The age-old debate of value versus growth still rages on today. While growth outperformed over the last decade and value saw a resurgence in 2022, there's no telling what 2023 will bring.

Most investors opt to "split the difference" by buying total market ETFs with a blended approach. That is, growth and value stocks in these ETFs are weighted according to their current market capitalizations.

For factor investors though, this approach can be suboptimal. Depending on your views for say, U.S. large-cap valueor U.S. large-cap growth, you may wish to overweight one for a shot at outperforming.

ETF issuers have taken note of this, and today there is no shortage of index, smart-beta, and actively managed ETFs on the market. Let's take a look at some of the notable ETFs for growth today.

A brief refresher on growth stocks

I covered growth stocks before in a previous article, but a quick summary here on their characteristics and historical performance in the context of the U.S. large-cap segment might help new readers understand their quirks.

In general, we can define a "large-cap U.S. growth stock" as one with:

- A market capitalization of $10 billion or higher.

- Higher earnings-per-share and revenue growth compared to sector peers.

- Higher price-to-earnings and price-to-sales ratios compared to sector peers.

To sum it up, investors can envision these companies as those expected to grow their earnings and revenues at an above-average rate. They often trade at elevated valuations as investors buy them to bank on expectations of continued growth.

Growth historical performance

Growth is the antithesis of value, and the two have historically undergone cycles of relative outperformance and underperformance. Younger investors may remember the growth stock outperformance of the last decade and think that on the whole, growth wins.

