USD/CAD has taken a pause on Wednesday, as the pair trades slightly below the 1.34 line. On the release front, there are no Canadian events. In the US, ADP Nonfarm Payrolls as well as the ISM Non-Manufacturing PMI. As well, the Federal Reserve releases its minutes from the March policy meeting.

The Canadian dollar briefly fell to 3-week lows on Tuesday, following a disappointing trade balance report. Canada recorded its first trade deficit in four months, with a decline of C$1.0 billion. The markets had expected a surplus of C$0.7 billion. On Friday, Canada will release key employment data, with the markets expecting a modest gain of 5.7 thousand jobs. An unexpected reading could trigger some movement from USD/CAD.

What’s next for the Federal Reserve? With the US economy continuing to perform well, the discussions around the monetary policy tables are not whether the Fed will raise rates, but how many hikes we will see in 2017. The markets will be paying close attention to the minutes of the March meeting, when the Fed raised rates by a quarter-point, to a range of 0.75%-1.00%. Any hints about the timing of the next hike, as well as the tone of the minutes are factors which could move the currency markets on Wednesday. The markets considered the rate statement overly cautious, and this sentiment sent the US dollar broadly lower in March. If the reaction to the minutes is one of disappointment, the dollar could again experience broad losses.

USD/CAD Fundamentals

Wednesday (April 5)

- 8:15 US ADP Nonfarm Employment Change. Estimate 184K

- 9:45 US Final Services PMI. Estimate 53.1

- 10:00 US ISM Non-Manufacturing PMI. Estimate 57.0

- 10:30 US Crude Oil Inventories. Estimate -0.1M

- 14:00 US FOMC Meeting Minutes

Upcoming Key Events

Thursday (April 6)

- 8:30 US Unemployment Claims. Actual 251K

*All release times are GMT

*Key events are in bold

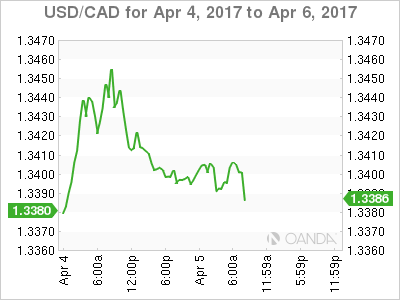

USD/CAD for Wednesday, April 5, 2017

USD/CAD April 5 at 7:45 EST

Open: 1.3401 High: 1.3409 Low: 1.3386 Close: 1.3389

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3120 | 1.3253 | 1.3371 | 1.3461 | 1.3551 | 1.3672 |

- USD/CAD has been flat in the Asian and European sessions

- 1.3371 is a weak support line

- 1.3461 is the next resistance line

Further levels in both directions:

- Below: 1.3371, 1.3253, 1.3120 and 1.3006

- Above: 1.3461, 1.3551 and 1.3672

- Current range: 1.3371 to 1.3461

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Wednesday session. Currently, short positions have a majority (61%), indicative of trader bias towards USD/CAD breaking out and moving higher.