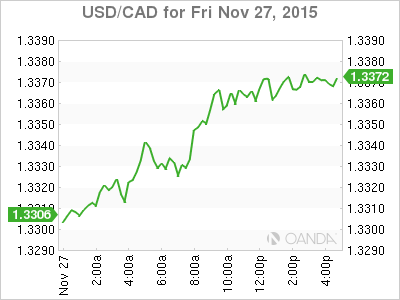

The USD/CAD appreciated 0.617 percent on Friday as the price of oil tumbled more than 3 percent following a stock market rout in China. The currency pair will finish the week trading at 1.3373. Canadian producer prices offered no support to the CAD after falling 0.5 percent on forecasts of a 0.1 percent contraction. Raw materials did not rise for Canadian manufacturers but the Industrial Product Price Index (IPPI) fall set the tone for the rest of the trading day.

In the aftermath of the U.S. Thanksgiving holiday there was reduced liquidity in the market. Next week will be filled with economic releases and Central Bank action. The main event for CAD traders will be the Bank of Canada economic policy statement. There is no rate change expected but investors will be looking for comments from BOC Governor Stephen Poloz around the state of the economy after dovish comments from the newly appointed Canadian Finance Minister.

OPEC Members to Ask Saudi Arabia for Production Cuts

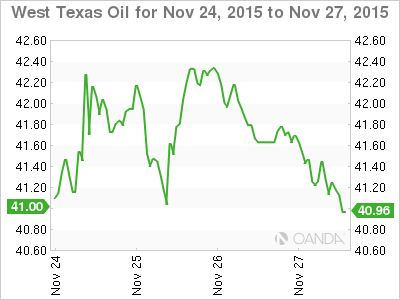

Oil continued to pile losses ahead of next week’s OPEC meeting. Crude tumbled more than 3 percent on Friday as Chinese worries about the economy and the oversupply of energy stocks around the world battered the price of the commodity.

OPEC members who depend on oil revenues to balance their budget have been hit hard by the drop in oil prices and have at different times request Saudi Arabia cut production goals for the organization with the intent to boost prices. The tactic has proven unsuccessful as Saudi Arabia continues to pump at record pace. The lower growth forecasts in China and the rest of the world have cut demand and with Iran about the come back online a more coordinated strategy to stabilize prices is needed.

Saudi Arabia has been content to grab as much market share as possible offering deep discounts to compete. It managed to pry Sweden away from Russia as a client based on this strategy, but even with the vast reserves of the middle east nation, it is questionable how long will this low price strategy will work before it ends up breaking the OPEC apart. For the time being energy importers are seeking storage as it seems a more scarce resource than the commodity itself.

Canadian dollar events to watch next week:

Wednesday, December 2

10:00 am CAD BOC Rate Statement

Friday, December 4

8:30 am CAD Employment Change

8:30 am CAD Trade Balance

8:30 am USD Non-Farm Employment Change

8:30 am USD Trade Balance

10:00 am OIL OPEC Press Conference