Within the realm of investing, individuals are afforded the ability to choose a variety of avenues to grow their wealth. Among the investment strategies available, factor-based investing affords investors the ability to construct portfolios with a high degree of precision, reflecting market exposures they desire to have over a long investment time frame.

Investment factors summarized

Investment factors refer to specific characteristics of a stock or a group of stocks that have historically been associated with higher returns; with each factor having its own unique attributes that may appeal to different investment strategies or market conditions. Detailed below are the most cited investment factors that have shown themselves to be resilient across time, markets, asset classes, and have a strong economic rationale.

- Value: Value stocks are those that are believed to be undervalued by the market. Value investors look for stocks with low price-to-earnings ratios, low price-to-book ratios, and high dividend yields.

- Momentum: Momentum stocks are those that have shown strong price trends in the recent past. Momentum investors look for stocks that are outperforming the market, while reducing exposure to stocks that are underperforming.

- Size: Size refers to the market capitalization of a company. Investors focused on size lean towards smaller companies; though often considered riskier, their realized potential is more rewarding than investments in larger, more established companies.

- Quality: Quality refers to the financial health and stability of a company. Quality investors look for companies with strong balance sheets, stable earnings growth, and high returns on equity.

- Low Volatility: Volatility refers to the degree to which a stock's price tends to fluctuate over time. Investors who consider volatility look for stocks with lower levels of volatility, which may indicate a more stable investment.

A look at individual factor performance

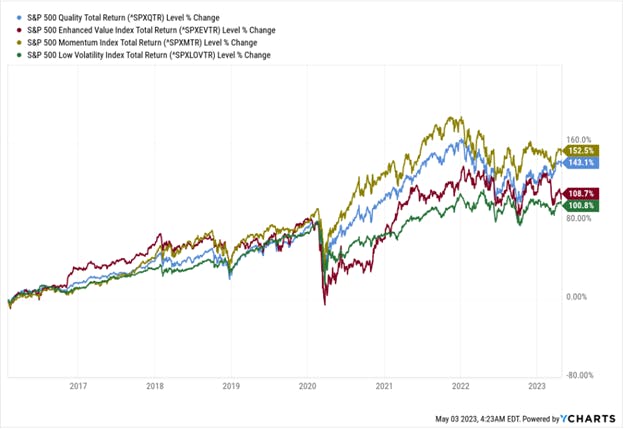

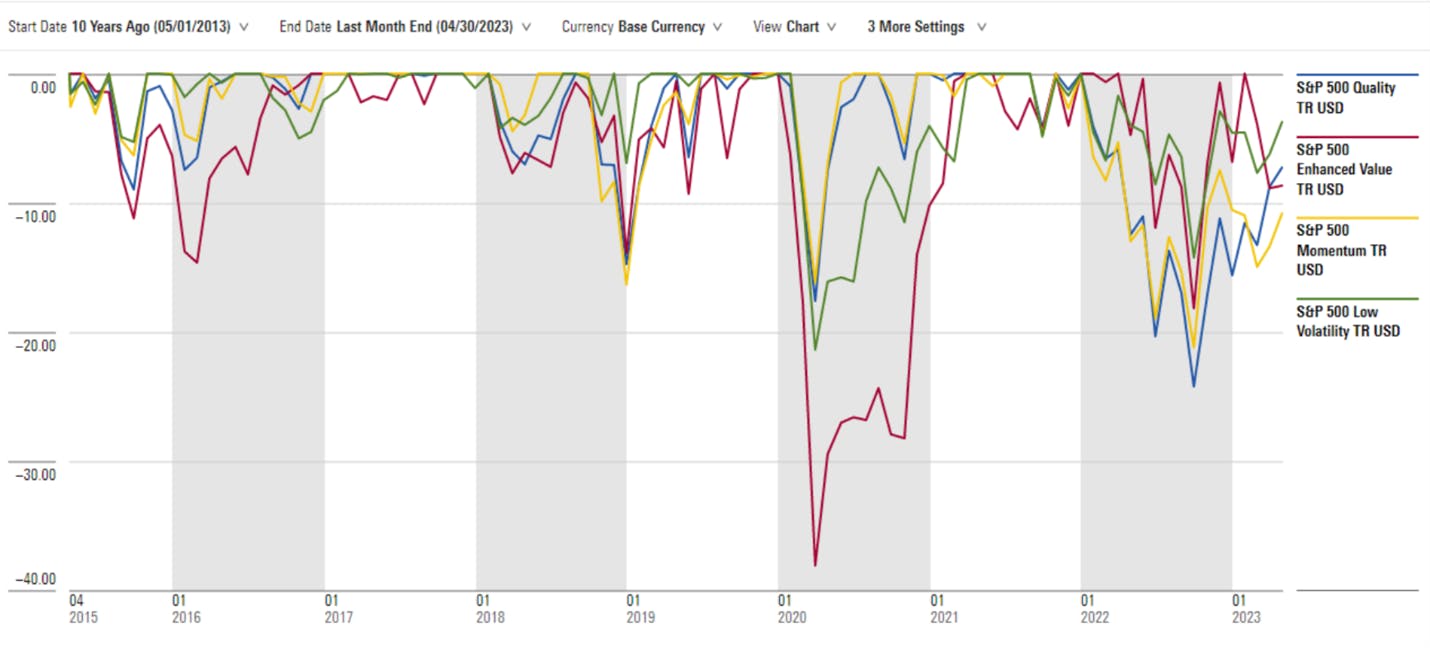

Though single factor investment strategies, such as the abovementioned, will reward investors over the long-term, individually they each are susceptible to unique cyclical drawdowns. In examining the index data available for these investment factors, over the past decade, there have been notable drawdown periods for each factor; even as their long-term performance has been exceedingly positive.

