The start of the EV boom was characterized by a fascination with sleek designs, quiet engines and touchscreen interfaces.

Today, that boom is maturing into a global phenomenon supported by factors that go much further than the aesthetic appeal and status signaling that sparked the first wave of EV purchases. There are three key parts to this new trend.

First, a growing middle class in parts of the world is enabling more people to buy EVs. As a greater share of people see their incomes rise they are making the leap to EVs. India, Indonesia, Thailand, and Vietnam are all expected to experience substantial growth in their middle-class populations.

Second, stricter government policies around emissions and fuel efficiency are pushing car manufacturers to focus more on battery-powered vehicles. Financial penalties for exceeding CO2 limits are providing automakers with a strong incentive to move away from internal combustion.

Third, manufacturing costs continue to fall. Advances in technology and in some cases lower lithium costs are making the economics of EV manufacturing more attractive than it has ever been.

Here we look closer at these three and why they mean that the EV boom is here to stay.

A Growing Middle Class is Ready to Ride

Data from the World Bank shows that by 2030 the global middle class could grow to 4.8 billion people. This means that 1.3 billion more people will experience an increase in their buying power compared to today.

With a rising middle class comes more disposable income. Consider that in 2020, the global middle class spent $44 trillion which represented 68% of all consumer spending in the world. In seven years this figure is expected to reach $62 trillion based on data from The Brookings Institution.

What makes this trend so important is the fact that it is progressing alongside another important trend which is the falling costs of EVs. An extensive analysis published as a working paper by the International Council on Clean Transportation asks the question “When might lower-income drivers benefit from electric vehicles?” After a review of the data their conclusion is that “by 2030, the average cost of ownership for a new EV is about the same as the cost of ownership for a used gasoline car that is several years old. This finding suggests that consumers may shift away from the used gasoline car market en masse, further accelerating the transition to electric vehicles.” Put simply, the middle class is increasing while EV costs are decreasing. The net effect: more EV sales.

In fact, this trend may be accelerating. This year, G.M. will sell its battery-powered version of the Equinox crossover for $30,000 which is only $3,400 more than the cheapest gasoline-fueled Equinox. After government incentives, however, the battery-powered version should be less than the gas-powered model.

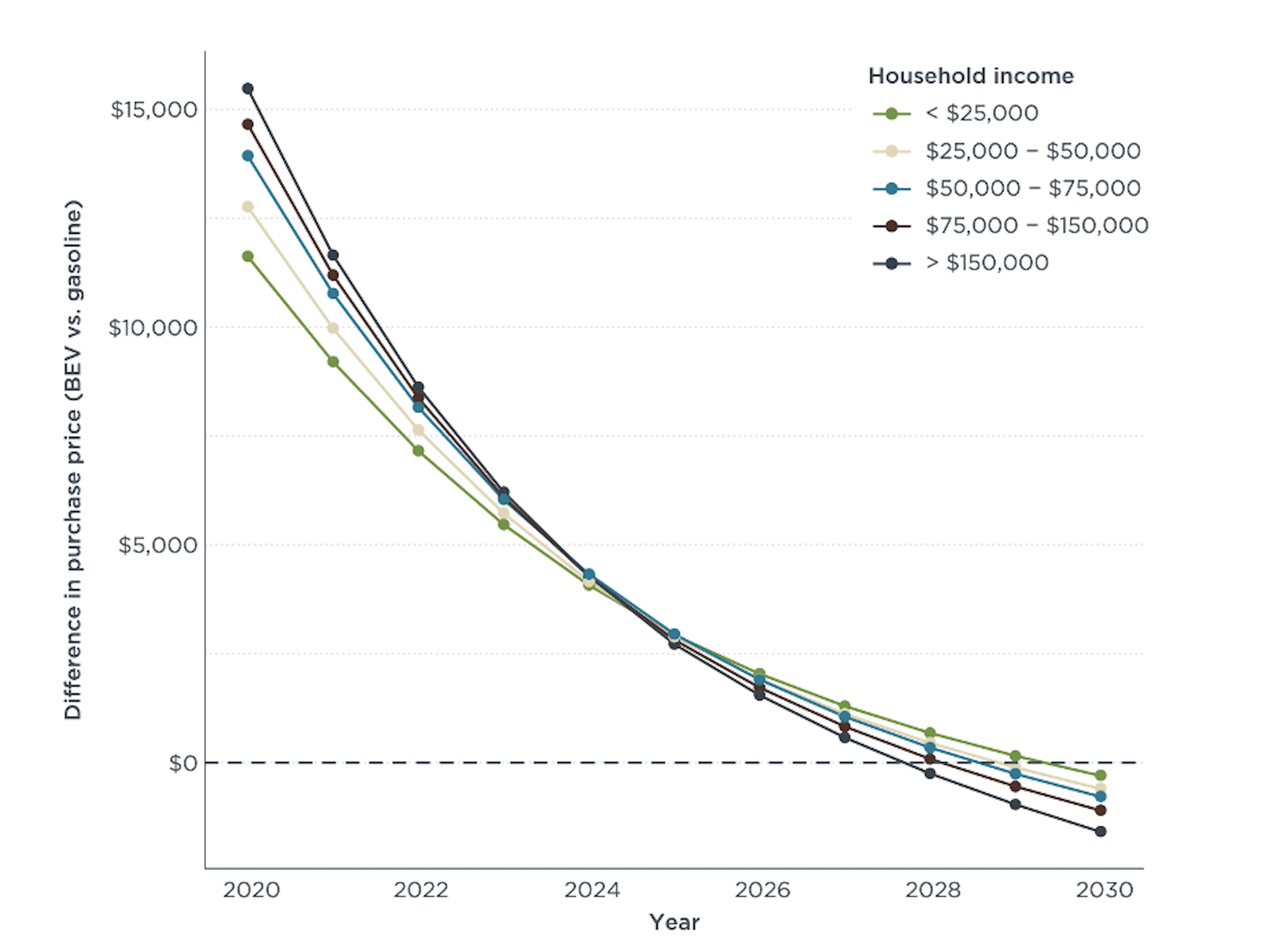

Source: International Council on Clean Transportation

BEV = Battery electric vehicle

Today, battery electric vehicles (BEV) cost about $10,000 more on average than the equivalent gas-powered vehicle for households in every income group. By 2025 this difference drops to $2,500 and reaches parity by roughly 2028.

Government Policies Hit the Accelerator

Governments across the globe are making considerable investments in EV infrastructure. In the US, The Infrastructure Investment and Jobs Act allocated $7.5 billion to support the construction of a nationwide charging network. This will put fast charging stations along the interstate highway system. Part of the funding will also help improve the power grid in an effort to provide the needed infrastructure to support broad EV adoption.

Other initiatives like the Inflation Reduction Act extended a tax credit of up to $7,500 for those purchasing a new EV until 2032. At the state level, California has implemented the zero-emission vehicle (ZEV) program which has been adopted by ten other states. The program requires automakers to invest in clean energy technology.

Similar plans are taking shape in Europe. As recently as March of this year European Union member states gave final approval to an initiative mandating that by 2035 all new cars sold in the EU be zero-emission. The plan also states that the average emission of new cars must fall by 55% by 2030 and that average emissions of vans drop by 50% by the same year.

The sum of these plans is a future - that is, a near future - in which consumers and manufacturers have fewer reasons than ever to make and buy internal-combustion cars. The regulations essentially make non-EV cars more expensive.

EV Manufacturing Costs Are Downshifting

The most expensive component of an EV is its battery which has fallen in cost over the last 15 years. The Department of Energy’s Vehicle Technologies Office estimates that the cost of these batteries (lithium-ion) has decreased by 89% between 2008 and 2022.

Part of this trend is due to more efficient manufacturing processes and improved technology. Additionally, there have been some unexpected developments that have brought costs down. For example, lithium prices have fallen by about 20% since the start of 2023. Cobalt - the most expensive battery metal - has fallen even more by about half. Even copper has fallen by about 18%. There are competing theories as to why these metals have declined in price but many believe the new mines and processing facilities have yielded more output faster than analysts originally expected.

These declines in price might reverse but for the moment they are helping to keep EVs affordable which will encourage more consumers to make the move away from internal combustion. Research shows that once they make this move they are very unlikely to ever go back to a gas-powered car.

How Investors Can Get Behind the Wheel

L&G Battery Value-Chain UCITS ETF (BATG)

This fund invests in companies that produce metals largely used for manufacturing batteries and companies involved in the development of electrochemical energy storage technology.

L&G Clean Energy UCITS ETF (LIT)

The fund holds several companies that are closely connected to lithium production and battery tech including firms that mine and process rare earth metals.

iShares Electric Vehicles and Driving Technology UCITS (ECAR)

The iShares fund is composed of companies involved in developing hybrid technology, lithium mining, EV manufacturing, and EV charging stations.