They prospered in most of October as his perceived chance of winning the election rose – then started slumping in the last few days. But for longer-term traders and investors, the most-important question is: What will happen AFTER the election?

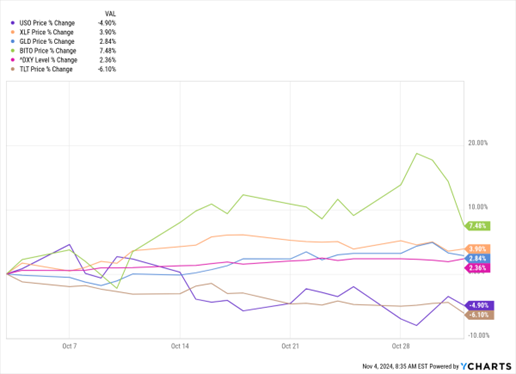

Let’s start by showing some of the Trump Trades in action. This MoneyShow Chart of the Week shows the 1-month percentage change in ETFs and indices that track crude oil, financial stocks, gold, Bitcoin, the US dollar, and long-term Treasuries.

Consensus thinking is that a Trump win would be positive for gold, Bitcoin, the dollar, and financial stocks...but negative for Treasury bonds and oil prices. That’s because most economists think his policies will boost the budget deficit and debt load more than Harris’s would, while also adding to inflationary pressures. On the flip side, he could roll back financial regulation in the traditional finance and cryptocurrency arenas.

Sure enough: The United States Oil Fund (NYSE:USO) lost about 5% of its value in the last month, while the ProShares Bitcoin ETF (TSX:EBIT) (BITO) gained more than 7%. The Financial Select Sector SPDR (XLF) rose 4%, while the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) slid 6%.

So, how durable are these moves?

In the short-term, a lot depends on the election. If Harris wins, many of these moves will reverse in early November. If Trump wins, they could gain more ground.

But in the long-term, underlying economic and market conditions in the US and abroad will overpower politics. Should the economy fall into recession, for example, Treasury prices (and TLT) would likely rise even if US deficits and debts climbed. The dollar could slide if our economy underperformed foreign ones, driving gold (and GLD (NYSE:GLD)) higher, regardless of who wins the election.

Be sure to keep that in mind if your timeframe for buying – or selling – the asset classes and ETFs above is longer than a few weeks!