This is the time of year when most investment writers predict what will happen in 2022. What I would rather offer, however, is what is “most” likely to happen for the next 10, 20, or 50 years.

The short and glib answer to what will happen in tomorrow’s market is the one proffered by J.P. Morgan when asked what the market would do next. “It will fluctuate,” he replied.

Glib for sure. But there is much truth, and the beginnings of what we now call Modern Portfolio Theory (MPT) in his pithy response. Modern Portfolio has much to recommend it.

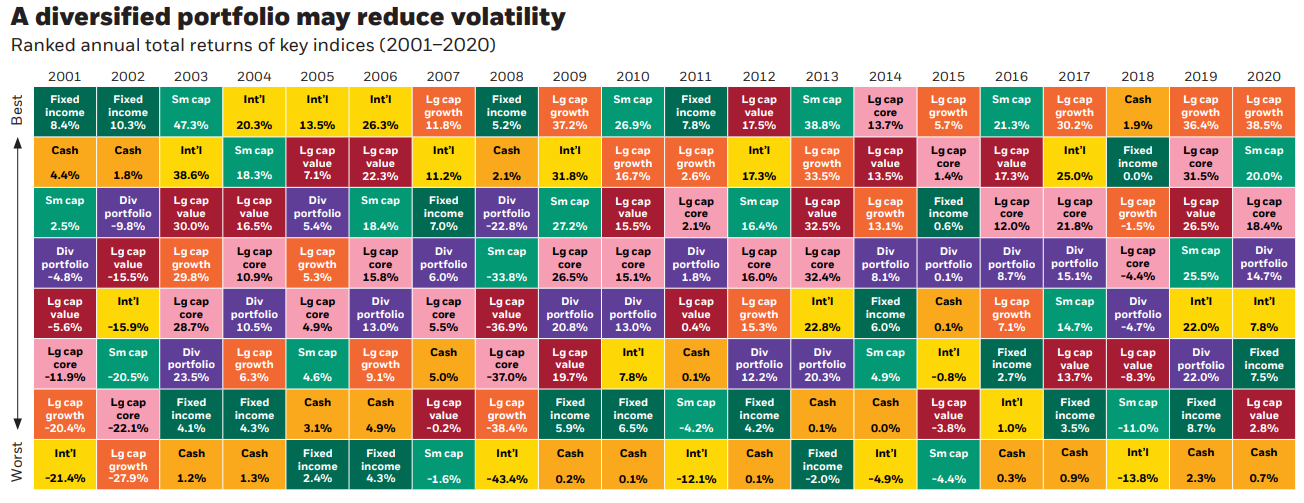

The basic idea is solid: MPT is a way to optimize your returns based on your acceptable level of market risk. You accomplish this by diversification among various asset classes. Here is a matrix of what have been the best- and worst-performing asset classes each year from 2000 to 2020 year-end:

During the go-go days of the dot-com jamboree in 2000, would you have chosen to invest in fixed income for the next 2 years? Would you have thought to switch a portion of your portfolio to International assets for the next 3 years?

Since 2012, large caps have dominated. For 6 out of 9 years they have been the place to be. Will this continue?

Before you answer, remember, behavioral finance psychologists warn us about the cognitive rush to recency versus primacy. (Recency meaning, of course, what has happened most recently, and primacy meaning what the bigger picture might show.)

I have been a student of the markets for many decades. I pay close attention to (what I have over the years narrowed down to) just over a dozen key sources and indicators. I still do not, however, have a crystal ball. That is why I stay diversified across asset classes.

Look again at the chart above. In “bad” years to be invested, even the top dog did not do well. On the other hand, in years in which the top dog enjoyed double-digit gains, even those in the four or five categories below the best performer also did well.

One lesson I take from this is that we can be wrong on our asset class best guess and still do well as long as we avoid the worst of the worst. I trust the fact that, while different companies, different industries, different sectors, and even different asset classes may change in popularity over time, human nature does not.

Diversification works; consistency wins

People tend to get more frightened the better things become in the market. That's why some of my clients who, in light of the poor showing in 2021 third quarter and the poor showing in December, are telling me they would like to go to cash.

I remind them that cash is not a particularly brilliant answer. Only once in the past 20 years have things been so unsettled that cash was a decent performer. And fixed income, in the form of bonds, are also consistent under-performers. If they are still concerned, I tend to steer them into a Quality Dividend approach. The “Div portfolio” in the above chart may never be the best performer but it has never been among the worst.

Diversification works. Yes, you will sometimes fail to beat the market, “market” being shorthand for most investors for the large caps represented by the S&P 500, but the intelligent investor’s goal is not to have something to brag about at this year’s Christmas party. The goal is to protect ourselves in the weakest market environments and participate strongly in the best. The people who live to say, “I beat the S&P this year!” suddenly go dark the next year or the next and the next and the…

Diversification works. Consistency wins.

I know that most readers read articles to glean single investment ideas. “What stock should I buy for maximum gains? Which company will outperform next year? What’s this analyst’s #1 idea for 2022?” That is putting the cart before the horse.

Once you have decided your risk tolerance you can easily construct your own matrix of what you will invest in. This will save untold hours of reading! If you are not comfortable buying, let’s say, SPACs, why even read about them? Great writing will sometimes sway our convictions. Then you are left with a stock called Remorse (symbol: UHOH).

I leave you with no stock or fund recommendation to end this year. Indeed, it doesn't matter what “My #1 Pick for 2022” is.

What matters is that you have the opportunity to become a calmer, more organized investor who selects in advance the asset classes you are willing to work with. You may then select the funds, ETF or OMF (Original Mutual Fund), or stocks that best fit your criteria.

You will certainly sleep more soundly if you do this—and I imagine you will do at least as well and probably better by so doing. Besides, I offer something better than a particular stock to buy. I offer this mantra:

Diversification works. Consistency wins.