For the month of May 2023, the US Debt Ceiling and Artificial Intelligence filled the public discourse and materially influenced the sectors that exhibited strong performance. The ETF segments that had the greatest net fund flows were US Large Cap ($12.70 bn), US Government Bonds ($12.03 bn), US Information Technology Sector ($9.42 bn), US Aggregate Bonds ($4.83 bn), and Structured Products ($3.41 bn).

A look at each Segment and ETF Flows

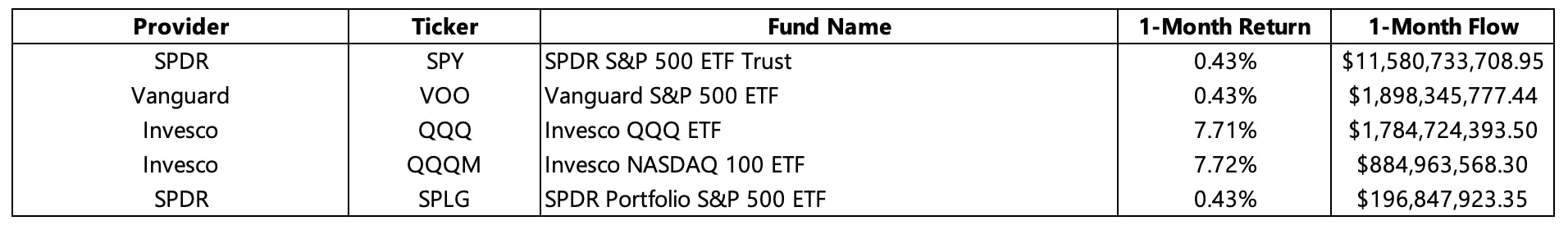

US Large Cap

Despite the issues that have plagued markets thus far in 2023, the performance of the S&P 500 index is markedly better than it was a year ago, at this same point in time. Year to date, the performance of the index has been 9.65%, leading many investors to invest in funds that track it. The SPDR S&P 500 ETF Trust (SPY (NYSE:SPY)) attracted the most flows with $11.58 billion. While also attracting sizable flows, the strong monthly performance of the Invesco QQQ ETF (QQQ) and Invesco NASDAQ 100 ETF (QQQM) is what differentiates these funds from their peers. The performance of these mandates can largely be attributed to the strong performance of their underlying holdings, the FANG+ companies - particularly NVIDIA (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO), which were among the best performing equities for the month.

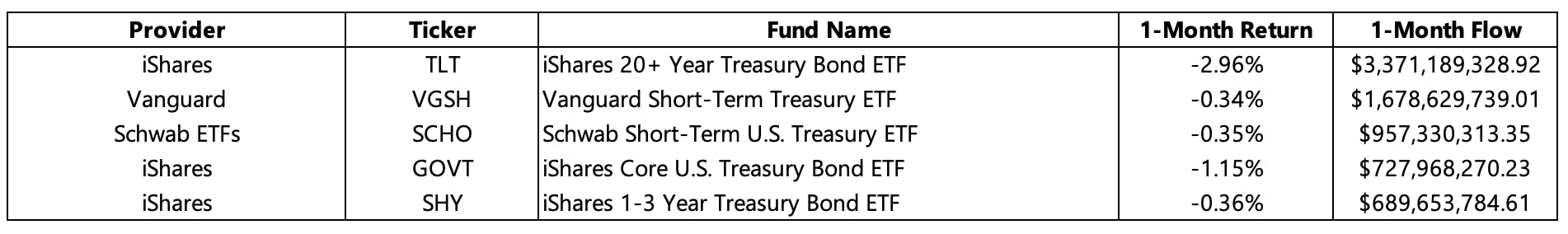

US Government Bonds

Against the backdrop of strong political posturing regarding the US debt ceiling, the bond market, particularly U.S. Treasury bonds, was adversely affected this month. In the weeks leading up to the eventual resolution, uncertainty as to whether the US government might risk defaulting on their debt was a real concern and was evident in the performance of fixed income ETFs. While all top five funds had a negative performance, the iShares 20+ Year Treasury Bond (NASDAQ:TLT) ETF (TLT) had the worst performance yet garnered the most flows. The performance of all short-term funds, namely Vanguard Short-Term Treasury ETF (VGSH), Schwab Short-Term U.S. Treasury (SCHO), and iShares 1-3 Treasury Bond ETF (SHY), were similar in nature.

