While most investors focus on fees when choosing an ETF, tax efficiency is usually an afterthought in their minds. As it turns out, the tax impact of taxes is much higher than the fees. How can investors protect their returns from tax drag, and what is the impact on their returns?

How taxes impact ETF returns

The topic of taxation has, and probably always be about as interesting as watching paint dry, there’s no getting around that. But as it turns out, the effect of taxes on ETF returns can be quite significant, and investors who are in a higher tax bracket should watch out for certain types of funds.

In comparison to mutual funds, ETFs are almost always the better option when it comes to tax efficiency, because of how they are structured and their investing style. Mutual funds are actively managed and try to beat their benchmarks by buying and selling securities, which generates taxable events. The more buys and sells, the more taxes need to be paid on those gains. On the other hand, ETFs usually track an index or benchmark and do not make changes unless the index itself changes. This significantly limits the activity and taxable events within the ETF.

Furthermore, when investors of an ETF choose to redeem units for cash, the ETF does not need to sell assets in order to meet that cash obligation, since it trades as equity on an exchange. The cash redeemed by the investor does not come from the ETF, but rather from normal bid-ask operations, similar to any other sale of equities. This also eliminates the need for transactions within the ETF that would generate taxable liabilities for the fund and the investor.

ETFs do have similarities with mutual funds when it comes to distributions. Although not all ETFs provide distributions, it’s important for investors to consider the sources of those distributions if the fund is held in a taxable account.

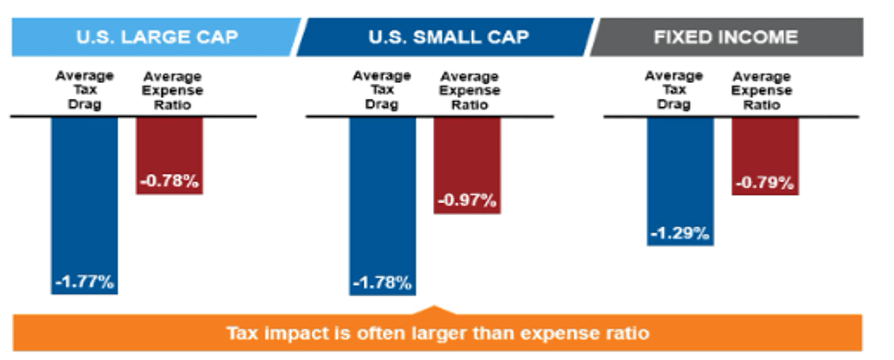

This may seem like a trivial amount, but Morningstar reports show just how impactful tax drag can be on overall investment performance:

For three years ending Sep 2022. Source: Morningstar. U.S. Large Cap: Morningstar U.S. Large Blend Universes average, U.S. Small Cap: Morningstar U.S. Small Blend Universes average, Fixed Income: Morningstar Taxable Bond Universes average. Tax Drag: Morning

Although the analysis is done for U.S based investors and similar research for Canadian investors isn’t readily available, it illustrates a very important point. Tax-drag can be more than twice as impactful on performance as the fees charged by the ETF!

Taxable ETF Distributions

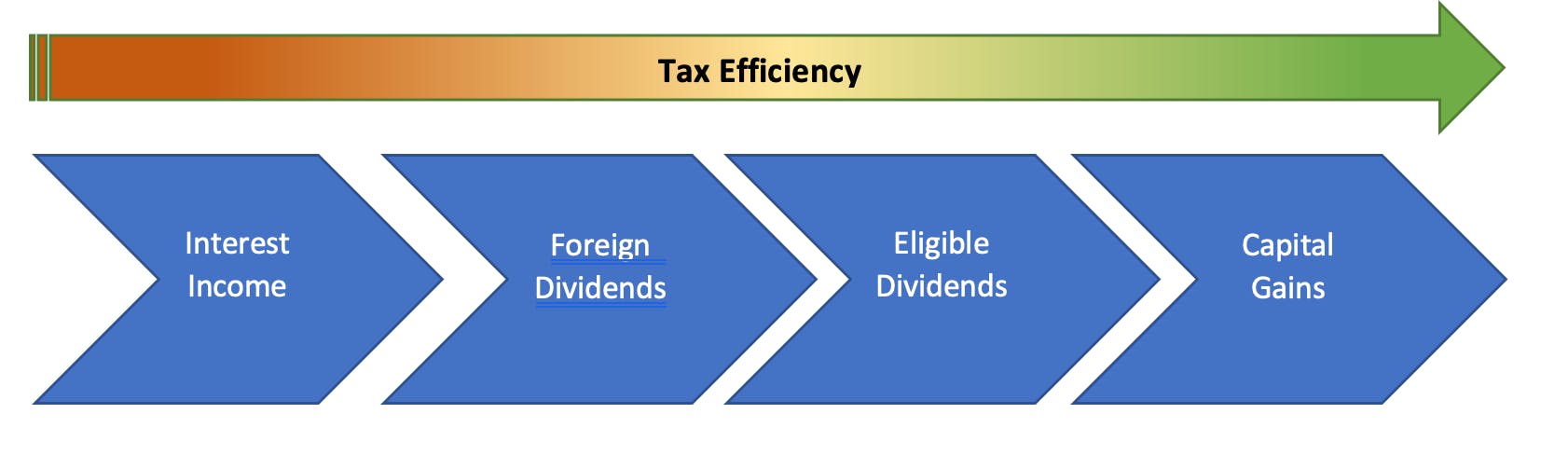

Although not all, some ETFs pay distributions based on their underlying holdings or strategies. The composition of these distributions can make a huge difference come tax time if held in a taxable account, as some types of income are taxed more favorably than others.

As a reminder:

Based on the classification above, bond ETF distributions will likely be taxed at the most unfavorable rate, whereas a Canadian Dividend Index ETF will likely generate most of its income from eligible dividends which are taxed the most favorably.

Therefore, it would be best if investors were able to keep the majority of their bond ETFs in tax-sheltered accounts, to reduce their tax drag, whereas their dividend funds can be kept in a taxable account due to their preferential treatment.

Investors looking to get exposure to foreign equities that will likely pay dividends should consider holding them in an RRSP rather than a TFSA or taxable account since they are able to bypass the 15% withholding tax on foreign dividends. The IRS recognizes the RRSP as a tax-free account and will not impose taxes on dividends earned.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.