The increased pace of U.S. interest rate hikes has elevated the yield-generation potential and expectations for most interest-bearing investments. For risk-averse investors or individuals focused on saving – now is truly an opportune time to consider investing in U.S. Treasury Bonds.

U.S. Treasuries: A look through time

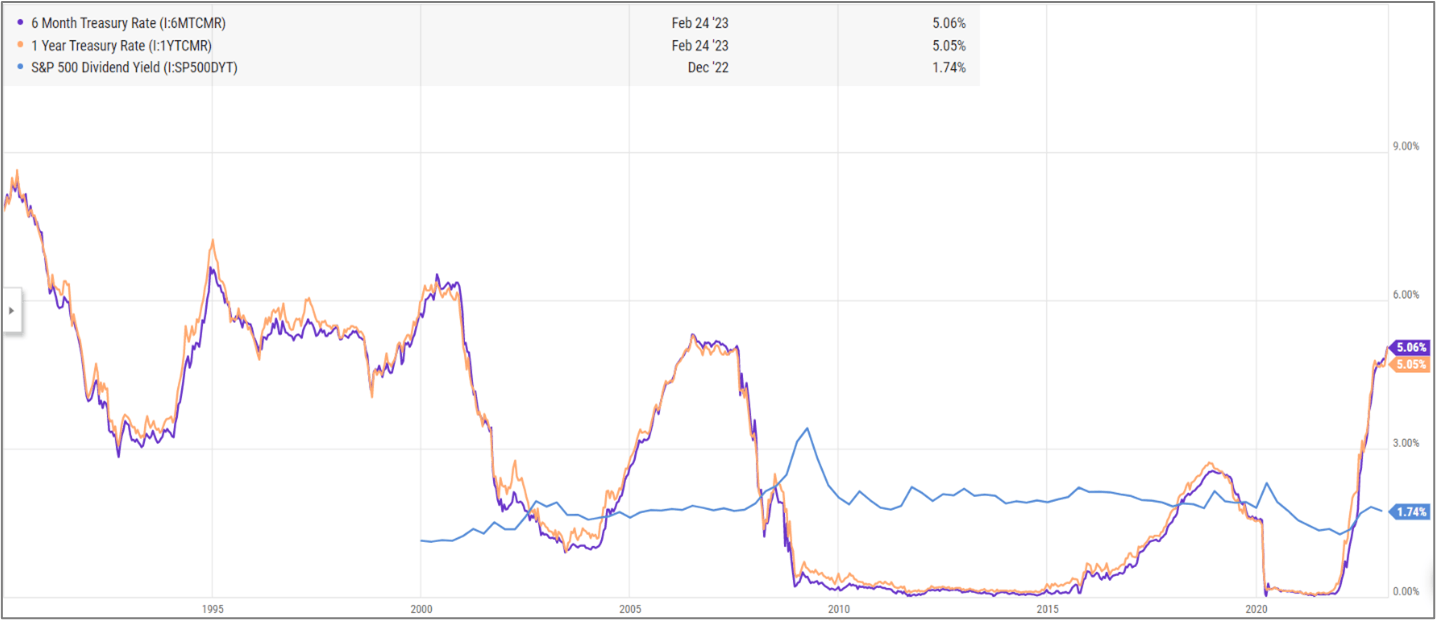

Presently, 6-month and 1-Year U.S. Treasuries are yielding approximately 5%, an occurrence that was last observed from 2006 to 2007. Furthermore, the yield of U.S. Treasuries is currently outpacing that of the S&P 500 Dividend Yield, truly highlighting the magnitude of return generation that is occurring now.

The opportunity cost of doing nothing

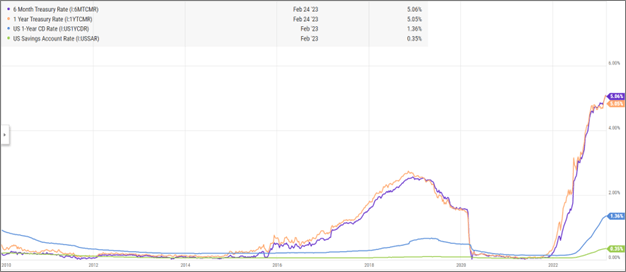

Because of the low-risk nature of U.S. Treasuries, one of the fairer instrument types to contrast them against is term deposits, such as a certificate of deposit. As observed from the following chart, the rate of return for a 1-year U.S. Treasury Bond is much greater than the yield guaranteed for a 1-year certificate of deposit and far more than anything one may receive from a U.S. savings account.

While it is also fair to acknowledge that treasury rates may change greatly over time, depending on the prevailing interest rate policy actions of the Federal Reserve – the opportunity cost of being ‘locked in’ to a low-yielding instrument for a prolonged period is much greater than the potential risk associated with changes in the interest rate environment. Simply put, because U.S. Treasuries are government-backed bonds, they provide a high degree of liquidity and optionality, relative to other low-risk investment offerings.

For risk-conscious investors, U.S. Treasuries currently provide them with the opportunity to safely invest and receive a reasonable rate of return relative to other savings instruments, such as a term deposit.

Investing in U.S. Treasuries

One of the easiest ways to invest in U.S. Treasures is through an ETF, as there is a wide selection of investment solutions that investors can choose from. In comparing the yield-generating capabilities of each ETF, the 30-Day SEC Yield is an easy reference point, as it reflects the interest earned after deducting the fund's expenses during the most recent 30-day period by the average investor in the fund. Below is a list of a few well-established U.S. Treasury ETFs worthy of consideration.

iShares 0-3Month Treasury ETF (SGOV)

The iShares 0-3 Month Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities less than or equal to three months.

- Expense Ratio: 0.12%

- 30-Day SEC Yield*: 4.43%

SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL)

The SPDR® Bloomberg 1-3 Month T-Bill ETF seeks to provide exposure to publicly issued U.S. Treasury Bills that have remaining maturities between one and three months.

- Expense Ratio: 0.1354%

- 30-Day SEC Yield*: 4.30%

iShares Short Treasury Bond ETF (SHV)

The iShares Short Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities of one year or less.

- Expense Ratio: 0.15%

- 30-Day SEC Yield*: 4.51%

iShares 1-3 Year Treasury Bond ETF (SHY)

The iShares 1-3 Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years.

- Expense Ratio: 0.15%

- 30-Day SEC Yield*: 4.58%

Vanguard Short-Term Treasury Index ETF (VGSH)

The Vanguard Short-Term Treasury Index ETF tracks a market-weighted index of fixed income securities issued by the U.S. Treasury, excluding inflation-protected securities, with maturities of one to three years.

- Expense Ratio: 0.04%

- 30-Day SEC Yield*: 4.66%

Schwab Short-Term U.S. Treasury ETF (SCHO)

The Schwab Short-Term U.S. Treasury ETF tracks a market-value-weighted index of debt issued by the U.S. Treasury, excluding STRIPS, with remaining maturities of between one and three years.

- Expense Ratio: 0.03%

- 30-Day SEC Yield*: 4.63%

*Data as of March 1st, 2023.

This content was originally published by our partners at ETF Central.