‘If you’re a buysider and want access to the whole universe of IPOs, you should probably be participating in these SPACs’. – Todd Foley, managing director at MPM Capital

Special-purpose acquisition companies (SPACs) have gained traction recently. In 2020, U.S. SPACs raised record capital of USD83bn in the US. Halfway through 2021, the 2020 record had been eclipsed.

Investopedia defines SPAC or a ‘blank check company’ as a ‘company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company’. For more information on SPACs and how they operate, click SPACs were hot in 2020 and are hotter now!

The latest cohort of biotech SPACs

SPACs offer highly lucrative opportunities to sponsors and investors, enabling them to make significant amounts of money in most cases. Bill Ackman – the renowned hedge fund manager – raised USD4bn for an SPAC in July 2020, the most to date. Institutional investors, such as hedge funds, mutual funds or investment advisors, have for long invested in SPACs. However, unlike the SPACs of previous decades, the latest cohort of SPACs is backed by blue chip specialist investors, particularly in the biotech space. The show is not run by SPAC specialists, but by the cream-of-the-crop biotech specialists – Casdin Capital, Deerfield, RTW Investments, RA Capital, Bain Capital, Foresite Capital, Vedanta Management, EcoR1 and other top-tier investors.

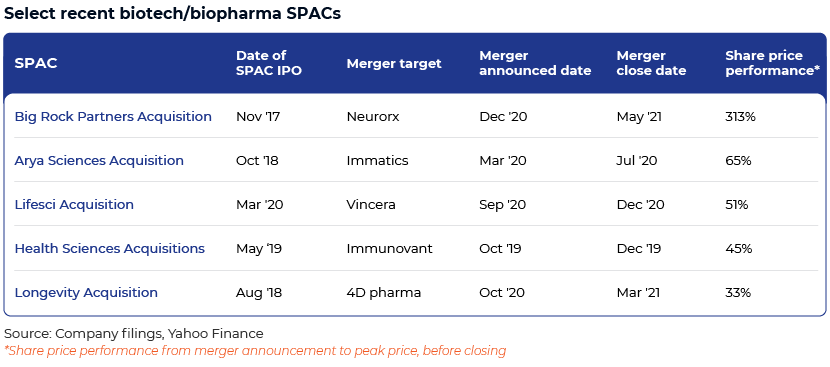

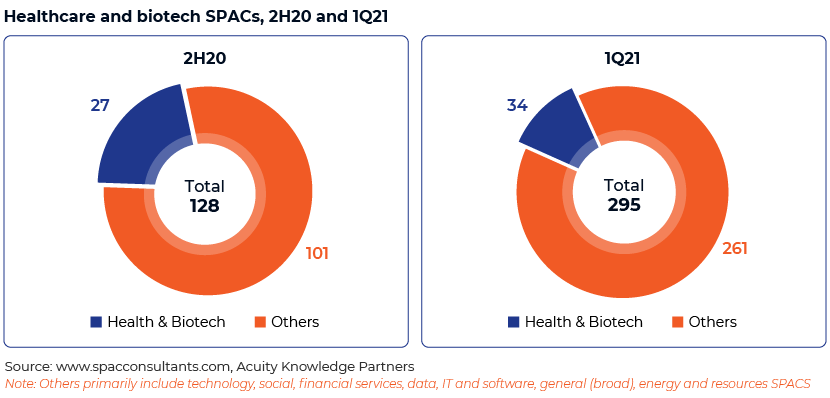

In recent years, biotech/biopharma SPACs have notched up impressive results. A select few are listed above. In 2H20, 27 of the 128 SPACs belonged to the healthcare and biotech space (21.1% share globally). In 1Q21, the share was 11.53% (34 of 295 SPACs).

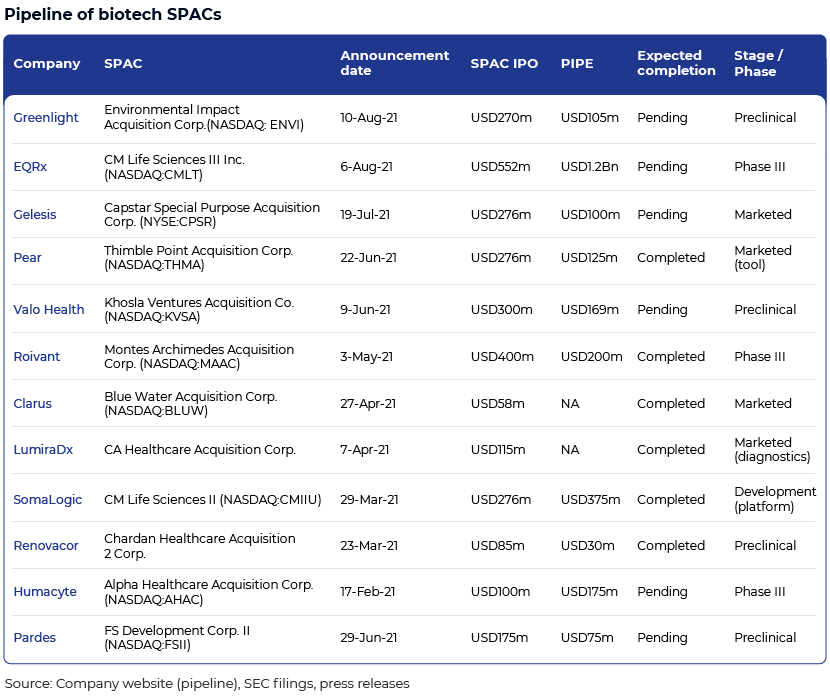

The US IPO momentum in the biopharma space slowed in 2Q21, compared to 1Q21, with lower aggregate deal value and deal volume. Nonetheless, it was healthy by historical standards. Although the SPAC IPO boom in 1Q21 lost steam in 2Q in the light of the SEC’s accounting guidance introduced at the start of the quarter and other headwinds to new SPAC offerings, it seems to be gaining momentum. The S&P 500 Biotechnology Index recovered from its tumble in 1Q, gaining c.6.0% YTD as of 12 December 2021 and touching a high of 17.3% YTD as of 9 August 2021. More than 20 biotech companies have announced plans to go public via the SPAC route this year. A robust pipeline of biotech SPACs, some of which have listed, is provided in the table below.