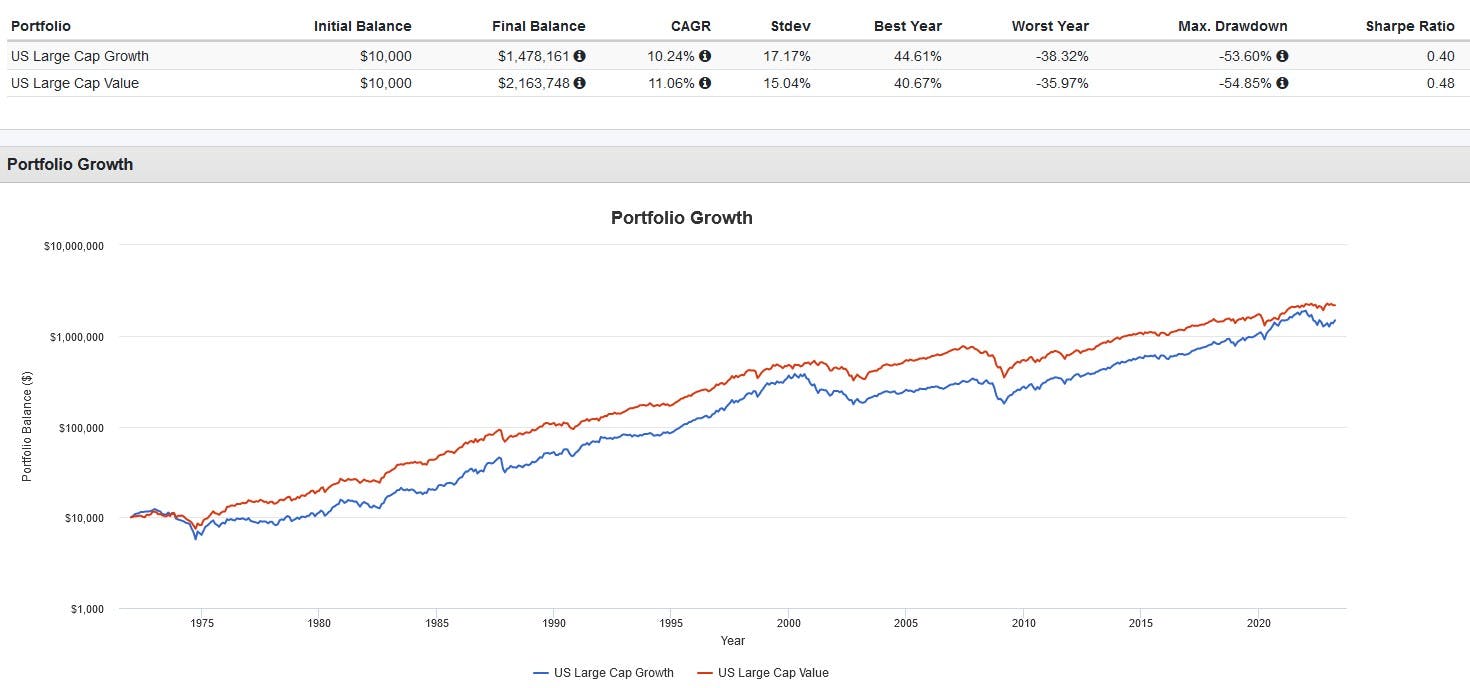

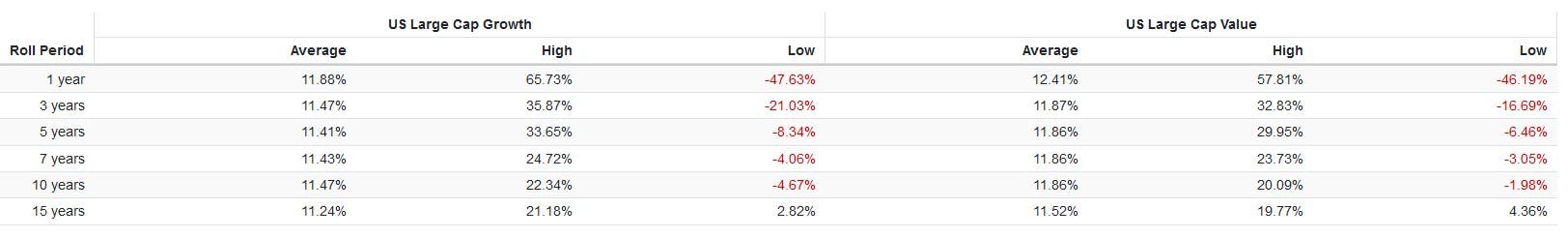

The opposite is actually true. While growth stocks tend to outperform dramatically during favorable economic conditions (including low interest rates), as a whole value has consistently outperformed on both a trailing and rolling return basis going all the way back to 1972.

I talked about this briefly in my article on the value risk premium. Long story short, the value risk factor plays an important role in explaining a portion of long-term stock market returns, alongside other Fama-French factors like size, investment, and profitability.

