In 2024, investors have been captivated by a handful of stocks known as the "Magnificent Seven." This cohort spans three key sectors: Technology (Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA)), Communications (Meta (NASDAQ:META) Platforms and Alphabet (NASDAQ:GOOGL)), and Consumer Discretionary (Amazon (NASDAQ:AMZN) and Tesla (NASDAQ:TSLA)).

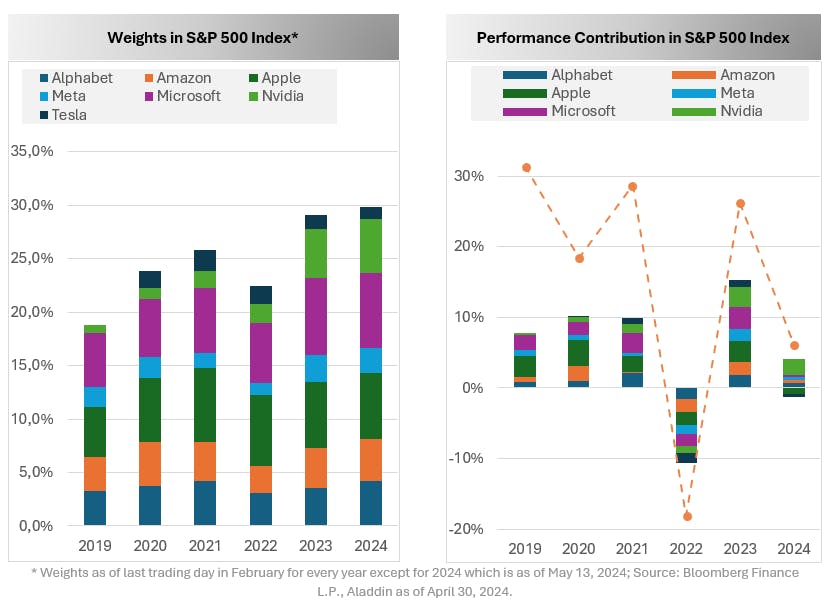

Collectively, the Magnificent Seven account for significant weights in popular indices like the S&P 500 and Nasdaq-100 and have driven the bulk of market returns in recent years. However, investors are now at a crossroads. Should they double down on these high-performing stocks, maintain their current exposure, or look elsewhere for diversification?

Here's the data for and against either strategy. If you do choose to diversify, I'll also introduce a few Xtrackers ETFs that retain palpable exposure to the Magnificent Seven while also potentially offering significant diversification.

The Magnificent Seven: Why

As of April 30, 2024, the Magnificent Seven accounted for nearly 31%¹ of the market cap of the S&P 500 index, a proportion that has steadily grown since 2019. In 2023, this cohort collectively were responsible for over 58%² total S&P earnings.

Moreover, the earnings contributions of the Magnificent Seven to the S&P 500 have steadily increased. By May 2023, the earnings of these seven companies diverged sharply from the rest of the index, often referred to as the "S&P 493," highlighting their outsized impact on the market.

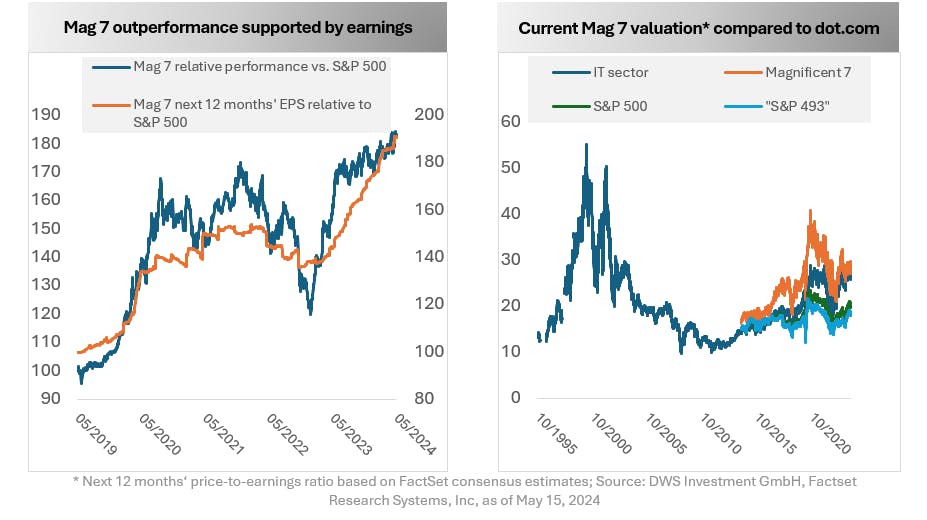

The rapid rise in their valuations appears to be supported by substantial earnings growth. As shown in the chart below, their relative outperformance versus the S&P 500 has been accompanied by robust EPS (Earnings Per Share) growth.

Importantly, their valuations still remain below the peaks seen during the Dot-Com bubble, indicating that, despite their high valuations, there is a fundamental earnings growth underpinning these stocks.

The Magnificent Seven: Why Not

Despite the positive data, critics have valid reasons to shy away from excessive exposure to the Magnificent Seven.

