlines, mostly for his stock recommendations that apparently don't have a great track record. Just check out some of the posts from @CramerTracker that call out his many errors.

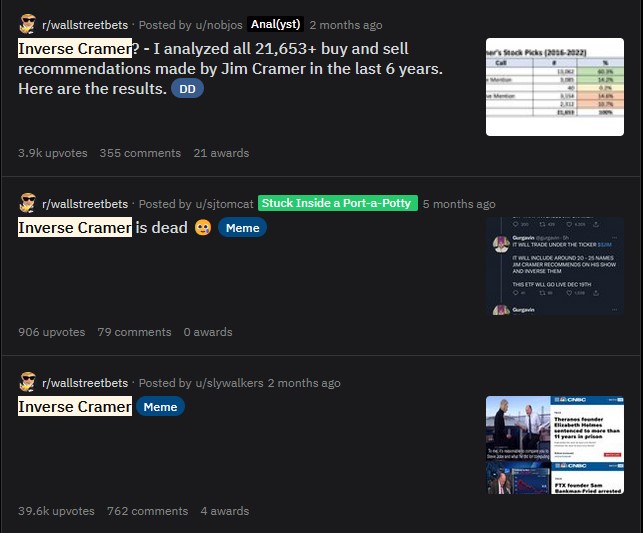

Gen Z has aptly taken notice. A quick search of "Inverse Cramer" on Reddit turns up a slew of results featuring not only memes, but also detailed analysis and even backtests, many of which sport thousands of upvotes and comments on popular communities like r/wallstreetbets.

At the center of any investment thesis is an idea, whether in terms of top-down or bottom-up financial analysis. The idea simply serves as a springboard. Cramer's picks are simply a starting point for Gen Z investors who digest memes better than proper financial news, and who can blame them?

A picture tells a thousand words. Case in point, it's easier for a Zoomer to consider shorting Netflix (NASDAQ:NFLX) after viewing this meme on r/wallstreetbets, than it is to create a discount cash flow model and do proper old-fashioned securities analysis.

Inverse Cramer ETF: Why it makes sense

My point is, if we want the new generation of investors to dip their toes into proper long-term investing with ETFs, they have to start somewhere. Buying SJIM is still a step up from meme stocks and weekly OTM TSLA calls – the progression from SJIM to something like VOO is much easier.

SJIM may very well be useful as a short-term trading tool. We know that the majority of stock pickers underperform the market, with studies showing that a blindfolded monkey could beat most professional investors. If Cramer is the quintessential stock picker, then why not bet against him?

To quote Matthew Tuttle: "The key thing I want to get across is that this is not a gimmick or a joke. Everyone knows the consensus is usually wrong, but we don't know how to monetize that. Jim is the consensus on steroids, and he is epically wrong from time to time. SJIM is the way to monetize that."

Sure, the usual caveats with inverse funds (volatility drag, high expense ratios, derivative risk) apply, but for a short-term hold the ETF is arguably no more dangerous than say, a 3x leveraged inverse industry ETF like the Direxion Daily Semiconductor Bear 3X Shares ETF (SOXS).

Gen Z was raised on a diet of Reddit, TikTok, and Twitter, and reading a stuffy ETF whitepaper laden with financial jargon is beyond them. Traditional ETF marketing campaigns must adapt to their meme-laden tastes in order to attract inflows. So far, only Tuttle has accomplished this, and to great effect.

This content was originally published by our partners at ETF Central.