Uber's (NYSE:UBER) shares have experienced a significant drop, with a 25% decline from their peak in October 2024 as of the time of writing. The global leader in ride-sharing has seen its market value drop even more since October 11, right after Tesla's (NASDAQ:TSLA) Robotaxi Event. As Tesla, the top global EV company, revealed its plans for self-driving cars potentially entering the ride-sharing market in the next few years, the market started seeing Uber as weak in this scenario. However, Uber's fundamentals may actually be stronger than ever, and any impact of robotaxis on Uber's business is still mostly speculative.

In this article, I'll share why I think the bearish reaction to Uber stock might be overdone. Given its strong fundamentals and valuation, I see this as a great buy opportunity.

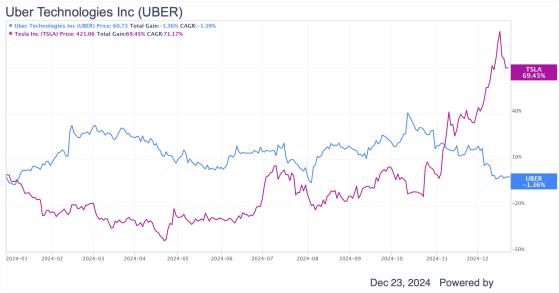

Uber Stock vs. Tesla StockThroughout 2024 and more specifically over the past few months, there has been a clear market perception associating the strong performance of Tesla stock with a negative impact on Uber's shares. This is because of the announcements made by Elon Musk's company regarding its plans to launch CyberCabs by 2025.

According to Tesla's own CEO, the business model for the Robotaxi service will be a kind of mix between Airbnb (NASDAQ:ABNB) and Uber where (1) Tesla will own and operate a fleet of carsthe user will book a ride in these vehicles and payment will go directly to Tesla; (2) private individuals will own robotaxis, where payment for these rides will go to vehicle owners.

But it's worth noting that the implementation of robotaxis is still a long way from being a reality in the short to medium term. Wedbush's own renowned technology analyst, Dan Ives, made this clear in a speech earlier this year: Our view is while this is an exciting announcement around robotaxis we do not expect full autonomy (no steering wheel models) until 2030.

Even so, as we can see in the graph below, in 2024, nearly every time Tesla's shares have rallied, Uber's have fallen. This is one of the market's misconceptions: thinking that Tesla's success means a problem for Uber.

This perception is a clear message that many investors think that in the near future, there will be millions of autonomous cars on the streets, and this would mean that no one would need an Uber driver anymore.

In any case, according to Uber's CEO, Dara Khosrowshahi, the company remains well-positioned to navigate and thrive in a scenario where the future of ridesharing will be shaped by a transition to autonomous vehicles. He also mentioned that Tesla's robotaxi project will require tools that Uber already possesses to make financial sense.

I don't think it's going to be all Robotaxi anytime soon, and we think that when the technology comes in, there will be a transition. You will have essentially hybrid networks. And going through that transition, we think we're uniquely situated as a marketplace to assess and have any and all safe AV tech along with human drivers on our network.

Where the Opportunity (SO:FTCE11B) LiesTo provide more context on the situation of Uber stock, as of the end of December 2024, Uber shares are 30% below their all-time highs, which represents the third worst drawdown since its inception. Uber stock now trades at 19x its earnings in the last twelve months, and if we consider the outlook for 2025, Uber stock trades at 21x its forward earnings.

From a technical point of view, the 9-day Relative Strength Index (RSI) of Uber stock is at 30, a level considered low and therefore can be considered oversold. Historically, when Uber's RSI reaches oversold condition, the stock rises by an average of 48% in the following yearas Josh Brown, CEO at Ritholtz Wealth Management, wisely points out.

Source: GuruFocus

But it doesn't stop there. Uber has shown every quarter that its business fundamentals are rock solid. In Q3 2024, the company beat Wall Street's expectations, not just on the earnings per share, but also the revenue. In fact, their top line was $11.2 billion, up 20% in comparison to the same quarter last year. Uber also reported a big EPS beat of $1.20 versus $0.41.

Other key metrics for Uber include performance indicators showing that gross bookings have increased by 16% year-over-year. Monthly active users are also up by nearly double digits, reaching all-time highs, while rides are up 16% year-over-year as well.

Source: Uber's IR

One area that I really like to focus on here is free cash flow, which is up 133% YoY, accounting for $2.1 billion.

Uber is currently generating $0.97 per share in free cash flow (FCF) and $0.99 per share in operating cash flow (OCF). Both of these are trending in the right direction, and I expect them to keep growing at a fast pace.

When it comes to Uber's margins, they're expanding quickly. The company is now posting positive operating and net margins9.48% and 23.34%, respectively. Management is clearly focused on driving profitable growth.

The balance sheet also looks solid. As of Q3 2024, Uber has over $9 billion in cash, cash equivalents, and short-term investments. This compares to total current liabilities of around $11 billion and long-term debt of about $11 billion. Overall, Uber's financial health is strong. Plus, remember that the company is now generating more than $2 billion in free cash flow every quarter.

In short, Uber's fundamentals are looking great. The management team has boosted profitability while keeping a dominant position in the ride-sharing market and a strong presence in food delivery.

Expectations for 2025 and AheadAs Uber's fundamentals are in strong shape, the company is poised to continue growing at very robust rates for 2025 and beyond. Analysts estimate that Uber will report EPS of 2.35 in 2025, which would imply 27.9% growth compared to the $1.83 to be reported in full-year 2024. On the top line side, revenues are expected to reach $50.6 billion in 2025, an increase of 15.67%, compared to the 17.4% increase forecast for the full year 2024, showing a slight slowdown.

Source: GuruFocus

Furthermore, when we look further ahead, analysts have estimated that, over the next three years, Uber will grow EPS at an extremely robust CAGR of 54.5%. If we adjust this growth for the forward P/E ratio of 21.6x, this confronts a PEG of 0.4x, which is extremely de-risked in my view.

The main risk, in my view, of this CAGR not being achieved (or coming close to it) correlates with a diverse consensus on ride-share market growth. According to Markets And Markets and Fortune Business Insights, the global ride-sharing market will grow at an annual rate between 16 and 18% for the next few years. Other sources, such as Statista, point to just 5% over the next few years.

Other than that, as the markets have been trading on hype, rather than fundamentalslike Tesla soaring on robotaxi news and Uber dropping despite improving fundamentalsthere may be little to stop this trend from continuing in the short to medium term, which could put pressure on Uber's shares throughout 2025.

Final RemarksIn summary, Uber remains, in my view, a rate case of growth at a reasonable price (GARP) opportunity, with the recent pullback largely related to noise and speculation rather than any kind of weakness in the company's valuation. Fears that robotaxis will dominate the future and make Uber's services obsolete seem exaggerated, although it could have some impact on the business. Uber's management team seems to be very aware of the challenges ahead and its ability to adapt to changes and potential disruptive players by encouraging innovation and seeking strategic partnerships.

This content was originally published on Gurufocus.com