USD/CAD has posted gains in the Monday session. Currently, the pair is trading at 1.3050. On the release front, there are no Canadian events on the schedule. In the US, there are two minor events. On Tuesday, Canada releases trade balance for December, with the deficit expected at C$45.0 billion, little changed from the previous release. The US will release JOLTS Job Openings, with the indicator expected to rise to 5.56 million.

The US released key employment numbers on Friday, to mixed reviews. Nonfarm payrolls jumped to 227 thousand, well above the estimate of 170 thousand. However, wage growth disappointed, as Average Hourly Earnings slipped to 0.1%, short of the forecast of 0.3%. There’s no arguing that the US economy is performing well, but there is a sense of uneasiness in the markets as Donald Trump continues to create controversy and dissent both at home and abroad. Trump has picked a fight with Mexico and his travel ban on Muslims from seven countries has created a strong backlash.

Moreover, the lack of an economic policy is a major source of concern and the the post-election euphoria which sent the markets higher appears to have dissipated. The Federal Reserve also in the dark about Trump’s plans, and is expected to adopt a wait-and-see attitude in the coming months. If the economy continues to grow, there is a strong likelihood of another rate hike in the first half of 2017, which is bullish for the dollar.

Donald Trump’s promise of “America First” includes revisiting the NAFTA trade agreement, which has been an anchor of the US-Canada trade relationship for over 20 years. Trump didn’t mince words last week when describing NAFTA, saying that

NAFTA has been a catastrophe for our country. It’s been a catastrophe for our workers and our jobs and our companies.

Although Trump is unlikely to unravel the agreement, his protectionist stance could spell trouble for the Canadian economy. With 70% of Canadian exports headed for the US, changes to NAFTA could unnerve the markets and weaken the Canadian dollar. January was good to the Canadian currency, which gained 3.0% percent against its US counterpart.

U.S Payrolls Increase +227,000, Wage Growth Weakens

Market Seeks Rate Clarity, Dollar Drifts

USD/CAD Fundamentals

Monday (February 6)

- 10:00 US Labor Market Conditions Index

- Tentative – US Loan Officer Survey

Tuesday (February 7)

- 8:30 Canadian Trade Balance. Estimate 1.2B

- 10:00 US JOLTS Job Openings. Estimate 5.56M

*All release times are GMT

*Key events are in bold

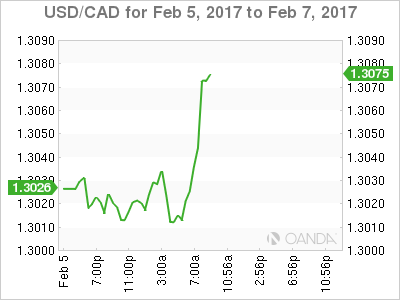

USD/CAD for Monday, February 6, 2017

USD/CAD February 6 at 8:30 EST

Open: 1.3019 High: 1.3053 Low: 1.3006 Close: 1.3047

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2815 | 1.2922 | 1.3003 | 1.3120 | 1.3253 | 1.3371 |

- USD/CAD was flat in the Asian session and has edged higher in European trade

- 1.3003 is providing support

- 1.3120 is the next resistance line

Further levels in both directions:

- Below: 1.3003, 1.2922, 1.2815 and 1.2653

- Above: 1.3120, 1.3253 and 1.3371

- Current range: 1.3003 to 1.3120

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Monday session. Currently, long positions command a majority (58%), indicative of trader bias towards USD/CAD continuing to move upwards.