USD/CAD has edged higher at the start of the trading week. In the Monday session, the pair is trading at 1.3150. On the release front, there are no Canadian events on the schedule. In the US, the key event of the day is Pending Home Sales, which is expected to rebound with a gain of 1.6%. On Tuesday, Canada will release GDP, with an estimate of 0.3%. The US will publish CB Consumer Confidence, with the markets expecting a strong reading of 112.6 points.

Canada will release the November GDP report on Tuesday. In October, GDP was unexpectedly low, missing the estimate of a 0.1% gain. This marked the first decline since May and has raised concerns that economic growth in the fourth quarter will be weak. If GDP again misses expectations, we could see the Canadian dollar lose ground, and the BoC will be under increased pressure to lower interest rates. Last week, Earlier in January, the bank held rates at 0.50% but expressed concerns of economic turbulence due to Donald Trump’s protectionist stance, which could have significant repercussions for the Canadian economy.

The markets had predicted that US economic growth would soften in the fourth quarter, and Advance GDP fell short of the estimate. The economy expanded 1.9%, shy of the estimate of 2.1%. Business investment and consumer spending remains solid and should continue into 2017. However, Trump’s protectionist rhetoric and action, which saw tensions escalate with Mexico last week, could cloud the bright picture for the US economy.

Donald Trump has barely warmed the president’s chair in the Oval Office, but has already signed a host of controversial executive orders which have been condemned both domestically and abroad. Trump has withdrawn from the Trans-Pacific Partnership and declared he will reopen the NAFTA trade agreement with Canada and Mexico. He has also ordered work to begin on a wall with Mexico and banned immigrants from seven Muslim countries.

Trump’s unconventional and disjointed approach to international politics and trade could have major ramifications on global trade and could lead to financial instability in global markets, triggering volatility in the currency markets. Just a few days before being sworn in as president, Trump stated that the US dollar was “too strong”, blaming a weak Chinese currency. Predictably, the greenback lost ground after Trump’s remarks. It’s a safe bet that Trump’s offhand tweets and comments will continue to fuel market movement.

Geopolitical and Trade Risks Dominate Market Moves

USD/CAD Fundamentals

Monday (January 30)

- 8:30 US Core PCE Price Index. Estimate 0.1%

- 8:30 US Personal Spending. Estimate 0.4%

- 8:30 US Personal Income. Estimate 0.4%

- 10:00 US Pending Home Sales. Estimate 1.6%

- Tentative – US Loan Officer Survey

Upcoming Key Events

Tuesday (January 31)

- 8:30 Canadian GDP. Estimate 0.3%

- 10:00 US CB Consumer Confidence. Estimate 112.6

*All release times are GMT

*Key events are in bold

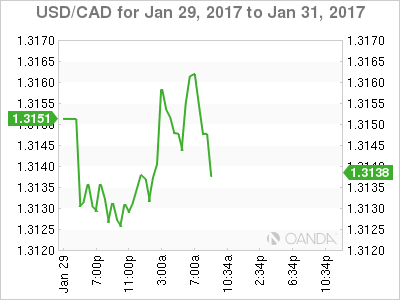

USD/CAD for Monday, January 30, 2017

USD/CAD January 30 at 8:20 EST

Open: 1.3129 High: 1.3169 Low: 1.3121 Close: 1.3155

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2922 | 1.3003 | 1.3120 | 1.3253 | 1.3371 | 1.3475 |

- USD/CAD was flat in the Asian session posted slight gains in European trade

- 1.3120 is providing weak support

- 1.3253 is the next resistance line

Further levels in both directions:

- Below: 1.3120, 1.3003, 1.2922 and 1.2815

- Above: 1.3253, 1.3371 and 1.3457

- Current range: 1.3120 to 1.3253

OANDA’s Open Positions Ratio

In the Monday session, USD/CAD ratio long positions command a strong majority (61%), indicative of trader bias towards USD/CAD continuing to move upwards.