My $4926 profit Trading AMD (NASDAQ:AMD) Options after its Earning

In yesterday's AMD earnings report on November 2, 2023, I closely monitored the company due to the recent buzz surrounding the AI industry. As an options trader, I specialize in capitalizing on market momentum following earnings announcements. AMD exceeded expectations in its third-quarter earnings, reporting a robust revenue of $5.8 billion and an EPS of $0.70. While its Q4 revenue projection of $6.1 billion fell short of analysts' estimates, the company quickly rebounded, bolstered by optimism surrounding its upcoming data center chips, ultimately driving a notable 8% increase in its stock price the following day.

Despite challenges, AMD remains focused on innovation, particularly in the competitive AI market, where it aims to challenge industry leader Nvidia. CEO Lisa Su emphasized the company's dedication to groundbreaking technology, even as it faces obstacles in the gaming sector. Notably, Cathie Wood's Ark Invest expressed confidence in AMD's potential, investing over $5 million in the company's shares.

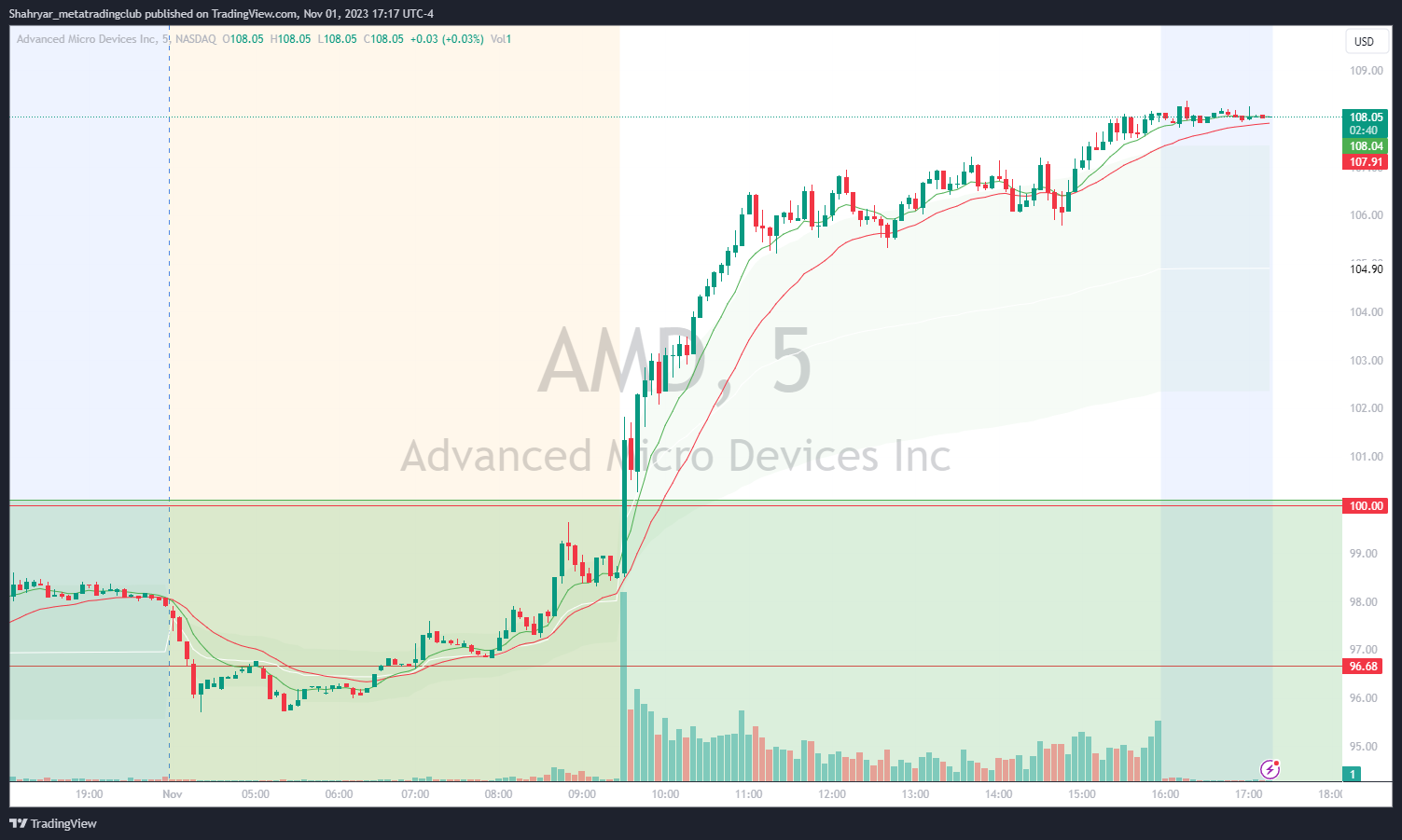

Analyzing the premarket data, I identified the $100 zone as a crucial resistance level for AMD.

I posted premarket gameplan before the market open for our Meta Trading Club community and this was my gameplan for the day:

Observing the substantial buying strength and significant volume after the market opened, I strategically entered the market at $102 strike, same-week expiry AMD Call options. Leveraging insights from Level 2 and Times and Sales, I made a calculated decision, witnessing AMD's impressive rally and cashing in on the opportunity.

By scaling out of my position, I managed to secure substantial gains, with some contracts yielding over 150% profit. In less than two hours, I realized a total profit of $4926.

It's worth noting that I closed my position before the FOMC announcement at 2 PM, where the Federal Reserve maintained its key interest rates, sparking a market rally.

Looking ahead, I anticipate increased market volatility in the coming days and weeks, especially with events like AAPL's earnings announcement on Thursday, November 2, after the market closes. These developments present lucrative trading opportunities, and I remain vigilant to capitalize on the evolving market dynamics.