The FX markets should come to life as we head deeper into the week, with lots of market-moving data to come. Among the majors, the USD/CAD particularly faces a busy week, with plenty of market-moving macro pointers due for release from both sides of the border throughout the week, culminating in the simultaneous publication of the February jobs report on Friday. We also have a rate decision from the Bank of Canada to look forward to in midweek.

US Dollar Steady After Friday’s Drop

The US dollar has started the new week flattish, ahead of major events happening later in the week. Federal Reserve chair Jerome Powell will be testifying before Congress while in terms of data, the US nonfarm payroll report on Friday will be the key focus.

The greenback fell on Friday on the back of softer-than-expected manufacturing ISM data. However, the losses were limited amid growing bets the US would avoid a recession, and Federal Reserve officials insist that there is no rush to start cutting interest rates. Let’s see if this week’s upcoming data changes that view. At the time of writing, the Dollar Index (DXY) was not moved much, holding between the 200-day average of 103.75 and December’s high of 104.26.

Key Data to Watch This Week for USD/CAD Currency Pair

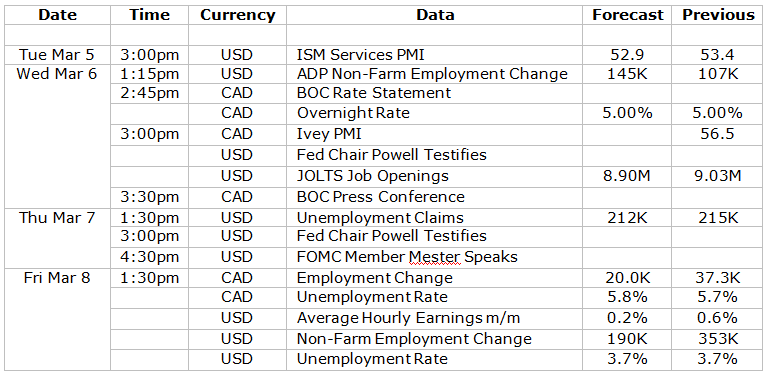

Here are the key highlights on the economic calendar to watch this week, relevant for the USD/CAD currency pair:

Among the macro highlights, this week is the Bank of Canada’s rate decision. The North American central bank is expected to keep rates unchanged at 5%, with expectations very low that Governor Macklem will make any immediate tweaks to monetary policy. Instead, expect the BOC to offer insights into its economic outlook and future expectations.

Meanwhile, the highly anticipated US jobs report is likely to reignite volatility. Forecasts suggest a significant slowdown in job growth following last month's addition of over 350,000 jobs and a 0.6% month-on-month rise in average hourly earnings. A robust report could diminish the likelihood of a Federal Reserve rate cut in the first half of the year.

USD/CAD Technical Analysis and Trade Ideas

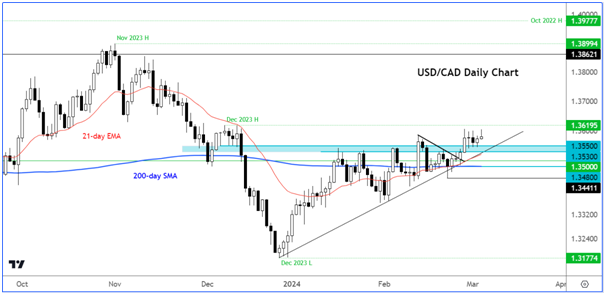

Source: TradingView.com

The USD/CAD has edged higher in the first months of the year, regaining December’s entire losses. Therefore, the momentum is with the bulls, albeit it has been a slow grind – and not just for the USD/CAD pair.

The USD/CAD has been printing higher highs and higher lows ever since it bottomed at 13177 in December. In the process, several resistance levels have broken down including the 200-day average at 1.3480 and the psychologically important 1.3500 handle. These levels are now among the support levels that the bulls will need to defend if they want to maintain the bullish trend.

More recently, the USD/CAD has started to chip away at resistance around the 1.3530-1.3550 area, which suggests that rates are gearing up for a potential breakout above the December high of 1.3620.

The line in the sand now is at 1.3440ish, which was the last low before the latest rally. A potential move below that level would invalidate the bullish trend for the USD/CAD.