The asset class to be in throughout 2022 was the almighty U.S. dollar (USD). As interest rates rose steadily, investors flocked to the safety of the USD, sending its price skyrocketing.

A year ago on February 3rd, 2022, $1.00 USD was worth $1.27 CAD. As of February 2, 2023 it's worth around $1.34, having hit a peak of $1.39 on October 14th, 2022.

With the USD at historical highs, Canadian investors holding Canadian denominated ETFs with underlying U.S. assets may be nervous about their future returns. For those with non-currency hedged ETFs, a fall in the USD / surge in the CAD could negatively impact their returns.

The alternative is currency hedged ETFs, which attempt to mitigate the impacts of fluctuations in the USD-CAD pair. These ETFs were unpopular when the USD was surging, but are now gaining attention. Here's what you need to know before you consider swapping ETFs.

How currency fluctuations affect unhedged ETFs

We'll use the popular Vanguard S&P 500 Index ETF (VFV) as an example for today's article. This ETF tracks the returns of the S&P 500 index in CAD by holding its USD denominated counterpart, VOO.

Because VFV's underlying asset, VOO trades in USD, it adds another source of risk and returns we need to account for. In a nutshell, the relationship can be summed up as:

- USD appreciates against CAD: VFV will gain additional value.

- CAD appreciates against USD: VFV will lose additional value.

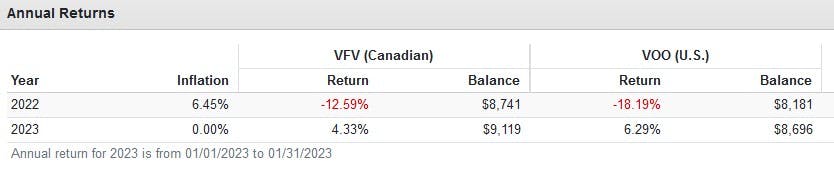

To sum it up, unhedged ETFs like VFV will outperform when the USD is strong, and underperform when it is weak. We can see this in action throughout 2022, where VFV lost less than its USD denominated counterpart, VOO thanks to the surging USD. So far in 2023, the opposite has happened, with VFV lagging VOO due to the CAD surging.

How currency fluctuations affect hedged ETFs

Currency hedged ETFs attempt to isolate and remove the impacts of currency fluctuations by using forward derivatives. For example, the Vanguard S&P 500 Index ETF (CAD-Hedged) (VSP) attempts to track the returns of the S&P 500 index without any currency risk.

Regardless of which direction the USD/CAD pair goes, VSP's return will be limited to the actual returns of the S&P 500 index. ETFs like VSP won’t benefit when the USD surges, but they won’t suffer when the USD depreciates either.

