GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1345, target 1.1550, stop-loss 1.1285, risk factor *

USD/CAD: short at 1.3020, target 1.2850, stop-loss 1.3130, risk factor **

AUD/JPY: long at 86.80, target 89.80, stop-loss 86.10, risk factor **

More Forex Strategies - GrowthAces.com

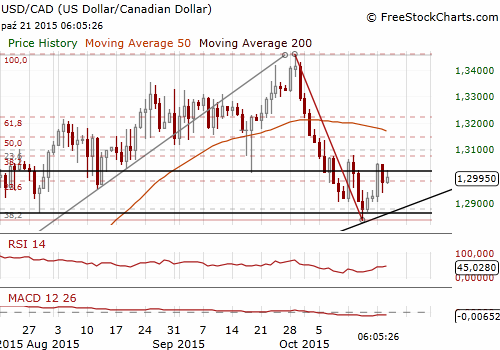

USD/CAD: BoC May Support The Loonie Today

(short at 1.3020)

- We expect the Bank of Canada to remain on hold today, leaving the overnight rate unchanged at its current level of 0.50%. The central bank’s statement is also likely to reaffirm the message it outlined at its 9 September meeting. The BoC is likely to say that the current stance of its monetary policy is appropriate and inflation is evolving in line with the scenario described in the July policy report.

- The CAD has recovered substantially since the end of September, but we do not think that the BoC will see this move as strong enough to trigger a substantial change in its foreign exchange rhetoric as, even after the recent bounce, the currency remains much weaker than it was at the start of the year.

- Positive surprises, if any, may come from the new set of economic forecasts, given the likelihood that the BoC may signal slightly better trends than those outlined in its July Monetary Policy Report that projected Canadian growth just over 1% in 2015 and about 2.5% in 2016 and 2017.

- Data from Statistics Canada showed on Tuesday that the value of Canadian wholesale trade unexpectedly fell 0.1% in August, as sales declined in sectors including machinery and motor vehicles. The machinery, equipment and supplies sector dropped 2.4% to its lowest level since April 2014, and the motor vehicle and parts sector fell 1.2%.

- In our opinion, the outcome of the BoC’s meeting may support the loonie. We went short at 1.3020, in line with our trading strategy announced yesterday. The USD/CAD is close to the 10-day exponential moving average now. Breaking below this indicator may open the way to stronger falls. The nearest strong support level is 1.2831 low on October 15. We have placed the target of our short slightly above this level, at 1.2850.

Significant technical analysis' levels:

Resistance: 1.3046 (high Oct 20), 1.3071 (38.2% fibo of 1.3457-1.2832), 1.3080 (high Oct 13)

Support: 1.2900 (psychological level), 1.2852 (low Oct 16), 1.2831 (low Oct 15)

Source: Growth Aces - Profitable Forex Trading Strategies