- An important Bank of Japan meeting is around the corner and Interest rates may go up finally.

- Meanwhile, the US CPI continues to stabilize above 3%.

- USDJPY Tests an important zone in the 146-147 yen per dollar price area

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Over the past few years, most Bank of Japan meetings haven't changed much regarding monetary policy.

The BOJ has kept interest rates very low to boost inflation, aiming for a sustainable 2% rate over the long term. However, current inflation rates have been consistently below this target for almost two years.

There's growing speculation that the BOJ might raise interest rates for the first time since 2015. This is fueled by expectations of strong wage increases following labor union negotiations.

These negotiations are expected to conclude around March 15, with initial estimates suggesting a significant wage growth of around 5.85%, the highest in three decades.

While a shift in BOJ policy towards tightening may be on the horizon, it won't be an easy decision. The potential for a hawkish move by BOJ officials is being discussed, with some suggesting it could happen as early as the March or April meeting.

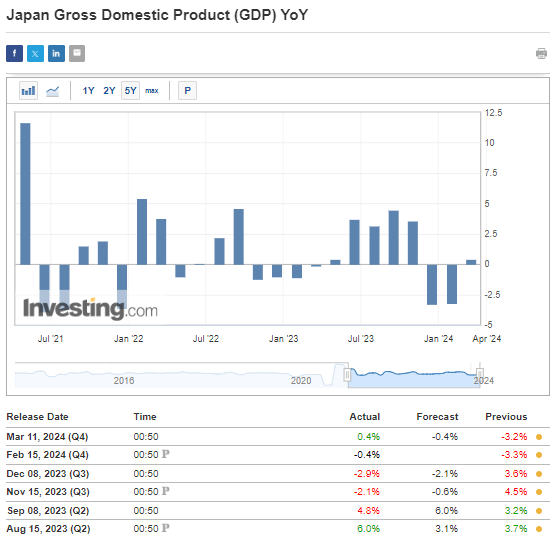

Additionally, recent revisions to GDP data show positive trends, with economic growth surpassing previous expectations and moving away from recessionary levels.

The BOJ's monetary policy relies heavily on controlling the 10-year government bond yield curve, aiming for a near-zero percent level with minimal deviation.

If the BOJ decides to adopt a more hawkish stance, it will likely proceed cautiously and gradually normalize its monetary policy.

A minor increase of 0.1 or 0.2 percentage points during the initial adjustment could lead to a strengthening of the Japanese yen.

Fed Ponders Path Ahead

As for the Federal Reserve, recent inflation data and the labor market have not provided clear signals for upcoming decisions.

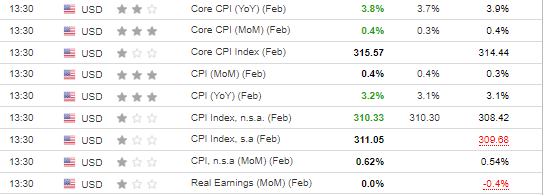

Friday's unemployment rate and non-farm employment figures were inconclusive, while yesterday's inflation data slightly exceeded forecasts, indicating a continued stabilization above the 3% mark.

Things will likely stay the same at this month's meeting, but the market is still betting big on a pivot starting in June.

How Can I Play the Japanese Yen?

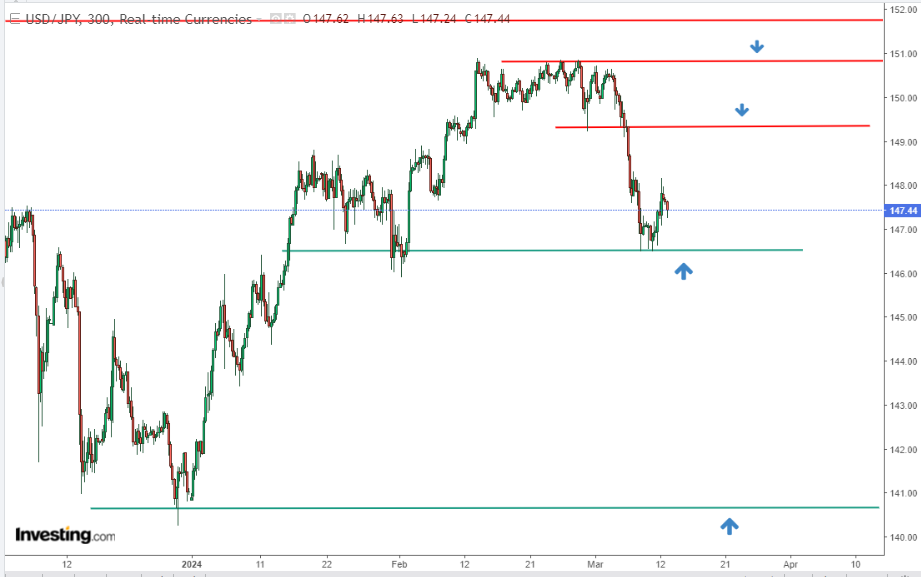

Looking at the USD/JPY pair, either the upward trend will keep going strong, or we might see a significant pullback.

Buyers have managed to hold their ground around the 146 yen per dollar mark, showing a strong demand for the currency.

The upcoming Bank of Japan meeting scheduled for March 19 will have a significant impact on the medium and long-term direction.

If the Bank of Japan does not announce a pivot as expected, it will strongly encourage buyers. Their first target will be the 149 yen price area, where there's local resistance.

However, if the BOJ makes a move and announces further hikes, we're likely to see the yen drop below 146 yen. This could lead to an attempt to reach the lows seen late last year.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year Invest ingPro subscriptions.

Do you only use the Investing app? This offer is also for you! InvestingPro for the app now also 10% off with INWESTUJPRO1. Enter discount code TU.

Undervalued stocks, portfolios of the most successful and well-known investors, ProPicks portfolios rebalanced every month - you'll find it all on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.