The multi-factor value proposition

One of the core tenets of investing is diversification, and while it is often spoken about in relation to multi-asset (class) investing; it is equally applicable in the arena of multi-factor investing. Similar to how combing different asset classes, each with their own risk-return profile, can lead to portfolios that optimize return and minimize risk – combining established investment factors can result in a diversified portfolio capable of providing more stable excess returns.

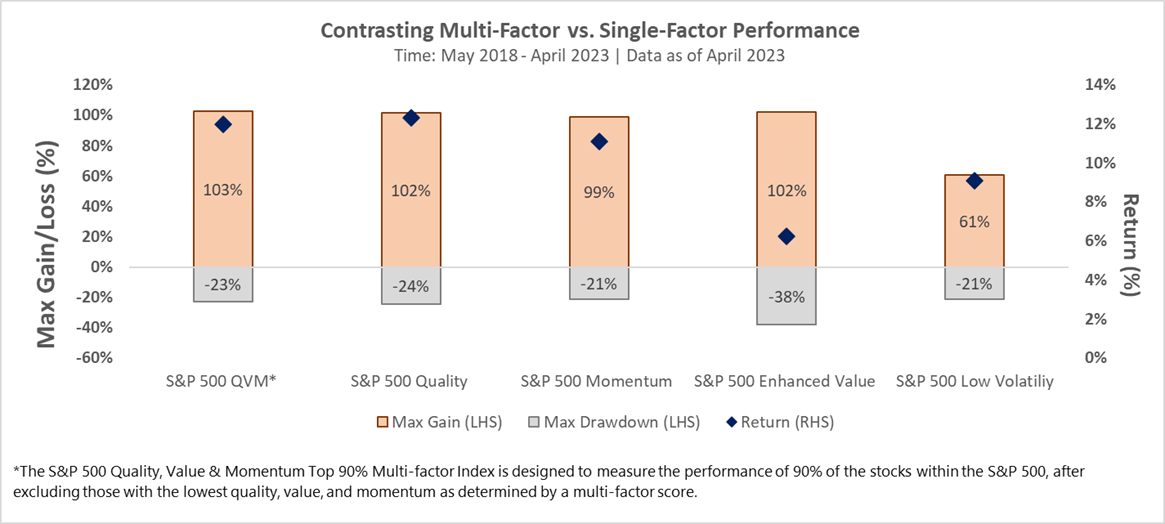

In contrasting the performance of the S&P 500 Quality, Value & Momentum (QVM) Multi-Factor Index against single-factor indices, we can highlight the benefits of a multi-factor investing approach. By using Max Gain and Max Drawdown investment metrics we are able to gain some insight, as they look at the peak-to-trough performance of an investment during a specified record period, with the former focusing on incline periods and the latter on decline periods. As observed from the chart, the historical drawdown of the multi-factor portfolio is in line with a majority of the group, the Enhanced Value index, being an exception. However, from a Max Gain perspective, the multi-factor index has exhibited the best performance of the group. Though the return performance of the QVM and Quality Index are similar, 12.0% and 12.3% respectively, the QVM index benefits from having exposure to the other investment factors – hence the marginally better max gain and max drawdown numbers, relative to the Quality Index. While the performance differential between the two indices is minimal, the embedded diversification present within the QVM index does have an outsized benefit.

For investors seeking broad exposure to the investment factors, multi-factor investment solutions are an avenue through which they can achieve said objective in a comprehensive fashion.

TSME: A solution capitalizing on Size, Quality & Sustainability

The Thrivent Small-Mid Cap ESG ETF (TSME) focuses on the small-to mid-cap equities space, investing in companies that have strong growth prospects and are in industries with a positive economic outlook. Based on the ETF’s top line description, the investment factors of Size and Quality are most inherent to the fund’s investment strategy.

Though the manager will use fundamental, quantitative, and technical investment research methodologies to determine what securities to purchase, the investment strategy will also integrate ESG policies and best practices to assess the viability and long-term sustainability of a firm’s business model. Based on the fund’s prospectus, the following ESG criteria will be used:

- Environmental Factors: Impact on climate change, natural resources, and waste management.

- Social Factors: Labor practices, supply chain management, workplace equality, diversity and inclusion, and supplier and vendor relationships.

- Governance Factors: Corporate governance practices, business ethics, board composition, executive compensation, and management incentives.

The use of a multi-factor investment approach and the integration of ESG principles into the fund’s investment strategy highlights the managers' commitment to building a solution that can derive alpha from different sources and identify potential risk exposures of both an imminent and existential nature. For investors seeking a multi-factor solution that also provides a strong ESG component, this fund is worthy of consideration.

This content was originally published by our partners at ETF Central.