Taiwan Semiconductor Manufacturing Corporation (NYSE:TSM) is the world's largest and most advanced pure-play semiconductor chip foundry. The company plays a critical role in the semiconductor supply chain by manufacturing cutting-edge chips for the most important companies in the world, such as Apple Inc (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA). Currently, TSMC is trading near the highest historical valuation. It is certainly not cheap. However, given TSMC's highly predictable earnings growth in the next 5 years, the stock is not expensive either.

Business description and competitive analysis

TSMC was founded in 1987 by Taiwanese-American businessman Morris Chang in Taiwan. Since its founding, TSMC has pioneered the pure-play foundry business model by only focusing on manufacturing chips for its customers. The rise of TSMC and the foundry business model has dramatically reduced the capital investment for chip designing companies, which led to the rise of the fabless companies. This disruptive business model fundamentally changed the semiconductor industry. According to TSMC's 2023 annual report, "the company manufactured 11,895 different products using 288 distinct technologies for 528 different customers across a variety of end markets including high-performance computing, smartphones, the Internet of Things (IoT), automotive, and digital consumer electronics".TSMC's current wafer fabs are mostly in Taiwan. Due to geopolitical tensions, TSMC has planned to jointly invest in a European fab, construct and operate two fabs in the U.S., and build a new fab in Kumamoto, Japan. These overseas fabs will have higher operating costs than TSMC's Taiwanese fabs. However, TSMC is expected to be at least partially reimbursed by both governments in the form of subsidies and by its customers in the form of price increases.

In terms of competition, TSMC has become almost a monopoly in the most advanced leading-edge chip manufacturing space after the recent struggles of both Samsung (KS:005930) and Intel (NASDAQ:INTC). There are rumors that Intel is likely to be acquired. However, even if this acquisition were to occur, it would not affect TSMC's competitive edge in the leading-edge technology, at least for a few years. In the mature-node market, TSMC competes against a number of competitors, such as GlobalFoundries (NASDAQ:GFS) and China's Semiconductor Manufacturing International Corporation (SMIC). Compared to Global Foundries and SMIC, TSMC has a much more extensive and diversified customer base. In addition, TSMC has established a global supply chain network that is both more efficient and more resilient than SMIC, which is unable to acquire some parts and equipment due to U.S sanctions.

The big tailwind for TSMC is that it is increasingly relying on leading-edge wafer manufacturing. As of the latest quarter, advanced technologies (7-nanometer and above) accounted for 74% of TSMC's total wafer revenue. Furthermore, TSMC is likely the biggest winner in the AI era. Not only is the company the dominant player in leading-edge chip manufacturing, it is also the indisputable leader in the advanced packaging technology required for AI chips. For instance, TSMC's CoWos(Chip-on-Wafer-on-Substrate) technology and SoIC (System-on-Integrated-Chips) technology are both critical for Nvidia's powerful AI chips and servers.

Financial and valuation analysis

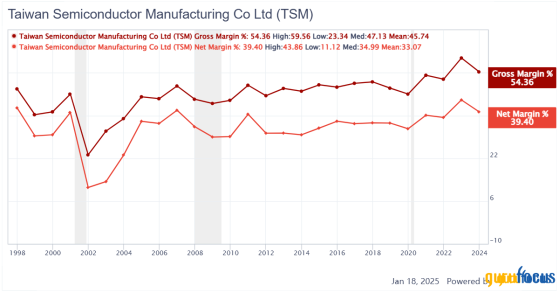

As of the latest quarter, TSMC's revenue grew 38.8% year-over-year. Both net income and EPS increased 57% year-over-year. The company's gross margin reached 59.0%, and its net profit margin reached 43.1%. Both gross margin and net margin are near all-time high levels. The rapid revenue and profit growth, coupled with increasing margins, indicate strong demand for TSMC's products and services during the quarter.TSMC's latest guidance is mid-40s CAGR for its AI revenue in the next five years, starting from the base year of FY2024. At this rate, in 2029, TSMC's revenue from AI chips will reach an astounding $80 billion. Based on this AI guidance, we can then infer that the total revenue growth for the next 5 years for TSMC is about 20%. This is very impressive, considering TSMC's high base.

Given TSMC's unprecedented lead in advanced leading-edge technology, I expect the company to achieve its revenue growth target while maintaining the current net margin. TSMC's revenue for FY 2024 is approximately $88 billion. By growing 20% a year for the next 5 years, TSMC's revenue will reach $218 billion, and its net income will reach $88 in 2029, assuming its net margin remains at 40%.

Historically, TSMC's P/E ratio has oscilated between 10 times and 35 times with a median P/E ratio of 18 times. Even if we assume TSMC's multiple will contract to the historic median by 2029, TSMC will still be worth about $1.57 trillion in 5 years. Compared to its current market cap of $870 billion, TSMC's 2029 target market cap indicate a CAGR of roughly 13%.

Risk discussion

While the predictability of TSMC's growth over the next 5 years is very high, there are certain risks that may prevent TSMC from achieving its target. The most obvious risk is the geopolitical risk. As this is highly unpredictable. I will not speculate on the likelihood of the extreme case. As I mentioned earlier, to mitigate this risk, TSMC is building fabs overseas. However, as TSMC's CEO C.C. Wei highlighted during the latest earnings call, TSMC is "encountering significant challenges in the Arizona plant due to compliance issues, construction regulations, and licensing requirements." Further delays in the Arizona fabs will adversely impact TSMC's future earnings.The second risk for TSMC is that the growth of non-AI revenue may be slower than expected. For instance, Apple Corporation, which is one of TSMC's largest customers, has experienced significant headwinds in China. If Apple's sales in China enter into a prolonged period of contraction, Apple may have to cut its orders from TSMC in the future.

Last but not least, every semiconductor company faces the risk of technological change. In the short term, TSMC is the beneficiary of technological change because it is the standard setter. However, over the long term, it's inevitable that new technology will emerge and it's unclear whether TSMC will be the winner should that happen.

Conclusion

In conclusion, Taiwan Semiconductor Manufacturing Corporation (TSMC) is very well positioned for strong growth in the next 5 years, driven mainly by the rapid growth of AI-related revenues. Despite potential geopolitical risks and non-AI-related customer demand risks, TSMC's dominance in leading-edge chip manufacturing and its lead in AI-related advanced packaging technology will ensure that TSMC can grow its revenue while maintaining a healthy profit margin. Even though TSMC's valuation level is close to 10 years high, the company's stock still has plenty of upside if TSMC can reach its 5-year guidance. My suggestion is that current TSMC shareholders can hold the stock while potential TSMC shareholders can wait for a better price.This content was originally published on Gurufocus.com