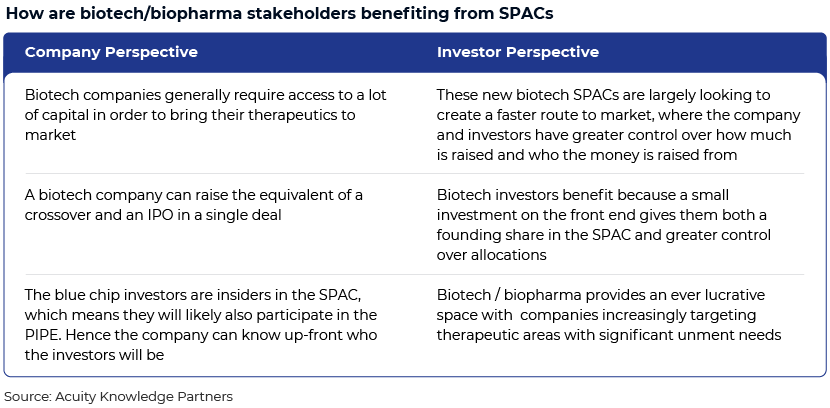

Why is the SPAC space so hot and how are biotech/biopharma stakeholders benefiting from it?

SPAC deals are a lucrative alternative to traditional IPOs from companies’ and investors’ perspectives. EcoR1 Capital’s founder, Oleg Nodelman, stated, ‘For all parties it is hyper-efficient. We were able to accomplish in about one and a half months what would have taken arguably 12-24 months’. SPACs achieve this by coupling crossover and IPO financings into a single deal. An SPAC IPO raise takes the place of the crossover round and when a merger is announced, typically a concurrent PIPE is proposed, which raises additional capital, taking the place of the traditional IPO round. Among recent classic examples, RA Capital invested c.USD4.4m in Therapeutics Acquisition Corp (in 2020), which raised USD118m. RA owned c.20% stake prior to acquiring a target. Similarly, Casdin Capital helped create CM Life Sciences by investing c.USD10m; it owns 20% after raising USD385m in proceeds. They both translate into greater than 6x paper returns prior to acquiring the target company.

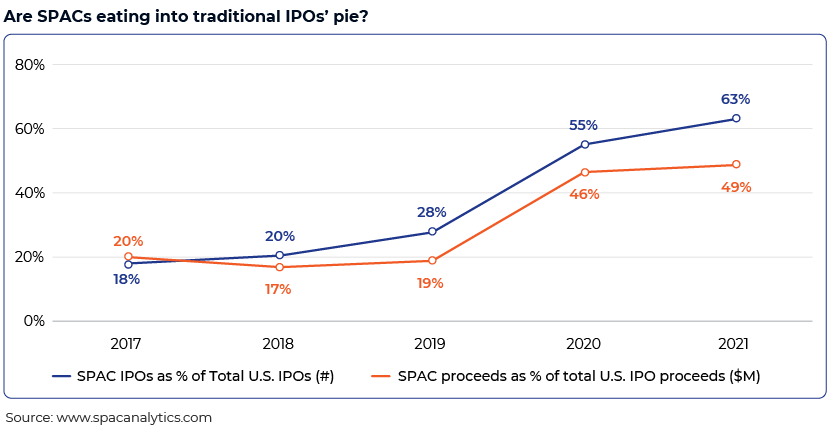

Are SPACs eating into traditional IPOs’ pie?

If numbers are an indication, we will likely witness a steady transition from traditional IPOs to SPACs over the next few years. We conclude that traditional IPOs may not be completely replaced by SPACs, but SPACs will likely gain share at the expense of traditional IPOs.

Conclusion: implications of SPAC boom

SPACs are competing for deals in a scorching hot biotech IPO market. The prolific biotech IPO market was robust in 2020. However, venture-backed private companies, particularly in the biotech and biopharma sectors, are increasingly considering the SPAC route as an attractive alternative to go public. Across all sectors, SPACs used to have a low share in the IPO market, but they currently account for more than one-third of all IPOs, according to NASDAQ. Considering the current race for private biotechs to go public, SPACs seem to far outweigh traditional IPOs. The extended time frame of a typical IPO process, resulting dilution of investors’ stakes in an IPO and many other shortcomings of traditional IPO provide enough reasons for them to be largely replaced by SPACs in the not so distant future. In addition to the benefits of listing via SPACs, SPACs are no longer considered ‘dirty financing’. They are being supported by some of the best biotech investors. Backed by an impressive pipeline of biotech SPACs for 2021, this trend is here to grow. However, the market needs to consummate these deals and go through transactions, while newly merged entities should yield impressive and competitive returns to demonstrate that they work, in order to be successful for the trend to be sustainable and durable. Moreover, recently, there has been heightened scrutiny from the SEC around SPACs as an asset class, with the regulatory body raising red flags on potential risks of investing in SPACs. The SEC’s guidance suggested warrants issued by SPACs to early investors may be considered liabilities, rather than equity instruments, for accounting purposes. The need for restatement filings has slowed the pace of SPAC listings; however, the right deals still contain immense upside potential.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI