Canadian Current Account Deficit Shrinks in Third Quarter

The loonie was higher versus the USD after the Canadian current account balance posted a 16.2 billion deficit. The deficit shrank from last quarter’s 16.6 billion. The deficit was expected to improve after the CAD has depreciated against the USD in favour of the Canadian Trade balance. The flow of cross border investment was higher mining the effect of the weaker loonie on the current account. The Loonie has fallen 15.13 percent year to date versus the USD as monetary policy divergence expectation grows. Two rate cuts by the Bank of Canada and the anticipated rate hike from the Federal Reserve on December 16 have put downward pressure on the Canadian dollar as an even lower currency is needed to boost growth through exports.

The week in forex got off to a slow start on Monday after the U.S. Thanksgiving holiday last week shortened the number of trading days. The Bank of Canada, the European Central Bank (ECB) and the nonfarm payrolls will kickstart the week that is expected full of announcements that will guide the price of the CAD.

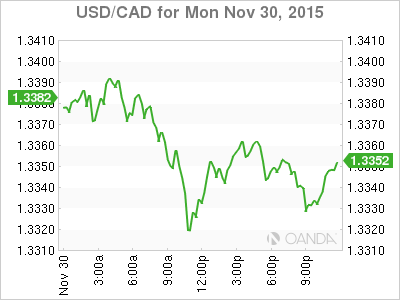

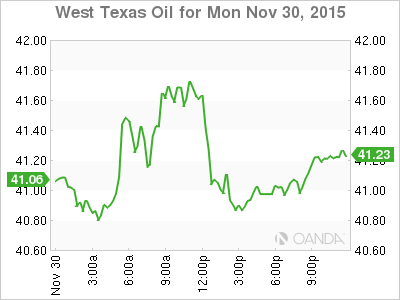

On Monday the USD/CAD depreciated by 0.148 percent as the Loonie managed to drop below the 1.40 price line and end up trading at 1.3352. The Loonie could not outrun the drop in price of oil that gave back all the gains from the asian trading session to finish below $41 for the spot price of West Texas crude.

News of Russia crude upping production to counter Saudi price discounts that have already lost Sweden as a client as well as the lower than forecasted drop in U.S. production are two of the factors putting pressure on the price of the black stuff. Friday’s Organization of the Petroleum Exporting Countries (OPEC) meeting in Vienna could bring a production cut, but non OPEC members are signalling they are content existing with production levels and show willingness to keep pumping at current rates.

Canadian data will be plentiful this week, with indicators such as the monthly GDP girl and employment data as well as an appearance by the Bank of Canada that will try to talk down the currency after the new government has warned the market to expect a bigger deficit after lower growth forecasts. The BOC is not expected to cut rates and will look for the Fed to finally realize the interest rate divergence that has been promised for so long. Since the Fed December rate hike has been priced for so long, a token rate hike of 25 basis points to the Fed Funds rate is not expected to have a deep impact on the CAD and at this juncture the price of oil could put more downward pressure.

CAD events to watch this week:

Tuesday, December 1

8:30 am CAD GDP m/m

Wednesday, December 2

10:00 am CAD BOC Rate Statement

Friday, December 4

8:30 am CAD Employment Change

8:30 am CAD Trade Balance

8:30 am USD Non-Farm Employment Change

8:30 am USD Trade Balance

10:00 am OIL OPEC Press Conference