Although special-purpose acquisition companies (SPACs) have been around for three decades, they suddenly reported USD83bn in investments in 2020. We also noticed increased participation in SPACs by private equity (PE) firms. In the current scenario, investors are likely wondering what benefits PE firms and investors can expect from SPACs, and whether the current frenzy is sustainable or just a passing fad.

Three decades of SPACs in nutshell

SPACs first appeared in the late 1980s. The 1990s were a dull phase as SPACs failed to benefit investors. They regained popularity in the early 2000s only to become dormant after 2007 due to the credit crunch. The recent spike started in 2019 with Virgin Galactic’s USD674m SPAC deal that went public at a significant valuation of USD2.2bn. Since then, SPAC deals have skyrocketed.

The Economist estimates that about 250 SPACs raised close to USD83bn in 2020. They started 2021 with a strong footing – in January 2021, on average, five SPACs were created daily, achieving USD26bn in capital. The amounts raised in 2019 were surpassed in January 2021 alone. CNBC estimates that USD38bn was achieved in early 2021, but, of course, we are still counting.

What is driving the current frenzy?

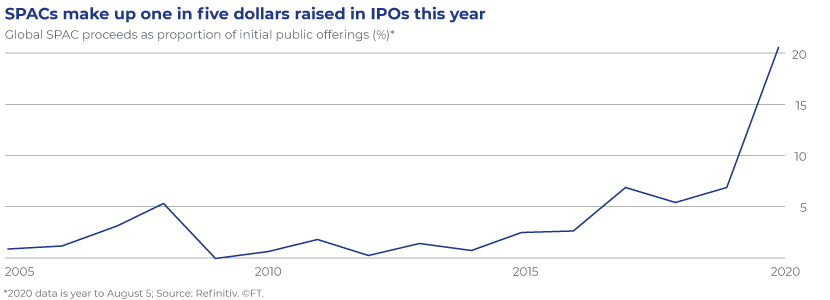

Besides the stated reduction in the time and documentation involved, SPACs are often used in times of stress and volatility, as they help investors avoid the “typical time, risks and uncertainty6 associated with typical IPOs”, we believe the current uncertainty due to the pandemic and US election provided the tailwind. SPACs help mitigate the risk of going public. As a result, they achieved large ticket sizes per SPAC (average of USD296m for 128 SPAC IPOs7 ), and their share in the overall IPO space is rising.

Why SPACs attract PE

SPACs primarily offer investors the advantage of taking a company public easily and at lower cost. Although a SPAC is an alternative transactional method for public markets, PE firms also showed a keen interest in SPACs in 2020 and early 2021. A large number of PE firms are associated with SPACs in some form or other.

SPACs seem to offer certain solutions to PE firms:

Exits: A number of investments are waiting to exit, especially since many of them have completed their usual two to three years in a portfolio. The recent surge in SPACs has provided timely support for PE funds. PE funds were keen to reduce leverage due to the COVID-19-induced economic and financial crisis. SPAC-supported exits provide sellers with more cash and offer greater control over valuation. PE firms that have used this exit route includeApollo Global Management(NYSE:APO), Blackstone (NYSE:BX) Group, Cerberus Capital Management, Clearlake Capital Group, Corsair Capital, Irving Place Capital, J.F. Lehman & Company, L Catterton, Platinum Equity, Roark Capital Group, Peninsula Pacific Strategic Partners and Energy Capital Partners.

Access to new limited partners (LPs) and funds: Many PE firms have started sponsoring SPACs, helping them gain a new set of LPs interested in “portfolios concentrated in a single stock”. SPACs also offer sponsors access to capital markets, enabling open-ended PE investments. In addition, SPACs are slated to be vehicles for co-investment deals and support large transactions.

Valuing unicorns: Valuations have skyrocketed. LBO deals in the US stood at 11.4x EBITDA multiple in 2020, while in Europe, they were at an all-time high of 12.6x. There are unicorn companies stuck in funds, waiting for the right moment and valuation to exit. SPACs are more efficient than traditional IPOs in conducting due diligence of complex business models, paving the way for ease of transaction for early-stage companies.

