USD/CAD has moved higher in the Tuesday session. In North American trade, the pair is trading slightly below the 1.35 line. On the release front, US PPI dipped to 0.3%, above the estimate of 0.1%. There are no Canadian releases until Thursday. Wednesday promises to be busy, with the US releasing CPI and retail sales reports. As well, the Federal Reserve is widely expected to raise the benchmark rate to 0.75 percent.

Canada continues to create jobs at an impressive clip, as the Canadian economy has taken advantage of a strong recovery south of the border. On Friday, Employment Change came in at 15.3 thousand. This was lower than the previous two readings, but easily beat the forecast of 0.6 thousand. The economy has created jobs for seven straight months, as the labor market continues to recover. The unemployment rate also improved, dropping from 6.8% to 6.6%. Still, these strong figures only tell part of the story. Wage growth remains soft and many of the recent job gains have been part-time positions. The Canadian dollar posted only modest gains on Friday, as upward movement was limited by a very strong Nonfarm Payrolls report in the US.

More job numbers out of the US, more good news for the economy. Nonfarm payrolls sparkled in February, as the indicator jumped to 235 thousand, easily beating the estimate of 196 thousand. Wage growth climbed 2.6% compared to February 2016, while the participation rate edged up to 63.0%, up from 62.9%. These numbers make it a virtual certainty that the Fed will raise rates by a quarter-point on Wednesday. Although a rate hike has been priced in by the markets at 93%, there have been disappointments in the past, so a rate move will likely give the dollar a boost against its major rivals, such as the euro. The solid job numbers also give President Trump a much-needed boost. Trump is under pressure to present an economic agenda, but the markets won’t mind giving him some additional breathing room with the economy performing well.

USD/CAD Fundamentals

Tuesday (March 14)

- 6:00 US NFIB Small Business Index. Estimate 106.1. Actual 105.3

- 8:30 US PPI. Estimate 0.1%. Actual 0.3%

- 8:30 US Core PPI. Estimate 0.2%. Actual 0.3%

Upcoming Key Events

Wednesday, March 15

- 8:30 US CPI. Estimate 0.0%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Core Retail Sales. Estimate 0.1%

- 8:30 US Retail Sales. Estimate 0.2%

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:00 US FOMC Press Conference

*All release times are GMT

*Key events are in bold

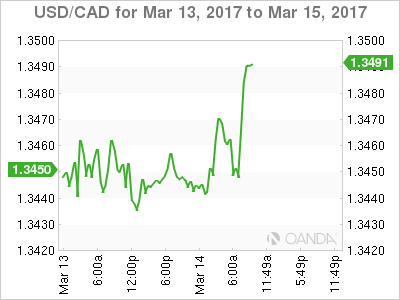

USD/CAD for Tuesday, March 14, 2017

USD/CAD March 14 at 8:45 EST

Open: 1.3451 High: 1.3491 Low: 1.3438 Close: 1.3481

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3253 | 1.3371 | 1.3461 | 1.3551 | 1.3672 | 1.3784 |

- USD/CAD was flat in the Asian session and has posted gains in European trade

- 1.3461 remains fluid and is currently a weak support level

- 1.3551 is the next resistance line

Further levels in both directions:

- Below: 1.3461, 1.3371, 1.3253 and 1.3120

- Above: 1.3551, 1.3672 and 1.3784

- Current range: 1.3461 to 1.3551

OANDA’s Open Positions Ratio

USD/CAD ratio is showing movement towards short positions. Currently, long positions have a strong majority (66%), indicative of trader bias towards USD/CAD continuing to move higher.