- Nuclear power is an indispensable component of a carbon-neutral energy future

- As a result, uranium demand set to grow in the coming years

- Which stocks in the sector could benefit the most?

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

As the world increasingly adopts cleaner energy solutions, the demand for uranium is on the rise and is expected to persist in the years to come.

Therefore, Investing in stocks related to uranium presents a distinctive opportunity for clean energy and sustainable investments.

This is particularly significant as uranium serves as a key component in nuclear power generation, playing a crucial role in the current global energy mix.

For instance, the price of Uranium has surged by over 60% since the start of the year, with a substantial portion of this increase observed in the last 7 months.

Source: Trading Economics

Meanwhile, the Global X Uranium ETF (NYSE:URA), which includes several companies in the sector, is up over 40% year-to-date.

Indeed, nuclear energy offers several advantages over renewable energies and is now considered an indispensable component of the energy mix in the context of carbon neutrality targets.

The world's growing demand for electricity, combined with the need for stable and reliable energy sources, makes nuclear power the most viable alternative to traditional energy sources.

In addition, technological advances in nuclear power, such as the development of small modular reactors (SMRs) and the new safety measures taken after Fukushima, have made nuclear power more efficient and safer, which should also help to increase demand for uranium.

So, investing in Uranium stocks seems to make sense on several levels, especially as part of a long-term portfolio. In this article, we'll try to identify the best Uranium stocks to invest in for 2024, using the InvestingPro strategy and data platform.

What are the best Uranium stocks to buy for 2024?

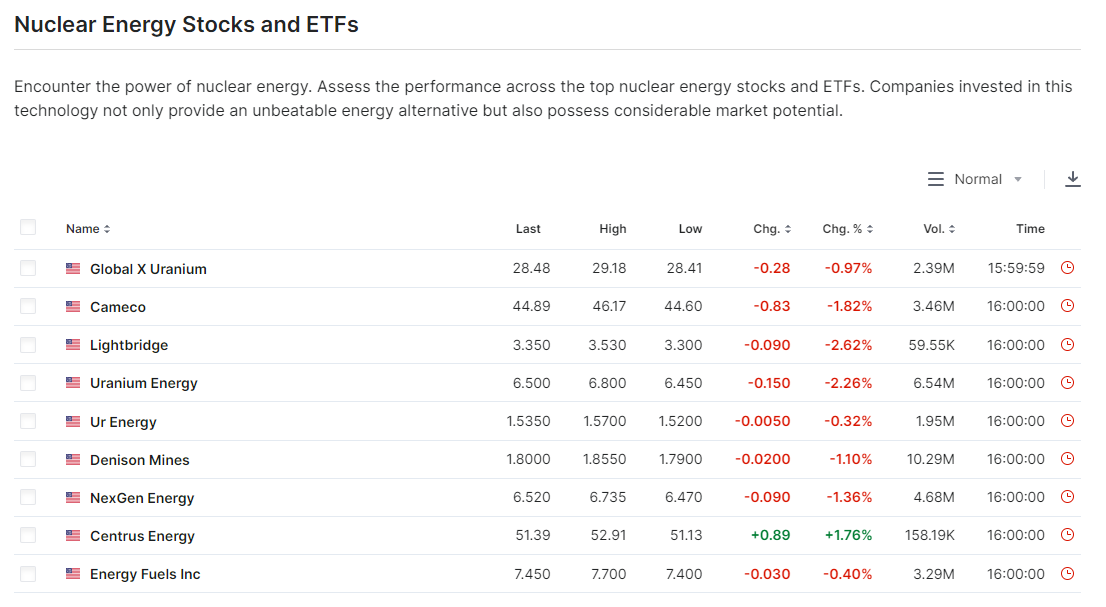

We started by looking at Investing.com's new Thematic Stock Lists section, which includes a list of stocks involved in Uranium.

Source: Investing.com

In addition to the Global X Uranium ETF, the list includes Cameco Corp (NYSE:CCJ), Lightbridge Corp (NASDAQ:LTBR), Uranium Energy Corp (NYSE:UEC), Ur Energy Inc (NYSE:URG), Denison Mines Corp (NYSE:DNN), NexGen Energy (TSX:NXE) Ltd. (NYSE:NXE), Centrus Energy (NYSE:LEU) and Energy Fuels (TSX:EFR) Inc (NYSE:UUUU), stocks which we have assembled in an InvestingPro watchlist to compare, particularly in terms of upside potential and financial health.

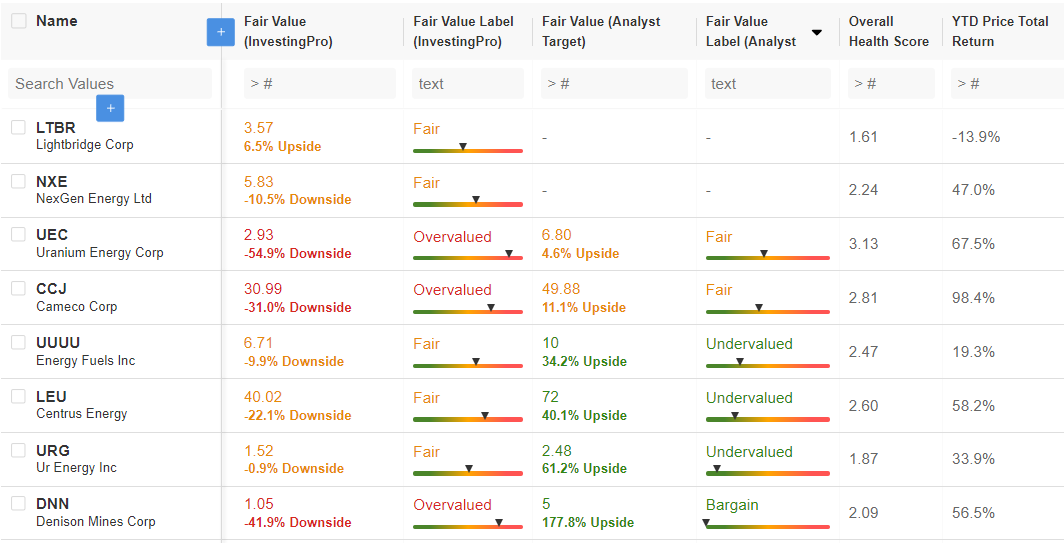

Source: InvestingPro

The first thing we notice is that the InvestingPro Fair Value, which is an average of several recognized financial models, indicates that the stocks on this list are all correctly valued, or already overvalued.

Indeed, many of them have already risen significantly since the start of the year, with Cameco, for example, almost doubling in value by 2023, while Uranium Energy has gained 67.5% and Centrus Energy 58%.

Analysts, on the other hand, are more optimistic, attributing a potential upside of over 177% to Denison Mines, 61% to Ur Energy, and 40% to Centrus Energy.

However, a closer look at the analysts' forecasts for each stock reveals that they are all followed by a very limited number of analysts, which reduces the importance of the average target.

In terms of financial health, Uranium Energy and Cameco stand out as the strongest companies, with scores of 3.13 and 2.81 respectively. Conversely, Lightbridge and Ur Energy have the lowest scores, at 1.61 and 1.87.

Conclusion

While there are tangible reasons to expect Uranium, and therefore Uranium stocks, to rise in the long term, the medium-term outlook is more uncertain, as the sector appears to have already largely exhausted its upside potential this year, if valuation models are to be believed.

Rather than buying immediately, interested investors would therefore do well to keep these stocks on their radar with a view to buying at a better price in the event of a correction, while continuing to monitor the evolution of their financial profile closely using InvestingPro data.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.