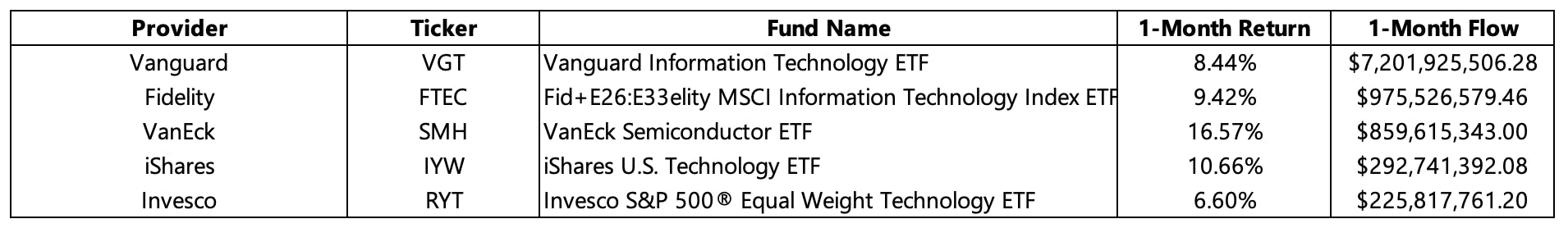

US Information Technology Sector

The technology sector has exhibited strong performance year to date, as the performance of ‘Big Tech’ has lifted the overall market. With Artificial Intelligence and all things associated with it gaining traction in the minds of investors, the semiconductor sector, and firms such as NVIDIA have become of great interest to the masses. As observed from the data, the VanEck Semiconductor ETF (SMH) performed exceedingly well for the month, due to its pure-play focus. The Vanguard Information Technology ETF (VGT) garnered the most flows for the month, but its overall performance was less than the Fidelity MSCI Information Technology Index ETF (FTEC) and iShares U.S. Technology ETF (IYW).

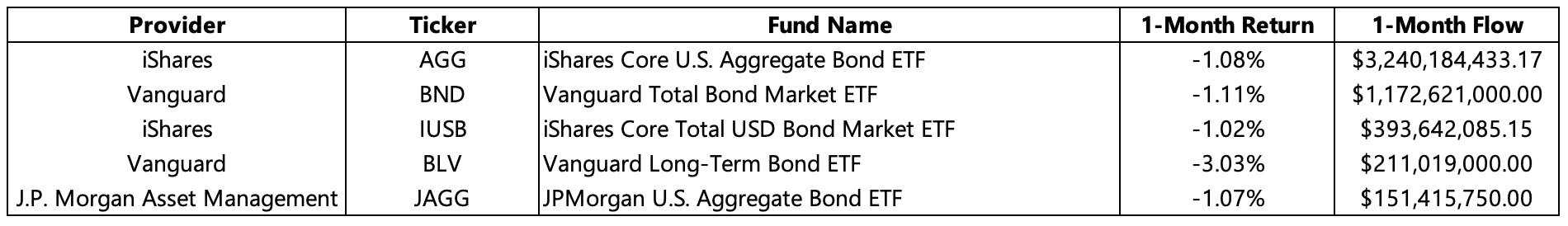

US Aggregate Bonds

As referenced earlier, the political posturing regarding the US debt ceiling negatively impacted the performance of fixed income solutions, nevertheless, flows into US Aggregate Bonds were still significant for the month. The iShares Core U.S. Aggregate Bond ETF (AGG) garnered the most fund flows, followed by the Vanguard Total Bond Market ETF (BND) and iShares Core Total USD Bond Market ETF (IUSB). Among the top five funds, performance was similar in nature, apart from the Vanguard Long-Term Bond ETF (BLV), which returned -3.03% for the month.

Structured Products

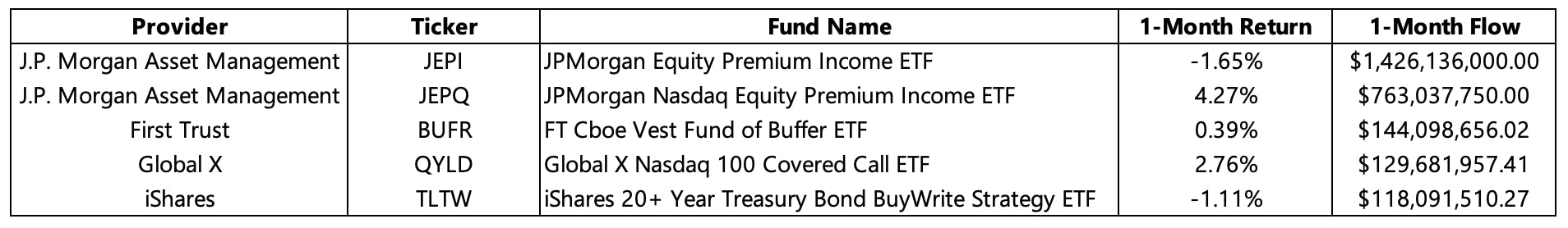

The occurrence of multiple bank failures and the discourse about whether the debt ceiling should be raised has elevated market uncertainty and led more investors to utilize structured products as a means of managing market volatility. The JP Morgan (NYSE:JPM) Equity Premium ETF (JEPI) garnered the majority of fund flows in this segment for the month, as it has become a top-of-mind solution for market risk mitigation by many investors. However, the JP Morgan Nasdaq Equity Premium Income ETF (JEPQ) continues to be a top performer; exhibiting a strong performance for the month – building on its positive performance in April 2023. The Global X Nasdaq 100 Covered Call ETF (QYLD) performed well for the month, returning 4.27% and garnering sizable fund flows.

This content was originally published by our partners at ETF Central.