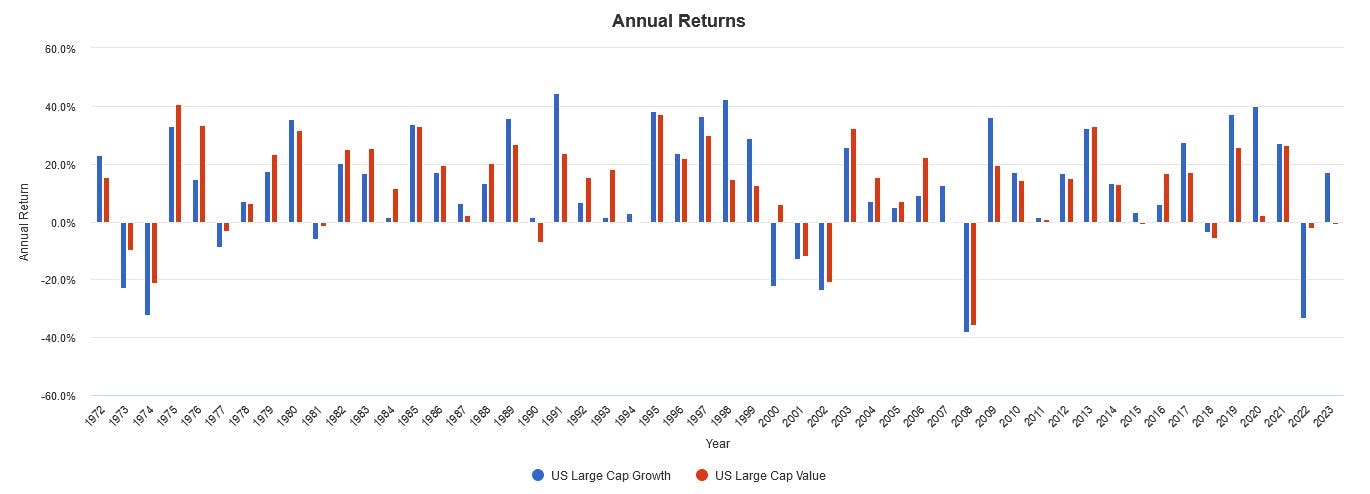

Still, that doesn't mean growth can't win sometimes. As seen in the chart of annual returns below, the value factor can return negative for extended periods of time, during which growth sees strong returns. Like many things in the market, it's all about timing.

Growth ETF options

The easiest way to pick a growth ETF is by checking its name, but I'm not a fan of this approach. Different ETFs will use varying strategies and methodologies to obtain growth exposure, with often disparate results. As always, checking the ETF's summary prospectus is a good idea.

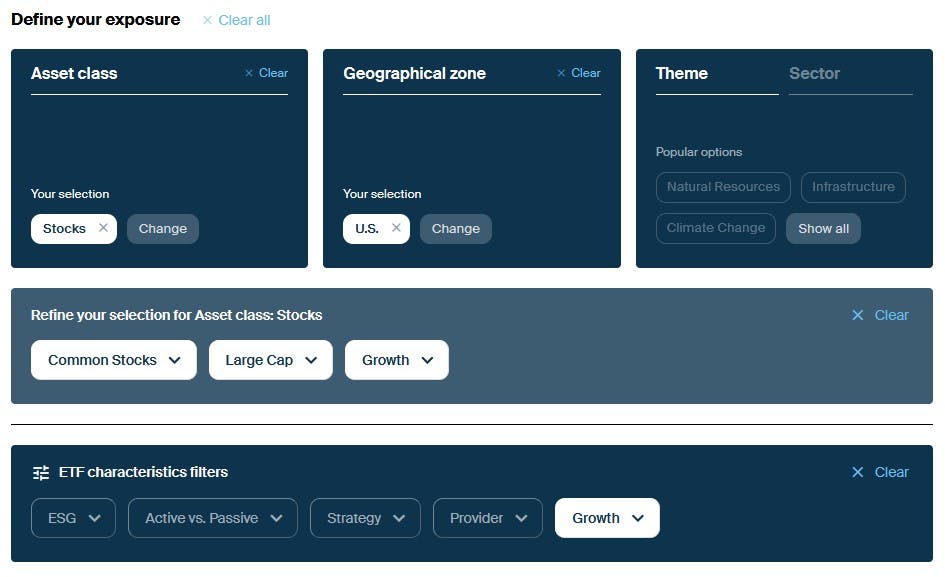

A better way in my opinion is to use the ETF Central Screener. Here's an example of the filters I would select to screen for large-cap U.S. growth ETFs:

From there, you can filter for active versus passive growth ETFs. Here's a brief explanation of each category and some possible picks for both:

1. Passive: These ETFs passively track a market index composed of large-cap growth stocks, such as the S&P 500 Growth Index or the Russell 1000 Growth Index. Passive growth ETFs aim to replicate the performance of the underlying index and typically have lower expense ratios and portfolio turnover.

Examples of popular passively managed U.S. large-cap growth ETFs include the Vanguard Growth ETF (VUG), the iShares S&P 500 Growth ETF (IVW), and the Schwab U.S. Large-Cap Growth ETF (SCHG).

2. Active: These ETFs are managed by professional portfolio managers who select and adjust the ETF's holdings based on their proprietary research, analysis, and investment strategies. Their goal is to outperform a benchmark growth index. These ETFs generally have higher expense ratios and portfolio turnover due to their active nature.

Examples of actively managed U.S. large-cap growth ETFs include the JPMorgan (NYSE:JPM) Active Growth ETF (JGRO) and the Hartford Large Cap Growth ETF (HGRO). I covered JGRO's value-oriented counterpart, the JPMorgan Active Value ETF (JAVA) in a previous article, so give that a read if you're interested.

This content was originally published by our partners at ETF Central.