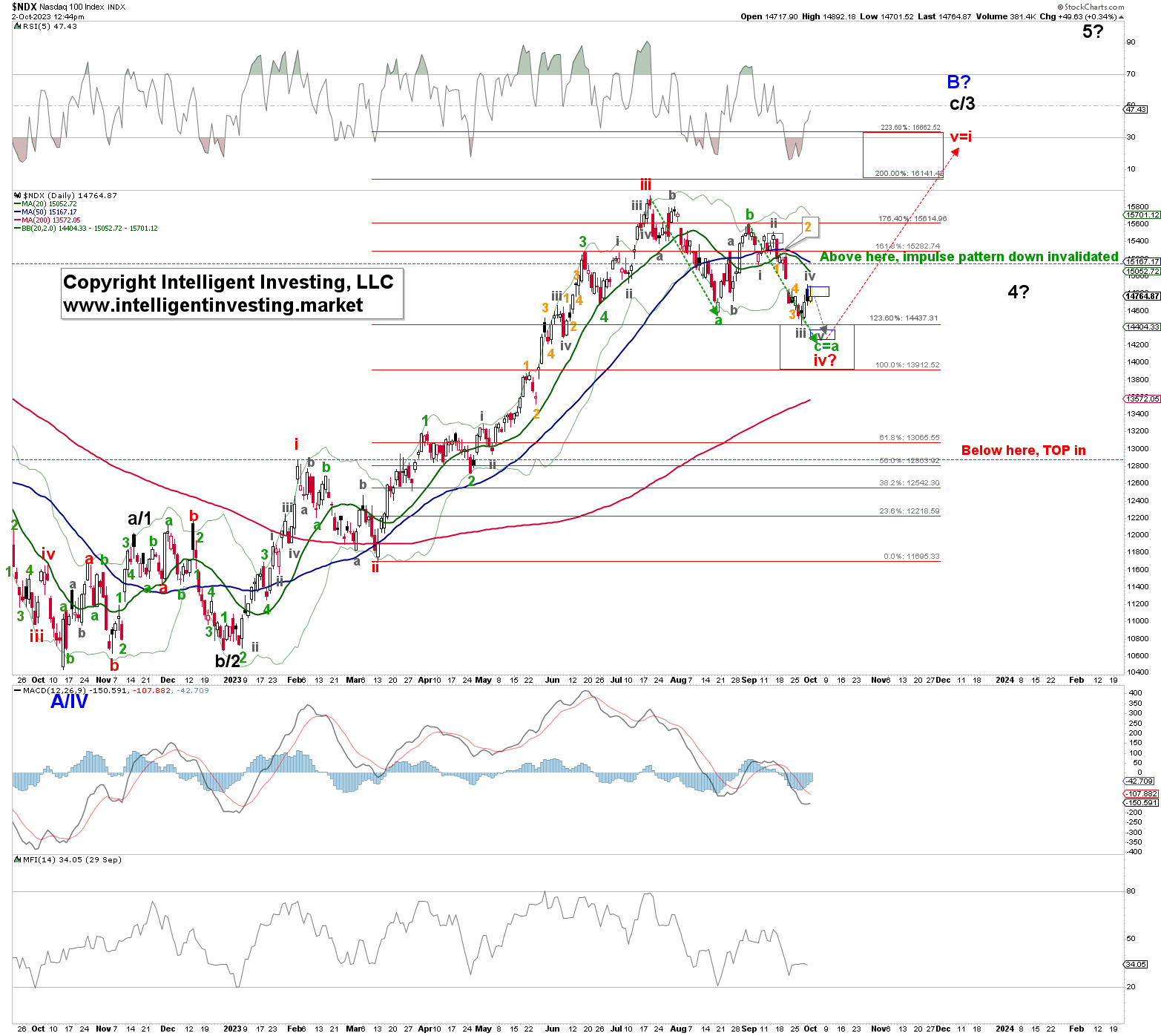

Two weeks ago, see here, we found for the Nasdaq 100 using the Elliott Wave Principle (EWP) that based on a standard Fibonacci-based impulse pattern, the index was most likely working on a five-wave move lower to ideally $14435-14500 as long as it stayed below $15600.

So far, so good, as the index bottomed out last week at $14432 and has staged a rally since into today’s high. The question is: has the index bottomed, and is a rally to $16100+ underway? The answers we seek lie, as always, in the price chart. See Figure 1 below.

Figure 1. NASDAQ 100 daily resolution chart with technical indicators and detailed EWP count. As you can see, a lot can happen in two weeks, and it pays to stay informed more frequently than once every other week because the index presented us with an extended grey W-iii. What does that mean? Typically, a 3rd wave seeks out the 1.382-1.681x extension of the 1st wave, measured from the 2nd wave low; grey W-i and -ii in this case. That would have targeted $14600-700. However, the markets do not owe us anything; we got a ~2.236x W-1 extension at the $14432 low. There is no alarm because wave extensions can always happen but cannot be known beforehand. The infamous “known unknown” [D. Rumsfeld].

As you can see, a lot can happen in two weeks, and it pays to stay informed more frequently than once every other week because the index presented us with an extended grey W-iii. What does that mean? Typically, a 3rd wave seeks out the 1.382-1.681x extension of the 1st wave, measured from the 2nd wave low; grey W-i and -ii in this case. That would have targeted $14600-700. However, the markets do not owe us anything; we got a ~2.236x W-1 extension at the $14432 low. There is no alarm because wave extensions can always happen but cannot be known beforehand. The infamous “known unknown” [D. Rumsfeld].

The green (arrows) W-c = W-a extension targets $14238, and the grey W-v target zone is now $14245-485. Thus, we have even better Fib-confluence at

“The low $14Ks” we forecasted a month ago would be reached on “a break below the green W-1 high at $15277”

See here.

In the meantime, the index should have completed the grey W-iv and ideally be at the start of the grey W-v. A break below last week’s low will confirm grey W-v. However, if the index breaks out above today’s high, then grey W-iv is becoming aberrant, and we should expect the index to reach the high $14000s to low $15000s before the countdown for W-v starts over. For now, our preferred path, as postulated two weeks ago, is:

“The completion of the red W-iv as an expanded flat, with green W-c underway. As stated, C-waves in a flat comprise five waves. Thus, grey W-iii, iv, and v of W-c of W-iv should commence soon” has filled in nicely and only grey W-v is most likely left.