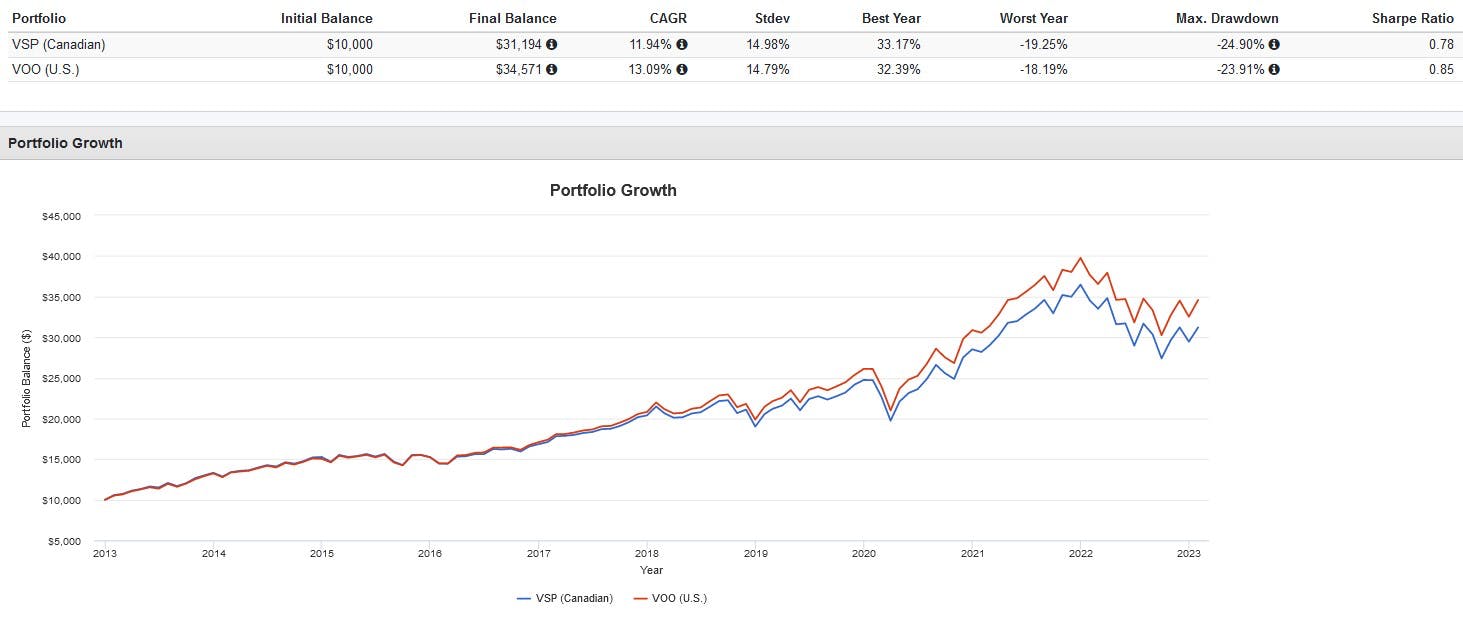

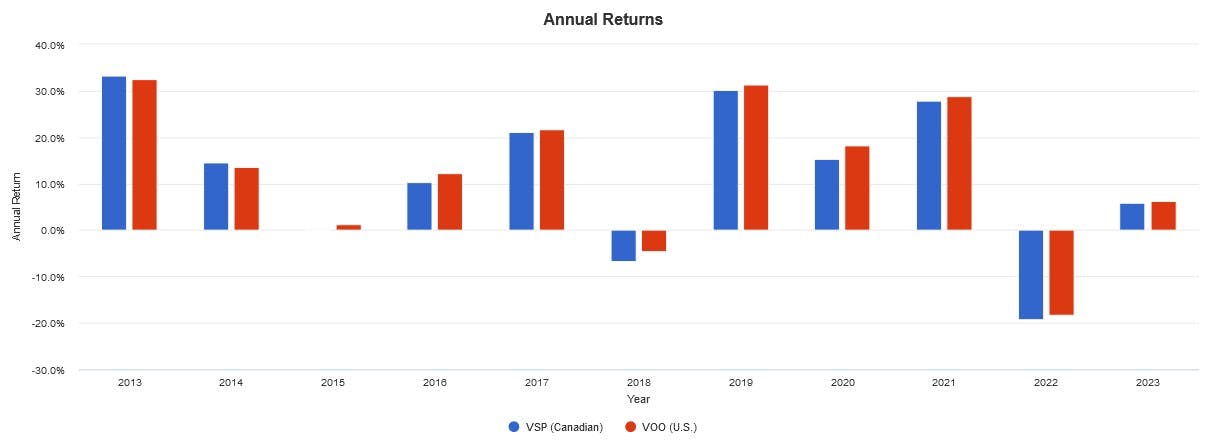

There is a catch though – tracking error. Currency hedging is costly, and using forward contracts isn’t a precise science. This is why since its inception, VSP has chronically underperformed its USD counterpart VOO. If the currency hedging process was perfect, this wouldn't occur.

Which one to pick in 2023?

Given that the USD had a strong year in 2022, but is starting to decline in 2022, many Canadian investors may be tempted to switch to currency hedged ETFs.

Personally, I dislike this approach because it is just another form of market-timing. By flip-flopping back and forth between currency unhedged and hedged ETFs, investors are consciously trying to predict foreign exchange movements and time their ETF selection.

If you can predict foreign exchange movements reliably enough to make the right choice, then you might as well go trade currencies. For those looking to invest long-term in a hands-off manner, this approach represents a complete departure from what should be done.

Moreover, history suggests that over long periods of time (1983 to present as seen below), the USD/CAD relationship goes through cycles, seeking peaks and valleys. Investors with a long-term time horizon of say, 20 years or more can simply opt to stay the course and let things average out.

Given that its difficult to predict short-term currency movements, long-term exchange rates tend to average out, and currency hedging causes a drag on returns, most long-term, risk tolerant investors may be better served with an unhedged ETF.

There is an exception. Older investors who wish to minimize volatility can consider currency hedged ETFs. These investors do not have the luxury of waiting for exchange rates to revert back to the mean. For them, currency hedged ETFs can ensure additional peace of mind.

This content was originally published by our partners at the Canadian ETF Marketplace.