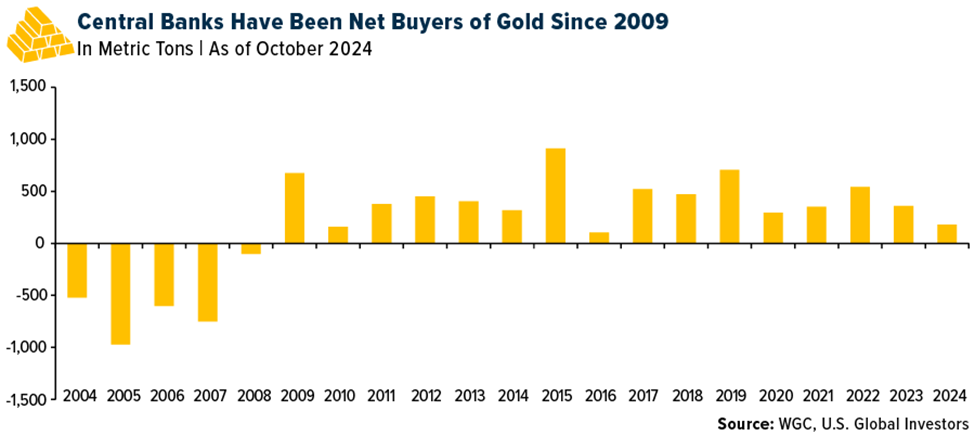

With over 36,000 metric tons in reserves—about one-fifth of all the gold ever mined—central banks know something we should too: Gold is the ultimate safety net. Since 2009, these institutions have been net buyers of the precious metal, and in the past decade alone, they’ve scooped up one out of every eight ounces produced globally.

If these guys are loading up on gold, shouldn’t that tell you something about where your own portfolio should be?

While fiat currencies can be printed at will (and we’ve seen plenty of that lately), gold remains a finite resource. I believe that makes it the go-to asset when economic uncertainty rears its head. Countries all over the globe have realized this, and they’ve been buying gold in bulk.

Here’s a look at the top 10 nations that have been piling up the most gold in the last decade, based on data supplied by the World Gold Council (WGC):

10. Hungary - 91.4 metric tons

The Hungarian National Bank has been holdings gold since it was created in 1924. Lately, it’s been serious about adding to its stockpile. With 110 metric tons in reserves, Hungary now boasts the highest per capita gold holdings in Central and Eastern Europe.

9. Qatar - 96.3 metric tons

Qatar views gold as a safe investment, especially during times of economic uncertainty. In recent years, Qatar’s gold purchases have soared, with holdings over 100 tons by the end of 2023. For a nation built on oil and gas wealth, it’s clear they see gold as a reliable backup plan.

8. Singapore - 101.5 metric tons

Singapore is no stranger to gold, even if it has to import every ounce. This year, it made a historic move, bringing its gold reserves to 236 metric tons, the highest level since the city-state gained independence in 1965. A savvy play for a global financial hub like Singapore!

7. Uzbekistan - 126.3 metric tons

Uzbekistan has been a quiet yet powerful player in the gold market. Its reserves have grown steadily, hitting 373 tons in 2024. Almost 80% of Uzbekistan’s total international assets are now in the precious metal.

6. Kazakhstan - 132.6 metric tons

Kazakhstan, a top global gold producer, has steadily increased its reserves, which now stand at a combined $23 billion. The country plans to reduce gold’s share of its reserves slightly but remains a major player in the global market, accounting for 2% of global gold production.

5. India - 291.4 metric tons

India’s Reserve Bank has been making some big moves in the gold market. Its purchases in the first half of 2024 were the highest since 2013, surpassing the previous two years combined. For India, where gold holds deep cultural significance, the metal remains central to its economic strategy.

4. Poland - 295.0 metric tons

Poland’s National Bank has been one of the most aggressive gold buyers this year, tying with India for the largest purchase in the second quarter of 2024. With current holdings at 16%, Poland is on a mission to have the precious metal make up 20% of its reserves.

3. Turkey - 475.6 metric tons

Over the past decade, Turkey has grown its gold reserves from 116 metric tons to over 584 tons today. With nearly 20% of its reserves in gold, Turkey is one of the top buyers, thanks to its long history of domestic gold ownership and investment.

2. China - 1,210.2 metric tons

China is always one to watch, and it’s been no slouch in the gold department. Having added over 1,200 metric tons in the past 10 years, the People’s Bank of China sits just behind the U.S. in total global rankings. However, it hit pause on new purchases in recent months as gold prices surged.

1. Russia - 1,230.6 metric tons

Taking the top spot, Russia has added more than 1,200 tons of gold to its reserves over the last decade. With sanctions from the West in mind, Russia has been preparing, even going as far as to peg its currency, the ruble, to gold—a strategy we haven’t seen since the days of the Bretton Woods system.

At U.S. Global Investors, we’ve always seen gold as a key part of a diversified portfolio, and we believe our gold-focused funds offer an excellent way to participate in this time-tested asset. After all, if it’s good enough for central banks, shouldn’t it be good enough for you?