- The week ahead is expected to be the biggest of the year for the stock market.

- U.S. voters head to the polls on Tuesday to pick their next president with the race between Republican Donald Trump and Democrat Kamala Harris too close to call.

- Two days later, the Federal Reserve will announce its November rate decision amid expectations for a 0.25% rate cut.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

The upcoming week promises to be one of the most pivotal of the year for U.S. markets, with two major events poised to shape the economic landscape: the U.S. presidential election on Tuesday, followed closely by the Federal Reserve’s November policy decision on Thursday.

Both events carry substantial implications for the stock market, and investors should be prepared for potential volatility. Here's all you need to know about the week ahead.

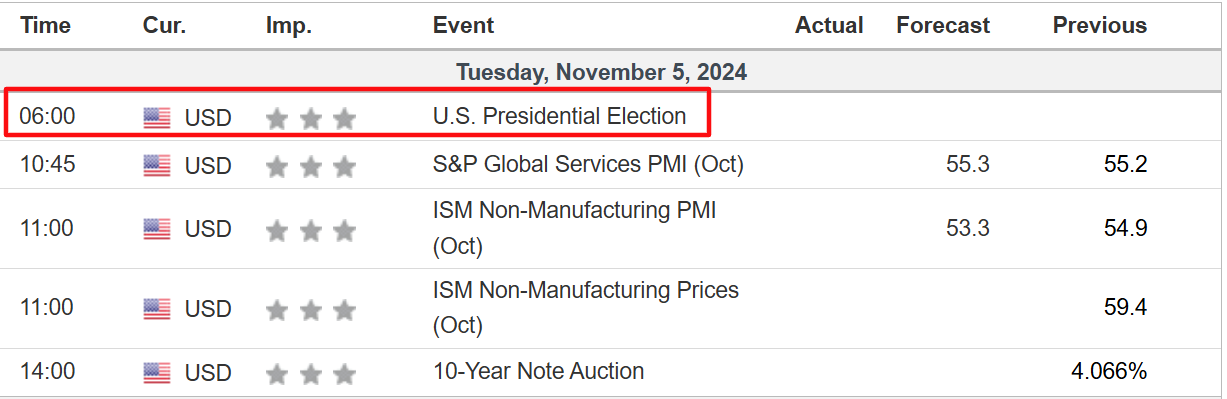

U.S. Presidential Election – Tuesday (All Day)

Tuesday’s presidential election could have dramatic effects on various stocks and sectors, as we’ve already witnessed in the weeks leading up to the big day.

Polls open on Tuesday morning, but already nearly 60 million voters have cast early ballots. The first exit polls, which are a projection, are expected to come out Tuesday night at around 7:00 PM ET.

Source: Investing.com

Results will be declared state by state, with most of the focus on the key battleground states, such as Pennsylvania, Michigan, Wisconsin, Georgia, North Carolina, Nevada, and Arizona.

If the outcome is clear, the major television networks are then expected to make their official call at 11:00 PM ET.

The latest polls show a narrow national lead for Vice President Kamala Harris over Donald Trump, with Harris polling around 1.4% ahead.

Despite this slim margin, several key swing states are leaning slightly toward Trump, which could impact the final electoral outcome.

The biggest fear for markets is for Wednesday to arrive with the election still in doubt and the vote too close or contested. That would likely lead to uncertainty and turbulence for markets in the near term.

However, if there is a clear outcome and a quick concession by the loser, we could then see an election night relief rally, similar to the one we saw in 2016, regardless of who the winner is.

Recent gains in the dollar, Treasury yields, and Bitcoin are seen by some traders as the market anticipating a win for Trump.