Attractive SPAC model: According to PE Insight, “SPACs require a relatively low upfront investment with a very significant upside potential and shorter investment horizon.”

Sponsors typically invest 2.5-3.0% of gross IPO proceeds and obtain 20% of outstanding shares with warrants to buy additional shares at a premium. Thus, a SPAC offers a safeguard in the event of stock price decline. This is extremely favourable for PE firms, as they usually realise gains only if the portfolio value increases in excess of the hurdle rate.

SPACs also help PE firms design the technical sides of deals favourably – these include additional leverage, limited risk and certainty of return during the pre-acquisition phase, and increased liquidity.

Are SPACs here to stay?

The current dynamics seem to favour SPACs, and it does not seem correct to categorise them as a fad. This year may hold promise for SPACs against the backdrop of the current market conditions and macroeconomic factors. Goldman Sachs (NYSE:GS) has, with a bullish appeal, suggested over USD300bn worth of SPAC stock in the next two years.

Adoption by large players may boost confidence: Since their emergence in the 1990s, SPACs have not been viewed very positively because of their poor performances, unfamiliar participants and terms highly skewed towards sponsors. However, the recent participation of large, reputed PE firms and professionals has boosted confidence in the space.

- Since 2015, The Gores Group and TPG have sponsored nine SPACs IPO in the range of USD375-650m

- Energy-focused Riverstone Holdings completed two SPAC IPOs – USD500m in 2016 and USD1tn in 2017

- Centerview Capital sponsored two SPAC IPOs – USD402.5m in 2016 and USD450m in 2019

- Thomas H. Lee Partners sponsored over USD400m in 2017

- Apollo Global Management sponsored over USD400m in 2018

- In addition, experienced PE professionals have launched multiple SPACs; they include Chinh Chu (former co-head of The Blackstone Group), Dan Hennessy (founding partner of CHS Private Equity) and Mark Ein (formerly with the Carlyle Group (NASDAQ:CG) and Brentwood Associates)

Industry insiders view these developments favourably:

“The current generation of SPACs includes better-quality companies, better management teams associated with them, and also better sponsorship” – Chinh Chu, founder, CC Capital Partners (ex-The Blackstone Group)

“…[large players] helped legitimize SPACs for sellers of assets … before it was viewed as something as a last resort” – Niron Stabinsky, head, SPACs, Credit Suisse (SIX:CSGN)

SPACs have evolved from their traditional avatar: The potential success was predicted by Ellenoff in February 2020: “As the program has matured, there are more and more serial SPAC sponsors … Given their success, they typically raise more money when they do their second SPACs. I would expect there will be more serial SPAC sponsors this year that will raise significant amounts of money.”

Favourable macroeconomic environment: The current environment of low interest rates is providing the impetus. There is no opportunity cost for investors if they commit funds to SPACs and keep their funds in T-bills. In the event an investor is unwilling to merge with an identified target, he can opt-out. Thus, opportunity cost is minimal in the current environment of low-interest rates and high equity valuations.

With the global economy gearing up to recover from the pandemic’s impact, interest rates are expected to remain low for an extended period of time. Furthermore, as retail investors in equity markets continue to increase and seek more nascent opportunities, equity markets are expected to remain healthy.

On the other hand, not all SPACs deliver: Whether SPACs will turn out to be a phase or see sustained development would ultimately depend on how they deliver in the near future. A 2020 study of 47 SPACs by Michael Klausner and Emily Ruan of Stanford University, and Michael Ohlrogge of New York University found that some SPACs deliver far worse returns for investors than others – with values declining by an average of 3% after three months, 12% after six months and by a third after 12 months.

Conclusion

The SPAC space is triggered not only by quantity but also by quality; hence, the recent changes may support confidence in and continuity of this mechanism. Undoubtedly, it may become an additional exit route for PE firms. There are concerns, however, that are common to any emerging field; thus, it requires keen observation, sound analysis and diligently working on the mechanism. PE firms should, therefore, rely on partnering with professional firms that can help them track this space and support with sound analysis. Acuity Knowledge Partners is a professional services firm with a large PE practice and well placed to assist PE firms in their journey in this space.