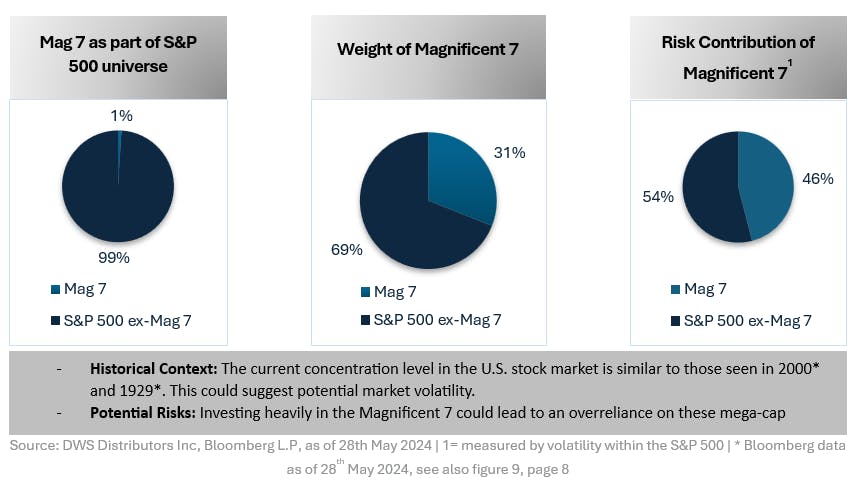

Chief among these concerns is concentration risk. Within the S&P 500, the Magnificent Seven account for just 1% of the companies but dominate 31% of the index due to its market-cap-weighted strategy and contribute 46% of the index's risk.³

This heavy weighting means that any significant changes in these companies' performance can disproportionately impact the overall index. With a small handful of companies, you are once again exposed to idiosyncratic risk.

These companies operate in high beta, volatile sectors, meaning that disruptions in any of these leaders could lead to significant impacts on your portfolio.

For example, while Nvidia has soared, Tesla has floundered, dragged down by controversies surrounding the rollout of its full-self driving (FSD) software suite and ongoing issues with the new Cybertruck.

The ETF Solution

Now, you can either amplify your exposure to the dominant "Magnificent Seven" or diversify to mitigate risks associated with overconcentration, all without sacrificing potential growth.

For those inclined to maintain a robust exposure to these leading stocks, the Xtrackers S&P 500 ESG ETF is an attractive option. Notably, five out of the seven Magnificent Seven stocks (excluding Amazon and Meta) are among its top holdings, collectively representing about 36% of the ETF's portfolio.⁴

Despite excluding industries that aren’t ESG compliant—such as thermal coal, tobacco, small arms, and oil sands, SNPE still maintains a sector allocation that is aligned with the overall S&P 500 index. Additionally, SNPE has consistently outperformed the S&P 500 index by approximately 1.5% annually since the ETF’s inception in June 2019.⁵

If you wish to diversify, the concentration issue can be effectively addressed through ETFs that weigh holdings differently rather than using a market-cap-weighted methodology.

In this scenario, you can still attain exposure to the Magnificent Seven and benefit from their growth without risking overconcentration.

For instance, the thematic Xtrackers US National Critical Technologies ETF holds four of the Magnificent Seven (Nvidia, Alphabet, Amazon, and Microsoft) among its top holdings, but only at a combined weight of 22.5%.⁶

Importantly, CRTC's index selects these companies not due to their sheer size, but due to their alignment with critical technology areas established by the U.S. Department of Defense.

If you prefer a fundamentally weighted index, consider the Xtrackers Russell 1000 US Quality at a Reasonable Price ETF with a reasonable 0.19% expense ratio. The top holdings include many of the Magnificent Seven stocks, such as Microsoft, Meta Platforms, Apple, and both share classes for Alphabet.

However, as the name suggests, the focus is on paying a fair price for quality. Thus, potentially overvalued names in the Magnificent Seven, like Nvidia or Tesla are excluded for the time being.

Finally, look to diversify by going international. Both the Xtrackers MSCI EAFE Hedged Equity ETF and the MSCI Japan Hedged Equity ETF offer currency-hedged exposure to international equity benchmarks, which historically has both smoothed the ride (currency risk reductions) and increased portfolio yield via the hedge carry. Over the past 10 years, both DBEF and DBJP have delivered significant outperformance versus their unhedged counterparts.⁷

Either way, whether you choose to amplify or maintain your exposure to the Magnificent Seven or diversify to mitigate risks, there are numerous Xtrackers ETF options available to suit your investment strategy.

By carefully selecting ETFs that align with your financial goals and risk tolerance, you can effectively balance growth potential with diversification to achieve a well-rounded portfolio.

¹ Source: DWS Distributors Inc. as of 28th May 2024

² FactSet consensus earnings per share for next 12 months; E = Expected; Source: DWS Investment GmbH, FactSet Research Systems Inc, as of May 15, 2024

³ Source: DWS Distributors Inc, Bloomberg L.P, as of 28th May 2024 | 1= measured by volatility within the S&P 500 |

⁴ Source: Bloomberg, L.P., as of April 30, 2024

⁵ Source: Bloomberg, L.P., as of June 6, 2024

⁶ Source: Bloomberg, L.P., as of April 30, 2024

⁷ Source: Bloomberg, L.P., as of April 30, 2024

This content was originally published by our partners at ETF Central.