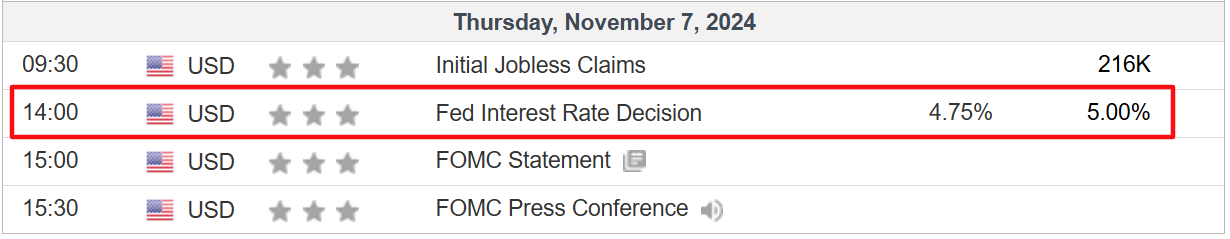

Fed FOMC Meeting – Thursday: 2:00 PM ET

Just two days after the election, the Federal Reserve will announce its November policy decision, adding further complexity to an already charged week.

Source: Investing.com

As of Friday morning, traders see a 93% chance of the FOMC cutting rates by 25 basis points, according to Investing.com’s Fed Monitor Tool.

The U.S. central bank kicked off the current easing cycle with a jumbo-sized 50-basis point rate cut in September.

While the Fed has been relatively dovish this year, rising inflation pressures and a recent batch of stronger-than-expected economic data have fueled speculation about the future pace of easing.

The FOMC is not publishing updated ‘dot-plot’ economic forecasts, and so any changes in the Fed's tone or policy outlook could have significant implications for the stock market.

Fed Chair Jerome Powell’s post-meeting commentary will be critical. Markets will be watching closely for signs of how the Fed plans to manage inflation while supporting the economy through any potential post-election volatility.

If the Fed signals a continuation of its supportive monetary policy stance, it could buoy risk assets, but a more hawkish tone might trigger some investor caution.

How Investors Should Prepare for the Week Ahead

With uncertainty looming over the election results and the Fed’s policy outlook, investors should approach the week with caution and a well-thought-out strategy. Here are some tips:

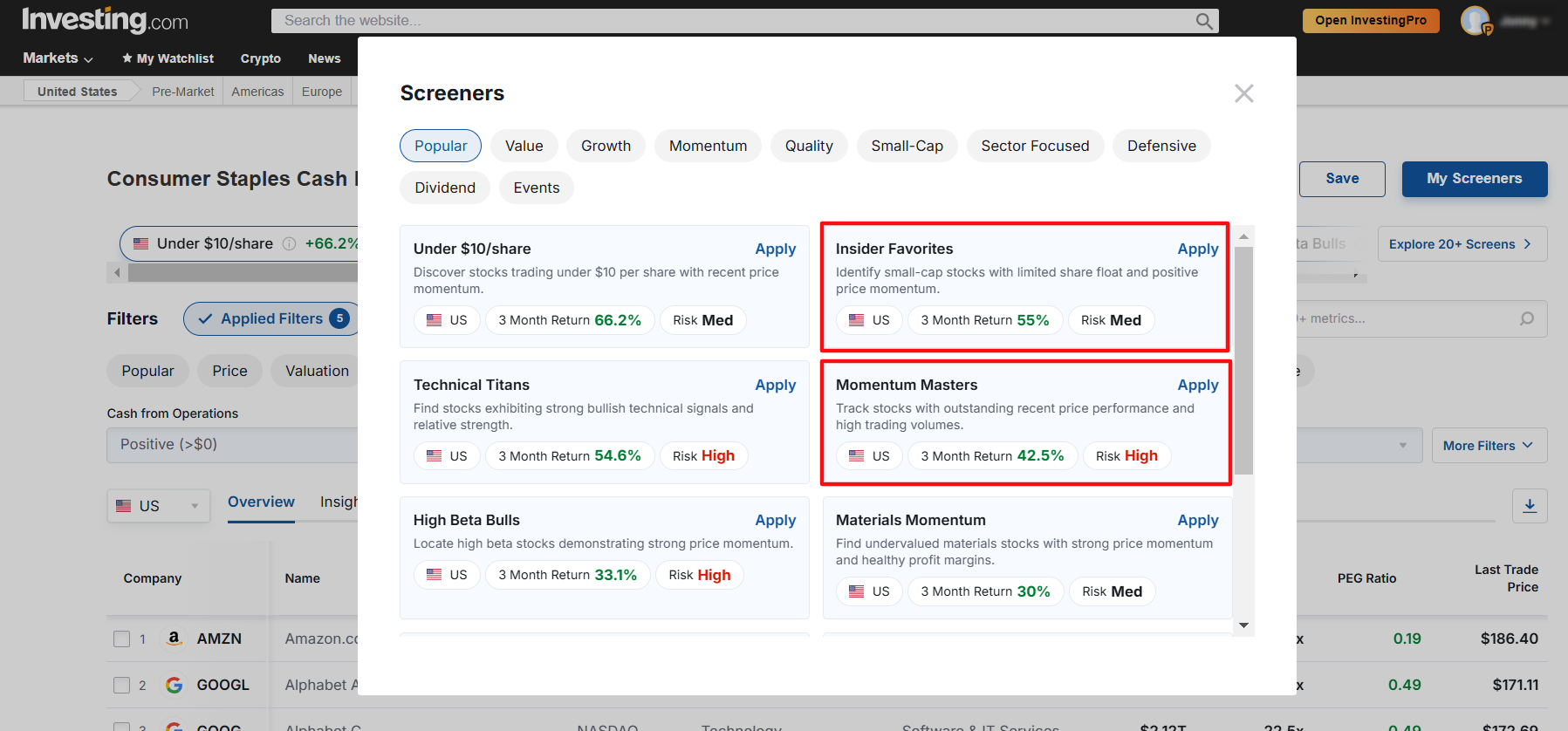

- Diversify for Stability: Holding a balanced mix of assets can help protect portfolios from election-related swings. Diversifying into defensive sectors like consumer staples, healthcare, and utilities can provide stability if market sentiment sours, while growth stocks and other risk-sensitive assets might capitalize on any post-election relief rally.

The Investing.com Pre-Set Stock Screeners offer a convenient way to identify promising stocks tailored to the current market backdrop.

Source: Investing.com

Noteworthy screeners include Low Volatility Leaders, Consumer Staples Cash Kings, Insider Favorites, Momentum Masters, and Growth Rockets, each offering unique insights to strengthen your strategy.

- Watch the VIX for Clues on Volatility: The VIX, often referred to as Wall Street’s ‘fear index’, could be a useful gauge of investor sentiment as the week progresses. Elevated VIX levels typically signal a more cautious, uncertain market.

Source: Investing.com

Higher VIX readings before the election might indicate hedging activity as investors brace for potential turmoil.

- Hold Some Cash for Opportunity: Volatile weeks often present buying opportunities in fundamentally sound stocks that may become temporarily oversold. Investors with cash on hand can be well-positioned to take advantage of these moments if the market reacts strongly to either event.

Final Thoughts

The upcoming week offers both opportunity and risk, with significant events that could shape market sentiment well into next year.

While a decisive election outcome and steady Fed policy could pave the way for a year-end rally, investors should be prepared for a bumpy ride.

By diversifying, keeping an eye on key indicators like the VIX, and staying nimble, investors can navigate this wild week with resilience and flexibility.

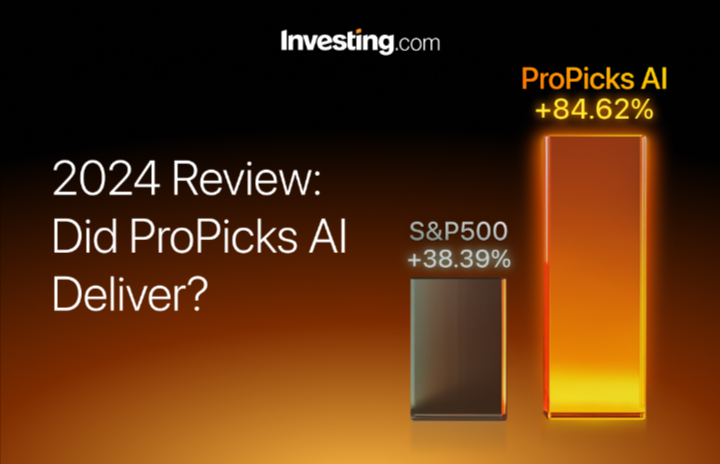

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

- Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.