In what was thought to be a slow Friday as we wait for the plethora of data, earnings and FOMC meeting next week, stock indices are trading at or near all-time highs today as the Office of the U.S. Trade Representative said they are close to finalizing some sections of the trade deal. Conversations are continuing and will be ongoing.

Afterwards, U.S. President Donald Trump also stated that China will be buying more agriculture products and that they want a deal “very badly.”

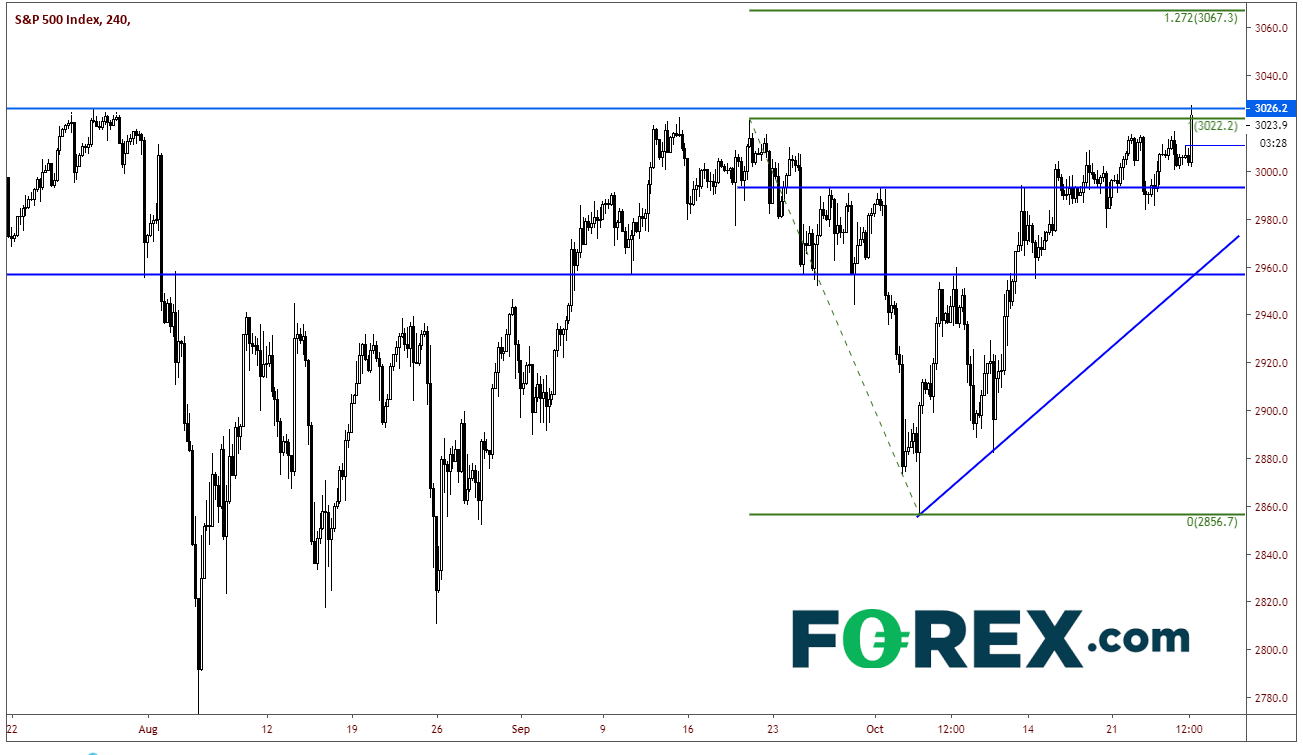

The S&P 500 cash index made all-time highs today and the futures are right behind, with today’s high just 3 handles off the all-time highs. The first target for SPX 500 (cash index) is 3067, which is the 127.2% extension from the Sept. 19th highs to the Oct. 3rd lows. First support comes across at Wednesday’s highs near 3010.

The S&P 500 cash index made all-time highs today and the futures are right behind, with today’s high just 3 handles off the all-time highs. The first target for SPX 500 (cash index) is 3067, which is the 127.2% extension from the Sept. 19th highs to the Oct. 3rd lows. First support comes across at Wednesday’s highs near 3010.

The DXY is also rebounding from last week’s wicked selloff towards horizontal resistance at 97.88 and the 38.2% retracement from the Oct. 1st highs to the Oct. 18th lows at 98.12. Support comes in on the day at 97.50.

As a result, gold futures are near unchanged on the day at 1505. The precious metal was trying to break out of a bullish pattern (either a descending wedge or flag) and was up as much as $14.50 before pulling back to unchanged. If gold were to close below 1505, the daily candlestick would be a shooting star or inverted hammer, both of which have reversal implications.

The expectations are now set that “something” will be done regarding Phase One of the U.S.-China trade war. Watch for more headlines over the weekend and early next week.

In addition, keep in mind the looming announcement of a Brexit extension, as well as economic data, including NFP on Friday, more earnings, and the FOMC meeting on Wednesday. We may see some volatility next week!