Last week I had the privilege of participating in a YPO (Young Presidents’ Organization) event held in Victoria Falls, Zimbabwe. One of the main topics of discussion was investment opportunities in neighboring Zambia, a country that, despite its challenges, is a rising star on the African continent, due largely to its copper exports. I was honored to meet Zambian President Hakainde Hichilema, whose pro-business and reform-oriented stance has attracted attention from international investors since his inauguration in August 2021.

Zambia, a landlocked country in south-central Africa and the continent’s 17th largest, has shown remarkable resilience. It has a common law judicial system, the same as the U.K. and the U.S.

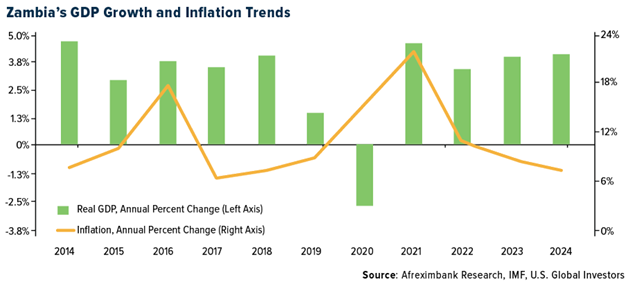

Economic growth exceeded 4.7% in 2022, despite the pandemic, the Ukraine war and other challenges.

The Role of Copper in Zambia’s Economic Resilience

Central to Zambia’s economic stability is its mining sector, which accounted for 17.5% of the country’s GDP and over 70% of foreign exchange earnings in 2021. Copper, the country’s main export, plays a pivotal role in this regard.

As many readers are aware, copper has emerged as an indispensable resource as the world accelerates its transition to renewable energy sources. The red metal’s conductivity and versatility make it crucial for various applications, from electric vehicles (EVs) to solar panels and wind turbines. Zambia’s ambition to produce 3 million tonnes of copper annually by 2032, up from around 800,000 tonnes today, highlights the metal’s importance going forward.

In the early 1990s, we were seed investors in Randgold Resources, as we believed in founder Mark Bristow’s vision. Randgold (LON:RRS) was purchased in 2019 by Barrick Gold (NYSE:GOLD), which has a plan to double its copper production by 2029, according to May’s investor presentation.

Major Investments Fuel Zambia’s Mining Boom

Top-tier mining firms recognize this potential and have announced significant investments in the country. Barrick committed nearly $2 billion in October 2023 to boost copper production at its Lumwana mine. A year earlier, {{0|First Quantum (NASDAQ:QMCO) Minerals}} unveiled a $1.35 billion investment over 20 years in its Kansanshi mine and an ambitious solar and wind energy project to power its operations.

Another significant aspect of Zambia’s investment appeal is its potential for surplus hydropower, which accounts for over 80% of the country’s energy mix. Zambia shares several large dams with Zimbabwe, and the possibility of harnessing this surplus energy for data centers presents a compelling investment opportunity. Given the increasing demand for data storage and processing capabilities, particularly in Africa, this could be a game-changer.

Hakainde Hichilema: From Business Leader to Reformist President

As I said, I had the honor of meeting President Hichilema, who’s introduced a renewed sense of optimism in Zambia. He holds a Bachelor of Arts in Economics and Business from the University of Zambia and an MBA in Finance and Business Strategy from the University of Birmingham in the UK. Before his political career, he served as CEO of Grant Thornton Zambia.

Hichilema’s pro-business approach, coupled with his commitment to economic reforms and anti-corruption measures, has steadily made Zambia an attractive destination for investors. His administration’s efforts to stabilize the economy, enhance governance and foster a conducive business environment are particularly noteworthy.

President Hichilema’s pro-America stance is another factor that I think could reassure investors. His administration has been actively courting foreign investment, emphasizing the importance of partnerships with American businesses.

Finally, Hichilema has taken steps to push back against Chinese influence, by renegotiating mining contracts, increasing transparency, diversifying investment and restructuring debt.

Independence Day Travel Expected to Reach All-Time High in 2024

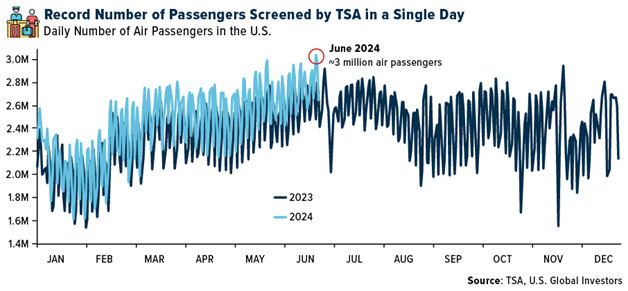

As someone who’s done a lot of traveling this summer, the record-breaking volumes have been impossible to ignore. On Sunday, June 23, the Transportation Security Administration (TSA) broke its record for most people screened on a single day, with nearly 3 million individuals passing through airport security.

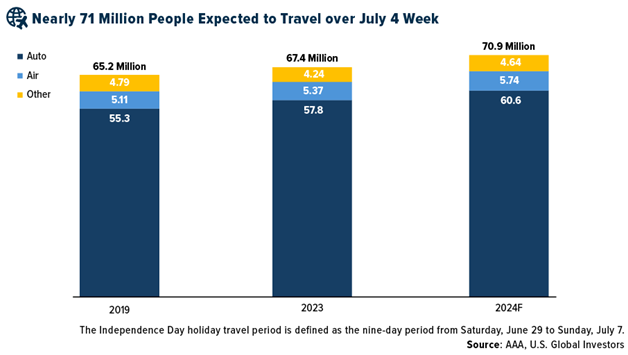

The trend is expected to continue. According to the American Automobile Association (AAA), a projected 70.9 million travelers will head 50 miles or more from home over the Independence Day holiday period, marking a significant increase from previous years. Air travel, in particular, is setting new records, with 5.74 million people expected to fly to their July 4 destinations.

Having experienced the busyness of airports firsthand, I’m happy to see such vibrant economic activity. The bustling airports and high travel volumes are clear indicators of a strong economy. This surge in travel not only benefits the transportation and tourism sectors but also contributes to the broader economic recovery.

Disclosure: Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

None of U.S. Global Investors Funds held any of the securities mentioned in this article as of 3/31/2024.