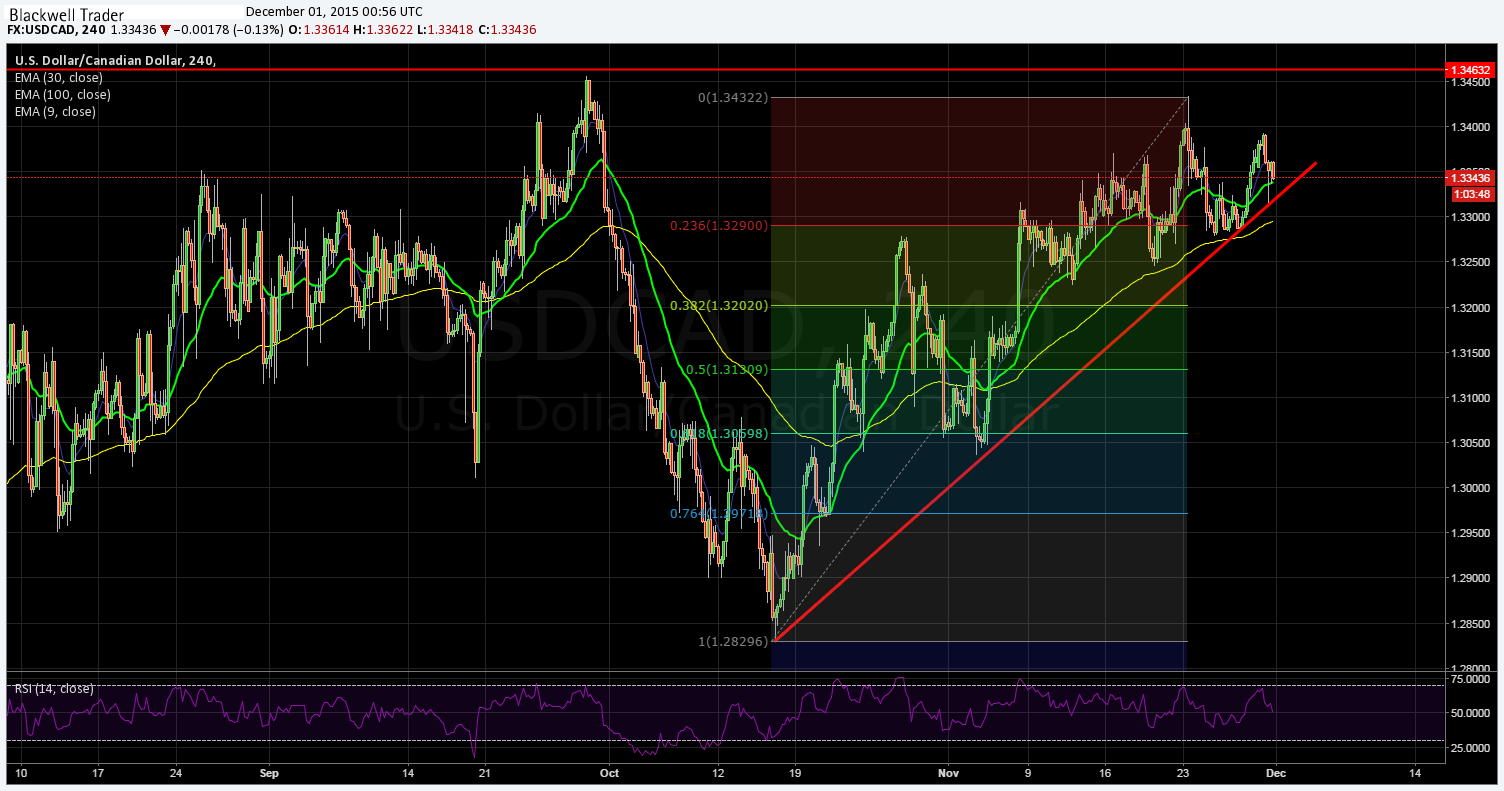

The USD/CAD continues to look buoyant as the pair remains supported by a strongly bullish trend line. However, last week saw the pair sliding back towards support and traders are now asking whether the pair faces a correction in the coming days.

The USD/CAD opened last week around 1.3355 and rose steadily before resistance at 1.3455 caused the drive to falter and the pair to subsequently pull back to around 1.3351. However, the supporting trend line is looming, which coincides with the 23.6% retracement level, and a continuation of the bull trend is therefore likely to resume in the coming days.

The CAD’s price action has continued putting higher highs and higher lows on the daily and weekly charts whilst it remains well above the 50 EMA. The RSI Oscillator also remains well entrenched within neutral territory indicating that there is plenty of room to move on the upside. The real obstacle for any long-side move remains resistance at 1.3456 which will need to be surmounted to cement a move higher.

However, December’s looming US Federal Reserve meeting on monetary policy is clearly impacting the pair given the recent swings in and out of sentiment for the US dollar. Subsequently, be very wary of any dovish tone from Fed Chair Janet Yellen in the lead-up to the FOMC meeting as it could be disastrous for the bulls.

Ultimately, the market truism of the trend is your friend clearly applies to the USD/CAD, and the bullish run is likely to persist for as long as the hawkish rhetoric surrounding a rate hike by the Fed continues.